The cryptocurrency landscape is a dynamic and multifaceted ecosystem, with Bitcoin standing as the pioneering digital asset and a multitude of alternative coins, known as altcoins, offering diverse functionalities and investment opportunities. Understanding the statistical distinctions between Bitcoin and altcoins is crucial for investors aiming to navigate this volatile market effectively.

Market Capitalization and Dominance

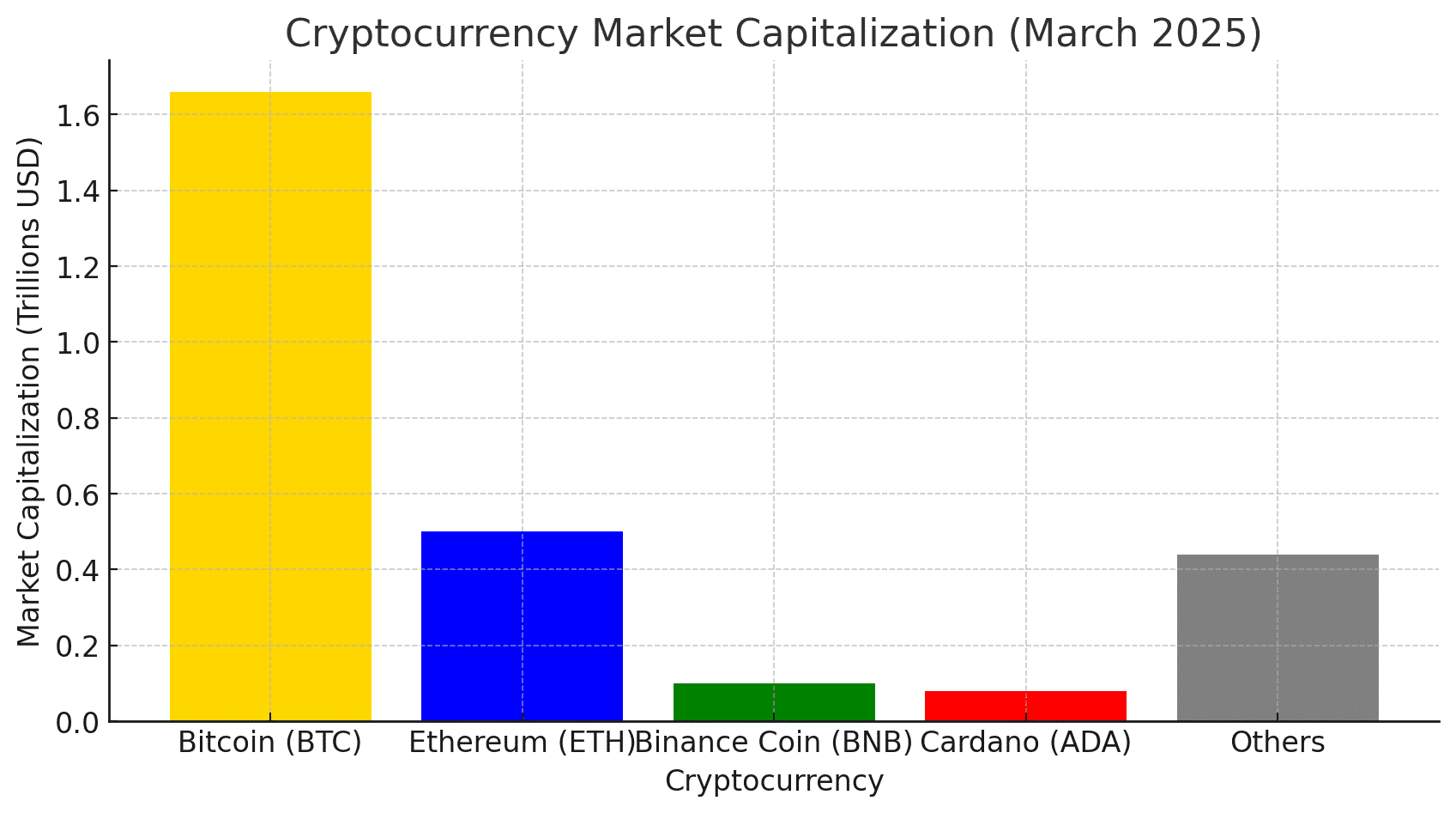

As of March 2025, the global cryptocurrency market capitalization is approximately $2.78 trillion. Bitcoin (BTC) holds a dominant position with a market cap of $1.66 trillion, representing 59.22% of the total market.

| Cryptocurrency | Market Capitalization (USD) | Market Dominance (%) |

|---|---|---|

| Bitcoin (BTC) | $1.66 trillion | 59.22% |

| Ethereum (ETH) | $500 billion | 18.02% |

| Binance Coin (BNB) | $100 billion | 3.6% |

| Cardano (ADA) | $80 billion | 2.88% |

| Others | $440 billion | 16.28% |

Note: Figures are based on data from coingecko.com as of March 2025.

