Bitcoin (BTC) soared past the $90,000 mark for the first time on March 5, 2025, following President Donald Trump’s decision to delay the implementation of 25% tariffs on auto imports from Canada and Mexico. This move eased trade tensions and fueled investor confidence across financial markets, with both traditional equities and cryptocurrencies experiencing an uptrend.

Bitcoin Price Surge: Key Market Drivers

Bitcoin’s rally beyond $90,000 was influenced by a combination of macroeconomic and geopolitical factors, including:

- U.S. Trade Policy Shifts – The tariff delay reduced economic uncertainty, increasing risk appetite among investors.

- Institutional Demand – Large-scale investors continue to accumulate Bitcoin, reinforcing its upward momentum.

- Market Liquidity – Increased liquidity in traditional markets spilled over into the crypto sector, supporting Bitcoin’s price surge.

- Positive Sentiment – The anticipation of further Bitcoin ETF approvals and halving event expectations contributed to the bullish sentiment.

Bitcoin and Traditional Markets React to Tariff Delay

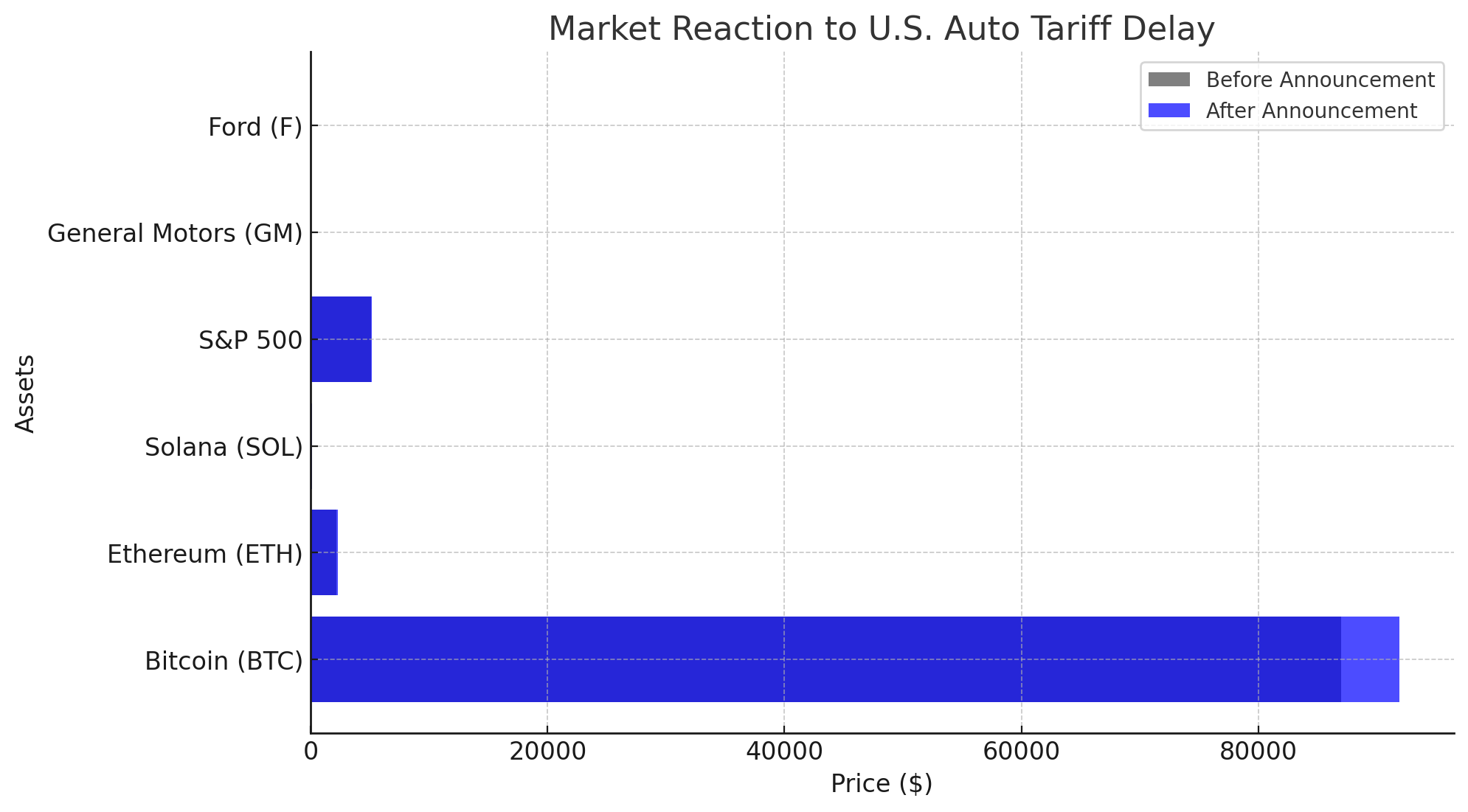

The announcement of tariff postponements led to a broad market reaction:

| Asset | Price Before Announcement | Price After Announcement | % Change |

|---|---|---|---|

| Bitcoin (BTC) | $87,000 | $91,904 | +5.63% |

| Ethereum (ETH) | $2,173 | $2,283 | +5.08% |

| Solana (SOL) | $142 | $148 | +4.43% |

| S&P 500 | 5,134 | 5,187 | +1.03% |

| General Motors (GM) | $39.12 | $41.95 | +7.23% |

| Ford (F) | $12.89 | $13.81 | +7.15% |

Bitcoin led the surge, benefitting from increased institutional interest and market optimism. Meanwhile, auto stocks such as General Motors and Ford saw substantial gains, reflecting improved outlooks for the industry.

Short-Term Bitcoin Price Prediction

Given the strong momentum, analysts foresee the following short-term Bitcoin price movements:

| Timeframe | Support Level | Resistance Level | Expected Trend |

| 24 Hours | $89,500 | $92,500 | Bullish |

| 1 Week | $87,000 | $95,000 | Volatile |

| 1 Month | $85,000 | $100,000 | Bullish |

While Bitcoin is expected to remain volatile, breaking the $95,000 resistance could pave the way toward the highly anticipated $100,000 milestone.

Long-Term Outlook: Can Bitcoin Sustain This Momentum?

The long-term trajectory of Bitcoin remains bullish, with several factors supporting further gains:

- Upcoming Bitcoin Halving – Scheduled for April 2025, the halving event will reduce Bitcoin’s supply issuance, historically leading to significant price increases.

- Institutional Adoption – Growing interest from hedge funds, ETFs, and corporate treasuries reinforces Bitcoin’s role as a store of value.

- Macroeconomic Factors – Inflation concerns and central bank policies continue to drive demand for decentralized assets like Bitcoin.

Summing UP

Bitcoin’s milestone above $90,000 signals continued bullish momentum, with both macroeconomic policies and investor sentiment shaping its path forward. As the market anticipates further developments, traders and investors remain watchful for the next breakout toward $100,000.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What caused Bitcoin to surpass $90,000?

Bitcoin’s surge was primarily driven by the U.S. government’s decision to delay tariffs on Canadian and Mexican auto imports, reducing economic uncertainty and increasing investor confidence.

How did traditional markets react to the tariff delay?

Traditional markets experienced a positive reaction, with major automakers like General Motors and Ford seeing stock price gains exceeding 7%, while the S&P 500 also recorded an uptick.

Can Bitcoin reach $100,000 soon?

Bitcoin is on track to test the $100,000 level, but price movements depend on factors such as macroeconomic conditions, institutional inflows, and market sentiment leading up to the Bitcoin halving.

Should investors buy Bitcoin at this level?

While Bitcoin remains in an uptrend, investors should be cautious of short-term volatility. Dollar-cost averaging (DCA) and long-term holding strategies are advisable.

Glossary

Tariff – A tax imposed on imports or exports, affecting trade policies and market dynamics.

Cryptocurrency – A digital asset that operates on blockchain technology and is decentralized.

Market Sentiment – The overall attitude of investors toward a market or asset, influencing buying and selling trends.

Bitcoin Halving – A programmed event that occurs approximately every four years, reducing Bitcoin’s mining reward by half and impacting its supply dynamics.

Institutional Adoption – The growing interest and participation of financial institutions, corporations, and funds in the cryptocurrency market.

Sources