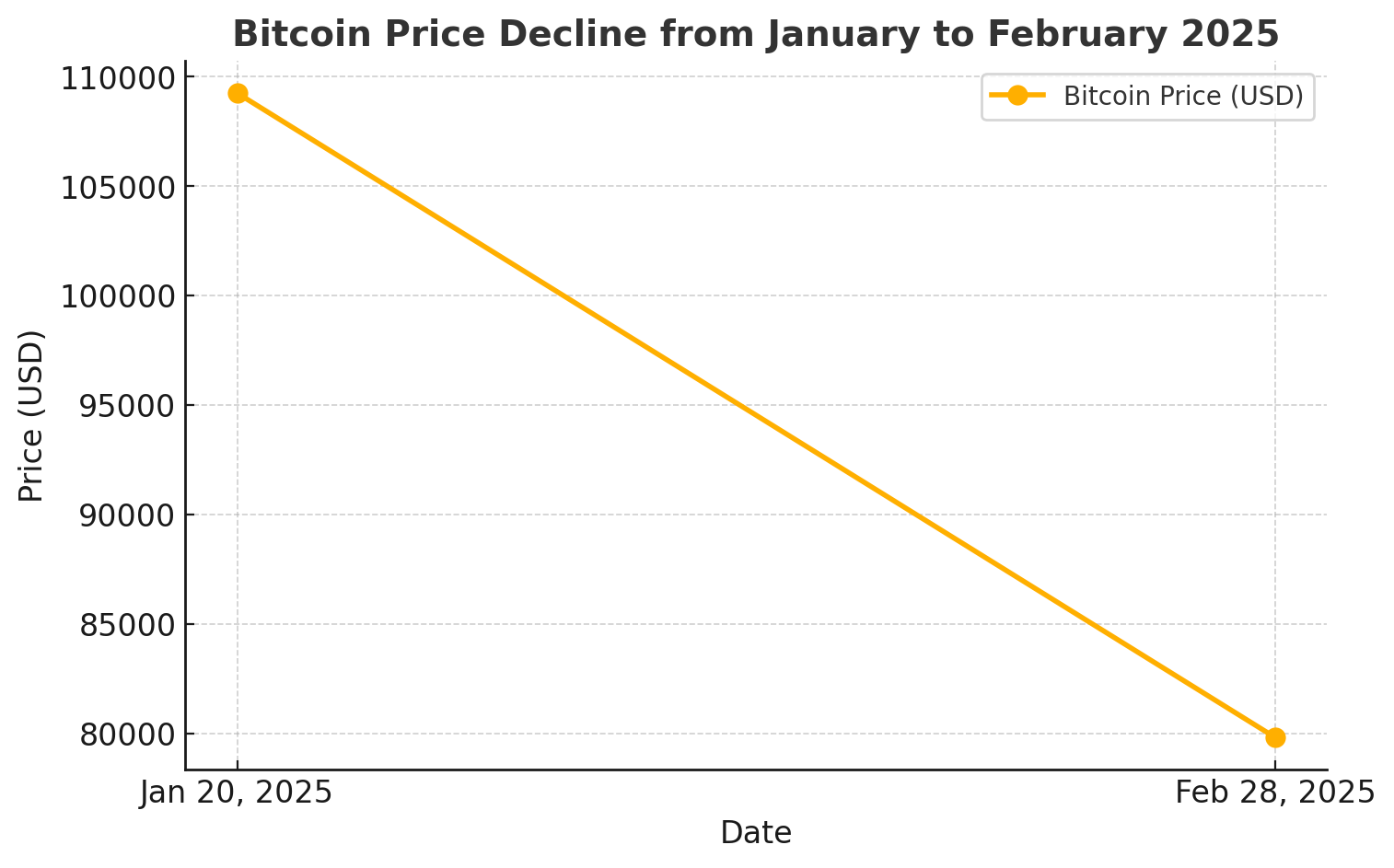

As of February 28, 2025, Bitcoin (BTC) has experienced a significant decline, falling below the $80,000 mark for the first time in over three months. This downturn has erased gains accumulated since the election of President Donald Trump, when optimism about a pro-crypto administration propelled Bitcoin to record highs.

