Bitcoin (BTC) has just reached a historic milestone, rising past $81,000 in response to President-elect Donald Trump’s election victory and his pro-crypto policy outlook. The crypto community is optimistic, seeing this as a turning point for Bitcoin and the whole crypto market. This is the market sentiment around his policies and analysts as well as investors expect this to continue.

Bitcoin’s Unexpected Rise and Market Reactions

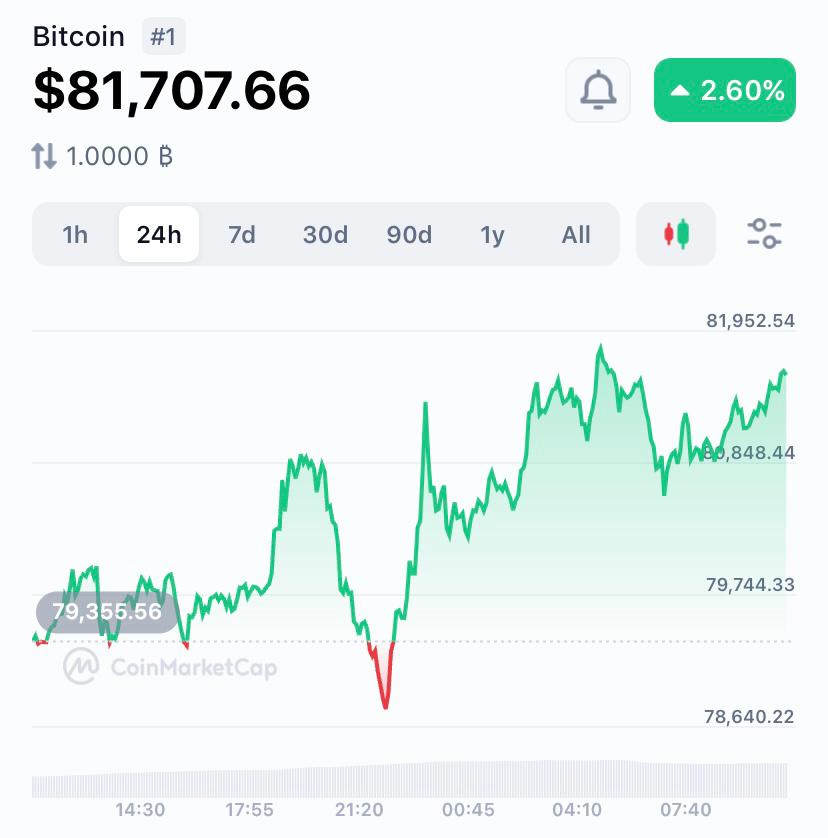

Following Trump’s victory, Bitcoin went as high as $81,891 early Monday morning. This bold new all time high has l shown how much political factors can move the crypto market. Bitcoin rose 6.1% on Sunday alone bolstered by Trump’s plan to make the US a leader in the digital asset space. The election also boosted smaller cryptocurrencies: Dogecoin (DOGE) went up because of the support from Elon Musk, Trump’s prominent supporter.

Crypto investors are elated because Bitcoin is outperforming stocks and gold, a new benchmark in a year of big growth for digital assets. The broad Altcoin gains also show how much of an impact a positive political environment has on the crypto market.

Trump’s Pro-Crypto Agenda and the Road to Regulatory Reform

One of Trump’s main campaign promises was to make the US a central hub for digital asset innovation. His plan includes creating a national Bitcoin reserve and appointing crypto-friendly regulators. His administration aims to boost domestic economic growth through tax cuts and deregulation, a better climate for digital asset businesses and investors.

Crypto enthusiasts see this as an opportunity for the much needed regulatory reform. Noelle Acheson, author of ‘Crypto Is Macro Now’, said that with more crypto friendly lawmakers in Congress, crypto positive legislation can move faster.

This is a big departure from the regulatory scrutiny during the previous administration. Trump’s support for digital assets will allegedly help solve the long standing problems of the crypto industry, from regulatory uncertainty to banking access.

Institutional Demand and All-Time High ETF Inflows

Bitcoin’s rise also shows institutional interest in the asset. Institutional investors who had reduced their exposure before the election are now getting back in because of Trump’s pro-crypto stance. The confidence is reflected in the record ETF inflows. BlackRock’s iShares Bitcoin Trust just saw an all time high daily inflow of $1.4 billion.

Richard Galvin, founder of crypto investment firm DACM, said the demand is because institutional players are getting back in the market post election. “This shift in market dynamics is likely to create sustained buying pressure,” he said, pointing out the bigger picture of institutional involvement. Bitcoin’s market cap also increased because of BlackRock’s ETF, where daily trading volume hit an all time high after Trump won. This shows how Bitcoin is being accepted as a mainstream asset by traditional finance players.

Bitcoin’s 94% year to date growth also shows how attractive it is compared to other assets like equities and gold which have not grown much. Bitcoin backed ETFs are showing a maturing market with institutional interest.

What the Shift Means for the Crypto Space

Trump is pro crypto, a big departure from the previous administration. Under the last administration, crypto was under more scrutiny, especially from the Securities and Exchange Commission (SEC) led by Gary Gensler. The SEC increased oversight, focusing on fraudulent activity and market manipulation and introduced strict regulations after the FTX collapse. While meant to protect investors, these regulations created hurdles for the industry and some crypto companies went offshore to avoid US regulations.

But analysts believe that Trump’s administration will likely be more friendly. By appointing regulators who understand digital assets, his administration may allegedly bring policy changes that support innovation and clear and fair regulations. This has given the industry hope and many see this as the path to more stability and wider adoption of digital assets.

Digital asset companies spent over $100 million to support crypto friendly candidates in this election cycle. This shows the industry is willing to shape the regulatory environment. This has increased the speculation that regulation will be supportive. If Trump delivers on his campaign promises, industry players expect a crypto boom from blockchain innovation to DeFi adoption.

Conclusion: A New Era of Crypto-Friendly Policies?

The crypto community hopes Trump’s support for digital assets will bring more stability and support for Bitcoin and other cryptos. As the election dust settles, Bitcoin’s break above $81,000 is a sign that the US will soon have regulations that are pro-digital asset holders and innovators. For now, the all time high is a glimpse into the future of the crypto space under a more crypto friendly administration.

TheBITJournal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.