Discover how Bitcoin soared above $60,000 in response to a Trump assassination attempt, revealing the crypto market’s sensitivity to political shocks and sparking debates on future market trends.

On July 13, an attempt was made to allegedly assassinate former President of the United States Donald Trump when he was attending a campaign event in Pennsylvania. This led to a significant increase in the price of bitcoin. The positive reaction of the market to the Trump assassination attempt has captured the attention of the cryptocurrency community, which has led to discussions regarding the elements that are contributing to the exponential increase in price.

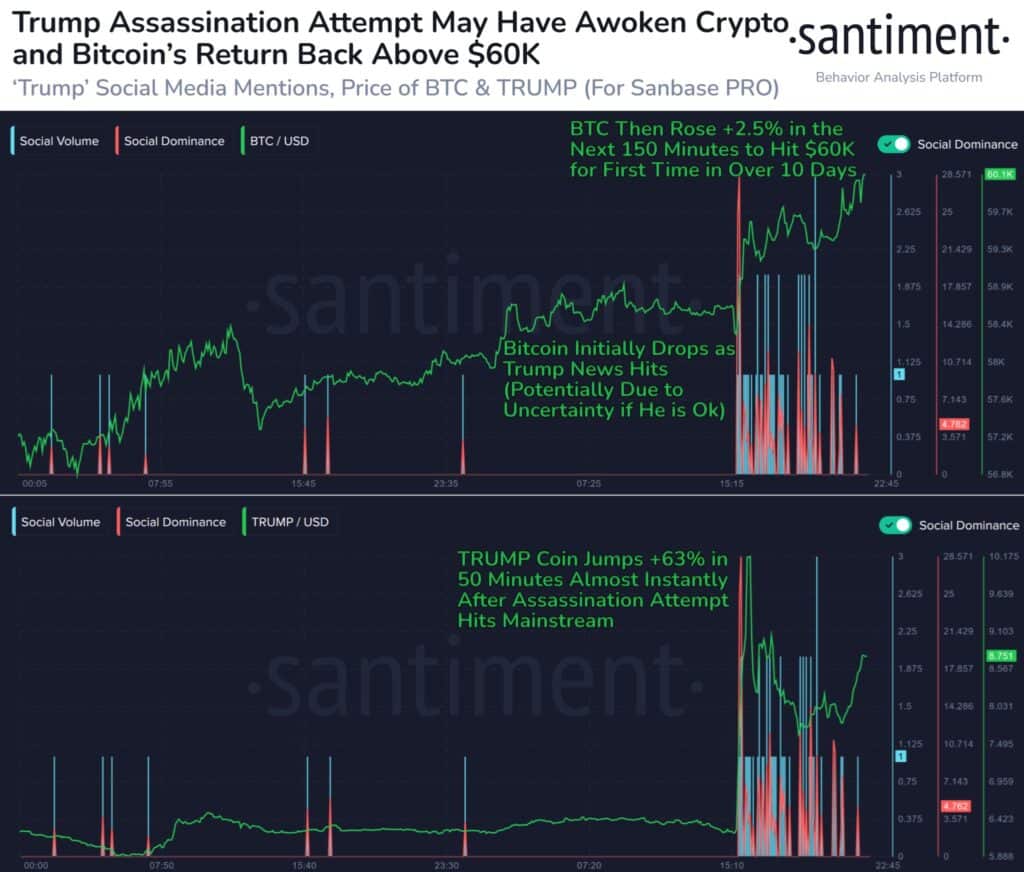

Santiment, a blockchain intelligence platform, attributed the increase to a positive outlook regarding the potential 2024 US presidential candidate. The firm observed that the crypto community had responded positively to the news of the assassination attempt, likely influenced by Trump’s recent favourable remarks about the crypto industry. This incident is seen as news that supports Trump, resulting in a positive response.

“Regardless of your political stance (or lack thereof), note how much these types of market reactions will continue on any notable US political news for at least the rest of 2024, especially in an always speculative-driven sector like cryptocurrency,” Santiment stated on X.

In a similar vein, Will Clemente, the co-founder of Reflexivity Research, expressed the same viewpoint. According to his analysis, the markets are beginning to factor in a complete Trump victory in the upcoming November elections. “Based on Bitcoin’s reaction so far, it looks like markets are going to begin pricing in a full Trump victory,” he stated on X.

It is worth noting that according to Polymarkets data, the shooting incident has positively impacted his likelihood of winning. Based on the platform’s data, crypto bettors are indicating a higher probability of Trump winning the elections at 70%, while President Joe Biden’s chances have decreased to 15%.

In recent months, Trump has gained popularity among the Bitcoin and crypto community. He is committed to safeguarding the freedom to possess Bitcoin and has been invited as a prominent speaker at the Bitcoin 2024 conference scheduled for later this month.

These actions have earned him the support of influential figures in the crypto industry, such as Cathie Wood, CEO of Ark Invest, and Tyler and Cameron Winklevoss, founders of Gemini Exchange. Interestingly, Elon Musk and billionaire investor Bill Ackman are also backing his re-election campaign.

“I fully endorse President Trump and hope for his rapid recovery,” Musk stated on X.

The increased speculation and optimistic emotion surrounding Trump’s potential impact on the cryptocurrency markets are reflected in the jump in the price of Bitcoin, which has reached over $60,000 at this point. The political situation is expected to continue to shift in the years leading up to the elections in 2024, and analysts think that market reactions and volatility will persist.

Trump Assassination Attempt: An Unfortunate Event Leading To Bitcoin’s Price Rally

In conclusion, Bitcoin’s recent price surge underscores the intertwined relationship between political events and cryptocurrency market dynamics. The reaction to the Trump assassination attempt highlights the speculative nature of the crypto market and its sensitivity to political news, demonstrating how swiftly external factors can influence market sentiment.

As the 2024 election season unfolds, investors and analysts alike will continue to scrutinize political developments for their potential impact on crypto markets. This event serves as a stark reminder of the volatility inherent in cryptocurrency trading, where perceptions of political stability and policy direction can significantly sway market behaviour.

Moving forward, further discussions and analysis are expected to delve deeper into the implications of the Trump assassination attempt on the digital asset currency arena, shaping the broader narrative around the intersection of politics and finance in the digital age.