Bitcoin’s Current Market Overview

At 11:17 AM GST, Bitcoin is trading at approximately $79,805, reflecting a 7.48% decrease from the previous close. The day’s trading range has seen a high of $86,971 and a low of $78,990.

| Date | Price (USD) | Percentage Change |

|---|---|---|

| January 20, 2025 | $109,241 | – |

| February 28, 2025 | $79,805 | -27% |

Note: The percentage change indicates the decline from the peak on January 20, 2025, to the current price.

Factors Contributing to Bitcoin Decline

Several elements have contributed to Bitcoin’s recent downturn:

Policy Uncertainty: Initial enthusiasm surrounding President Trump’s pro-crypto stance has waned due to a lack of concrete policy implementations. The anticipated establishment of a national Bitcoin reserve and regulatory reforms have not materialized, leading to investor skepticism.

Macroeconomic Concerns: The global economic landscape faces challenges, including potential U.S. tariffs and rising inflation. These factors have prompted investors to shift away from speculative assets like cryptocurrencies.

Security Breaches: A significant $1.5 billion hack of the Bybit exchange has raised concerns about the security of digital asset platforms, further dampening market confidence.

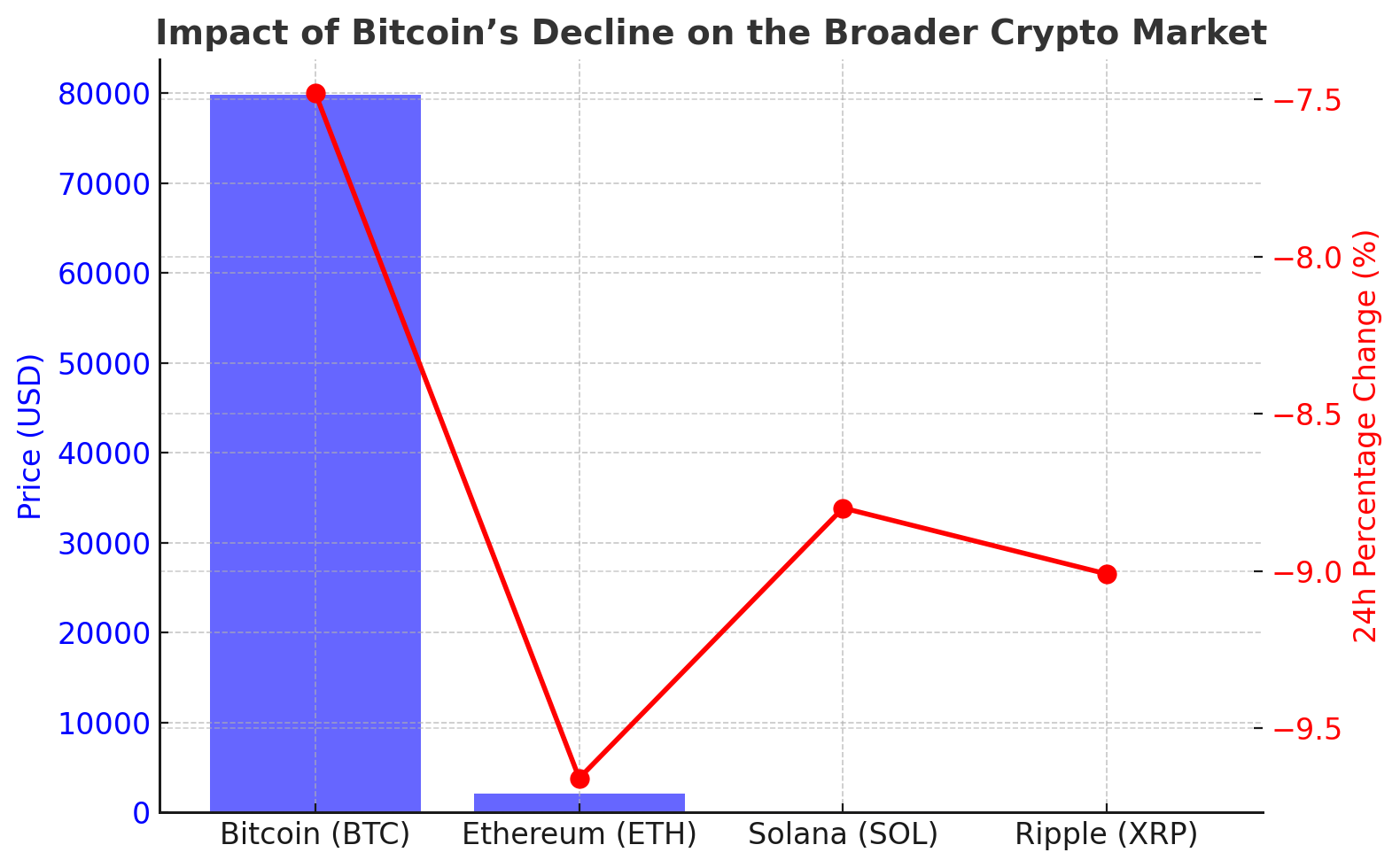

Impact on the Broader Cryptocurrency Market

The decline in Bitcoin’s value has had a ripple effect across the cryptocurrency market:

Ethereum (ETH): Currently trading at $2,124.74, down 9.66% over the past 24 hours.

Solana (SOL): Trading at $129.11, experiencing an 8.80% decrease.

Ripple (XRP): Valued at $2.02, reflecting a 9.01% drop.

Bitcoin’s Market Outlook

The cryptocurrency market remains volatile as Bitcoin struggles to maintain stability. Analysts suggest that if Bitcoin continues to trade below the $80,000 mark for an extended period, it may trigger further downward momentum, pushing prices closer to the $75,000 support level. On the other hand, a strong rebound above $85,000 could reignite investor confidence and signal a potential recovery. Market sentiment is heavily influenced by macroeconomic factors and regulatory developments, making it imperative for investors to stay informed and adapt to the changing landscape.

Advice for Investors

