Bitcoin (BTC) has successfully rebounded from a technical bear market after experiencing a sharp decline in February 2025. The leading cryptocurrency recently surged by 10%, pushing its price to $94,003 and restoring investor confidence. This development comes after Bitcoin’s worst monthly performance since June 2022, marked by a 17% decline. But what drove this market correction, and what does it mean for the future?

Factors Behind Bitcoin’s Downturn

Bitcoin’s recent slump was attributed to macroeconomic and crypto-specific factors.

1. Geopolitical Uncertainty and Economic Pressures

The United States’ escalating trade tensions with key global partners, including China, Canada, and Mexico, have raised concerns about inflation and potential economic instability. President Donald Trump’s announcement of new tariffs added to market volatility, prompting a shift away from riskier assets like cryptocurrencies.

2. Regulatory Crackdowns and Uncertainty

Governments and financial watchdogs worldwide have intensified their regulatory scrutiny of cryptocurrencies. The SEC’s continued lawsuits against crypto firms and uncertainty surrounding stablecoin regulations have created hesitancy among investors.

3. Security Breaches and Market Confidence

A major security breach at Bybit, one of the world’s leading cryptocurrency exchanges, resulted in losses exceeding $1.5 billion. The hack severely impacted investor sentiment and triggered a sell-off across the market.

Bitcoin’s Recovery: What Triggered the Rebound?

Despite recent setbacks, Bitcoin has demonstrated resilience, climbing out of bear market territory. Several key factors contributed to this turnaround:

1. U.S. Crypto Strategic Reserve Announcement

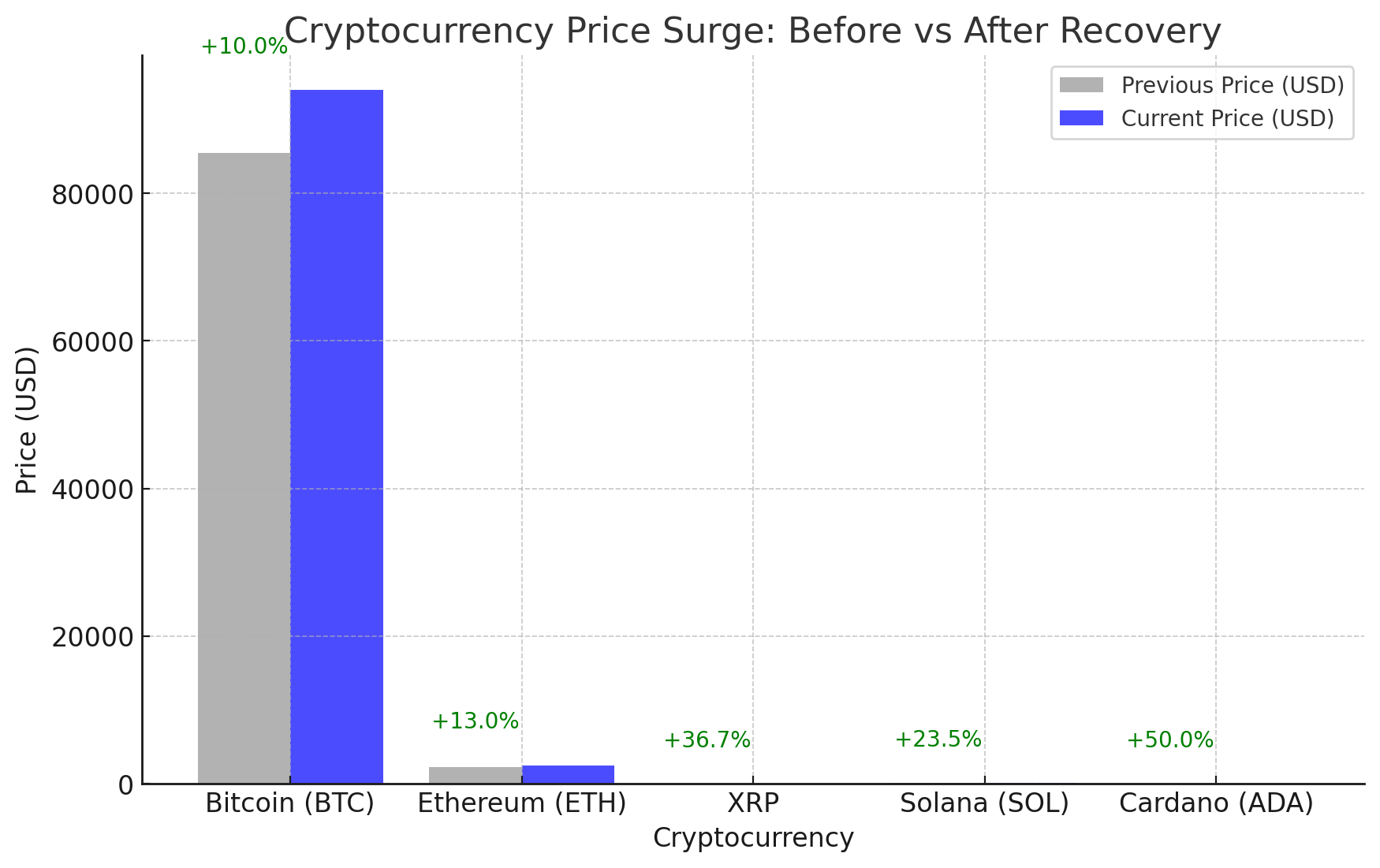

The announcement of the U.S. Crypto Strategic Reserve, which includes Bitcoin, Ethereum, XRP, Solana, and Cardano, provided a major confidence boost. The move signals increased government support for digital assets, positioning the U.S. as a key player in the global crypto economy.

2. Institutional Adoption and Market Sentiment

Institutional interest in Bitcoin continues to grow. BlackRock and Fidelity have further increased their crypto holdings, with Bitcoin ETFs attracting billions in inflows. These developments reinforce Bitcoin’s status as a legitimate financial asset.

3. Upcoming White House Crypto Summit

The White House has announced plans for a cryptocurrency summit, bringing together policymakers, regulators, and industry leaders to discuss the future of digital assets. This move is expected to bring much-needed regulatory clarity and further legitimize cryptocurrencies.

4. Halving Anticipation and Supply Constraints

Bitcoin’s next halving event, expected in April 2025, is another factor fueling bullish sentiment. Historically, Bitcoin halvings have preceded massive price rallies due to the reduction in mining rewards, leading to constrained supply and increased demand.

