Bitcoin and the broader crypto market have entered a steep correction, sparking a surge in dip-buying enthusiasm among retail traders. Mentions of “buy the dip” on social media have reached their highest level since July 2024, according to data from on-chain analytics platform Santiment. While this might seem like a strong bullish signal, experts caution that crowd-driven market psychology often backfires—and now might not be the best time to buy.

Bitcoin and Ethereum Struggle—Will the Dip Get Deeper?

Bitcoin and Ethereum are facing significant losses, with BTC dropping below $80,400 and ETH tumbling to $2,125 amid rising macroeconomic uncertainty. With social sentiment at extreme levels, analysts warn that the current dip-buying frenzy may not signal a true bottom just yet. If support levels fail, both assets could see further downside before a sustainable recovery begins.

Ethereum has experienced a significant price dip recently, dropping by over 11.5%, sparking concerns among investors. The sharp decline has led to fears of mass liquidations, with estimates suggesting a potential $340 million in liquidation risks.

The dip has been attributed to broader market uncertainties, regulatory developments, and macroeconomic factors affecting the crypto space. As Ethereum struggles to maintain support levels, many are left wondering whether this is a temporary setback or the beginning of a more substantial downtrend. Investors are closely watching the next moves in the market, hoping for stability or a potential rebound.

Bitcoin Drops To $80K as ‘Dip Buying’ Sentiment Spikes

Bitcoin (BTC) dropped below $90,000 on Feb. 25, and continued its slide to $80,400 after U.S. President Donald Trump confirmed a 25% tariff increase on Canada and Mexico. At press time, the current price stands at $80,394. The market also reacted to looming tariffs on China, adding macro uncertainty to an already fragile environment.

Despite the decline, retail traders are doubling down on “buy the dip” narratives, as evidenced by Santiment’s social sentiment tracker. Between Feb. 25 and 26, crypto discussions across platforms like X (Twitter), Telegram, and Reddit showed an unusually high confidence level in this being the perfect buying opportunity.

Santiment reported:

“Social data is showing a very high level of confidence that this dip is ‘the one to buy.’ However, excessive optimism often precedes further downside.”

Why Buying Now Could Be Risky—Experts Weigh In

Despite the surge in dip-buying enthusiasm, analysts caution that excessive optimism often precedes further declines. Markets tend to move against the crowd, and current sentiment suggests retail traders may be jumping in too soon. Experts advise waiting for decreasing social hype, stronger support levels, and signs of seller exhaustion before considering an entry, as further downside remains possible.