Risk management remains crucial for investors navigating this turbulent market. Diversification across different asset classes, including stablecoins and traditional investments, can help mitigate potential losses. Monitoring regulatory updates and technological advancements in the blockchain sector can also provide valuable insights into Bitcoin’s long-term trajectory. While short-term fluctuations are inevitable, Bitcoin’s historical resilience suggests that strategic, long-term investments may still yield substantial returns.

Conclusion

In conclusion, Bitcoin’s recent dip below $80,000 reflects a confluence of policy uncertainties, macroeconomic challenges, and security concerns. Investors are advised to stay informed and exercise caution in the current volatile market environment.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

Frequently Asked Questions (FAQs)

Why has Bitcoin’s price dropped below $80,000?

The decline is attributed to policy uncertainties, macroeconomic concerns, and significant security breaches within the cryptocurrency ecosystem.

How has the Bybit hack affected the market?

The $1.5 billion hack has undermined investor confidence in the security of digital asset platforms, contributing to the market’s downward trend.

What are the prospects for Bitcoin’s recovery?

While some analysts believe Bitcoin could rebound, reaching highs of $150,000 to $185,000 by the end of 2025, the market remains volatile and influenced by various economic and political factors.

Glossary

Bitcoin (BTC): A decentralized digital currency without a central bank or single administrator, operating on a peer-to-peer network.

Ethereum (ETH): A decentralized, open-source blockchain featuring smart contract functionality, with Ether as its native cryptocurrency.

Solana (SOL): A high-performance blockchain supporting builders around the world creating crypto apps that scale today.

Ripple (XRP): A digital payment protocol and cryptocurrency aiming to enable instant, secure, and low-cost international money transfers.

Bybit: A cryptocurrency exchange platform known for offering derivative trading options.

Market Capitalization: The total market value of a cryptocurrency’s circulating supply, calculated by multiplying the current price by the total number of coins in circulation.

Bear Market: A market condition where prices are falling or are expected to fall, typically by 20% or more from recent highs.

Sources

Note: Data sourced from market observations as of February 28, 2025.