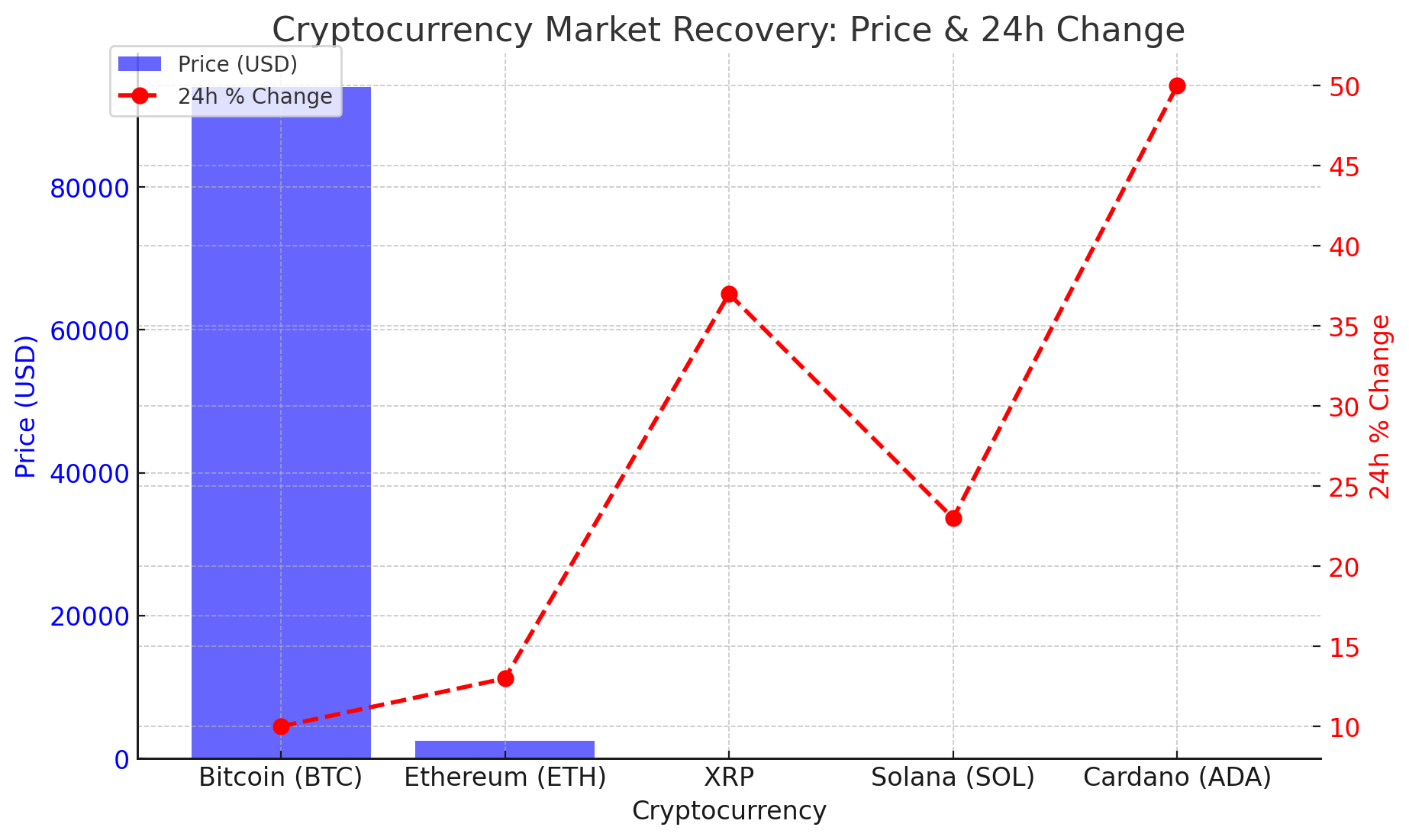

Updated Cryptocurrency Market Prices

| Cryptocurrency | Price (USD) | 24h % Change |

|---|---|---|

| Bitcoin (BTC) | $94,003 | +10% |

| Ethereum (ETH) | $2,504 | +13% |

| XRP | $2.94 | +37% |

| Solana (SOL) | $105 | +23% |

| Cardano (ADA) | $1.50 | +50% |

Source: CryptoSlate

Conclusion

Bitcoin’s escape from a technical bear market signals renewed optimism in the crypto industry. While macroeconomic and regulatory challenges remain, the combination of institutional adoption, government initiatives, and the upcoming Bitcoin halving suggests a promising outlook. Investors will closely monitor developments, particularly regarding regulatory policies and the White House crypto summit, to gauge Bitcoin’s next potential move.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. What is a technical bear market?

A technical bear market occurs when an asset’s price declines by 20% or more from its recent highs, signaling a prolonged downturn.

2. How did trade tensions affect Bitcoin’s price?

The introduction of new tariffs by the U.S. raised concerns about inflation and economic instability, leading investors to reduce exposure to risk assets like Bitcoin.

3. Why did Bitcoin recover so quickly?

The announcement of the U.S. Crypto Strategic Reserve, institutional adoption, and anticipation of regulatory clarity contributed to Bitcoin’s rapid recovery.

4. What impact will the upcoming Bitcoin halving have?

The halving event will reduce mining rewards, decreasing the supply of new Bitcoin, historically leading to bullish price action.

Glossary

Bitcoin (BTC): The first and largest cryptocurrency by market capitalization, often called digital gold.

Ethereum (ETH): A decentralized platform enabling smart contracts and decentralized applications (dApps).

XRP: A digital currency and payment protocol designed for fast, low-cost cross-border transactions.

Solana (SOL): A high-performance blockchain network known for its speed and scalability.

Cardano (ADA): A blockchain platform focused on security, scalability, and sustainability for decentralized applications.

Sources