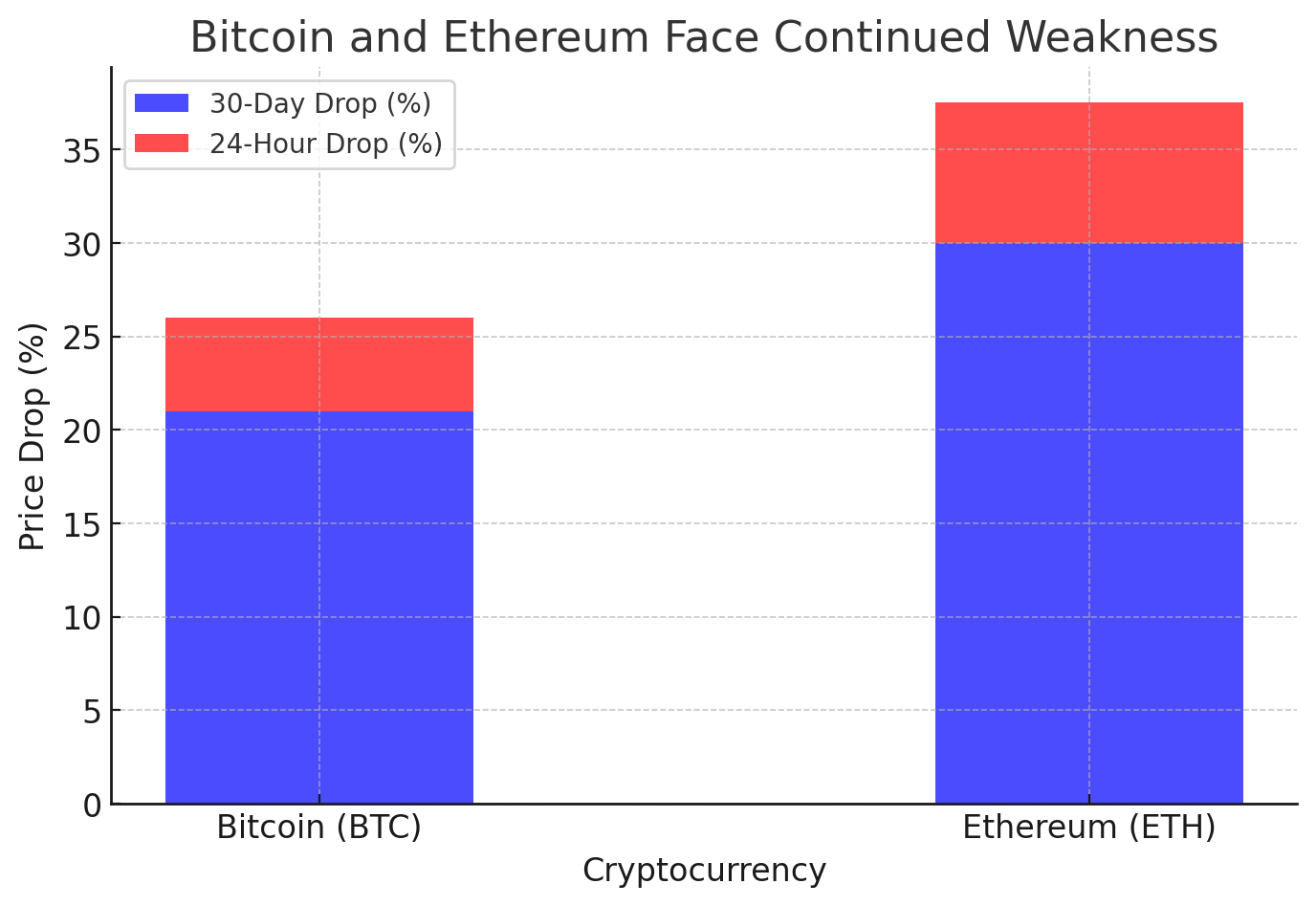

Bitcoin and Ethereum Face Continued Weakness

Bitcoin and Ethereum continue to struggle amid broader market uncertainty, with BTC down 21% in 30 days and ETH losing 30% over the same period. Analysts warn that further downside is possible as macroeconomic factors and retail investor sentiment could drive prices lower before a meaningful recovery takes place. According to CoinMarketCap, the current market performance shows:

Bitcoin (BTC):

- Current Price: $80,394

- 30-Day Drop: 21%

- 24-Hour Drop: 6.79%

Ethereum (ETH):

- Current Price: $2,125

- 30-Day Drop: 30%

- 24-Hour Drop: 9.41%

Google Trends Confirms ‘Buy the Dip’ Interest Is Peaking

Google Trends data aligns with Santiment’s social tracking, showing that searches for “buy the dip” peaked at 100 on Feb. 26—the highest possible score. However, enthusiasm is cooling off, with searches now scoring 49 out of 100.

Meanwhile, the term “crypto” reached its highest level of 100 on Feb. 25, currently sitting at 87—suggesting widespread market attention despite price declines.

What’s Next for Bitcoin?

With Bitcoin hovering around $80,400, traders are questioning whether the dip is nearing its bottom or if further declines are ahead. Analysts warn that high social sentiment and excessive dip-buying optimism could signal more downside before a true rebound. Key support levels and declining retail enthusiasm will be crucial indicators to watch, as institutional investors may wait for weaker hands to exit before stepping in.

Final Verdict: Patience May Be the Smarter Play

While the surge in dip-buying enthusiasm suggests retail traders see Bitcoin’s drop as an opportunity, historical data and on-chain analysis warn against rushing in too soon. Santiment’s research highlights that markets often move against mainstream sentiment, meaning the current optimism could precede another leg down before a true reversal. Bitcoin’s price remains volatile, and institutional players may wait for retail traders to exhaust their buying power before stepping in.

Analysts suggest monitoring key support levels, decreasing social media hype, and declining buy-the-dip calls as potential indicators of a real bottom formation. Google Trends data also shows that interest in “buy the dip” is declining, reinforcing the idea that traders should wait for sentiment to cool further before making significant moves.

For investors looking to enter the market, patience and strategic entry points could prove more profitable than following the crowd. Until sentiment shifts, staying cautious might be the best approach.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Should I buy Bitcoin now or wait?

Experts suggest waiting until social sentiment cools off and Bitcoin establishes a clear support level before entering.

2. What does social sentiment indicate for BTC?

When retail traders are overly bullish, markets often move against their expectations—meaning further downside may still be ahead.

3. What’s the best strategy for Bitcoin traders right now?

Monitor sentiment trends and price action. If optimism fades and BTC finds support, that could indicate a better buying opportunity.

4. How can I track Bitcoin’s market sentiment?

Platforms like Santiment, Google Trends, and CoinMarketCap provide valuable insights into social sentiment, trading activity, and historical trends.

Glossary

On-Chain Analytics: Data collected directly from blockchain transactions to assess market behavior.

Social Sentiment Tracker: A tool that analyzes social media discussions to gauge market sentiment.

Market Reversal: A change in market trend direction (e.g., from bearish to bullish).

Retail Traders: Individual investors who trade with personal funds rather than institutional capital.

Support Levels: Price levels where buying interest is expected to be strong enough to prevent further decline.