Bitcoin’s substantial market dominance underscores its leading role in the cryptocurrency market. However, altcoins collectively account for a significant portion, reflecting the market’s diversification.

Price Volatility

Cryptocurrencies are renowned for their price volatility, which varies between Bitcoin and altcoins.

Bitcoin: While Bitcoin has experienced significant price movements, its volatility has decreased over time. For instance, in 2024, Bitcoin’s annualized volatility was approximately 4.5%, a decrease from previous years.

Altcoins: Altcoins often exhibit higher volatility due to smaller market capitalizations and lower liquidity. For example, in May 2022, Ethereum (ETH) lost 26% of its value over one week, while Solana (SOL) and Cardano (ADA) lost 41% and 35% respectively.

The higher volatility of altcoins presents both opportunities and risks for investors, offering potential for substantial gains but also significant losses.

Altcoins: The Diverse Alternatives

Altcoins, or alternative coins, encompass all cryptocurrencies other than Bitcoin. They were introduced to address perceived limitations of Bitcoin and to offer additional functionalities. Some of the prominent altcoins include:

Ethereum (ETH): Launched in 2015, Ethereum introduced smart contracts, enabling decentralized applications (dApps) to operate on its platform.

Litecoin (LTC): Created in 2011, Litecoin offers faster transaction times compared to Bitcoin.

Ripple (XRP): Designed for real-time gross settlement and currency exchange, Ripple aims to facilitate secure, instant, and nearly free global financial transactions.

Cardano (ADA): A blockchain platform for changemakers, innovators, and visionaries, with the tools and technologies required to create possibility for the many, as well as the few, and bring about positive global change.

Correlation Between Bitcoin and Altcoins

Several studies have examined the relationship between Bitcoin and altcoins:

Price Dependency: Research indicates a strong long-run relationship between Bitcoin and altcoins, suggesting that price movements in Bitcoin significantly influence altcoin prices.

Asymmetric Effects: Studies have found that Bitcoin’s price movements have asymmetric effects on altcoins, with altcoins reacting differently to positive and negative shocks in Bitcoin’s price.

Technological Differences

Beyond market metrics, Bitcoin and altcoins differ in technological aspects:

Consensus Mechanisms: Bitcoin utilizes Proof of Work (PoW), requiring miners to solve complex mathematical problems. Some altcoins, like Cardano (ADA), use Proof of Stake (PoS), which is more energy-efficient.

Transaction Speed: Bitcoin’s average block time is 10 minutes, whereas altcoins like Litecoin offer faster block times (2.5 minutes), leading to quicker transaction confirmations.

Smart Contracts: Ethereum’s platform allows for executing smart contracts, enabling decentralized applications, a feature not available on Bitcoin’s network.

Conclusion

Bitcoin’s pioneering status and substantial market dominance make it a cornerstone of the cryptocurrency market. Altcoins, with their diverse functionalities and innovations, offer alternative investment opportunities. Understanding the statistical distinctions between Bitcoin and altcoins is vital for making informed investment decisions in this evolving digital landscape.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is the primary difference between Bitcoin and altcoins?

Bitcoin is the original cryptocurrency, primarily serving as a digital store of value and medium of exchange. Altcoins are alternative cryptocurrencies that offer various features and improvements over Bitcoin, such as faster transactions or smart contract capabilities.

Are altcoins riskier investments than Bitcoin?

Generally, yes. Altcoins often have smaller market capitalizations and lower liquidity, leading to higher volatility compared to Bitcoin.

Can altcoins surpass Bitcoin in market dominance?

While some altcoins have experienced rapid growth, Bitcoin’s established position and widespread recognition make it unlikely to be surpassed in the near future.

How do I choose which altcoins to invest in?

Thorough research is essential. Consider factors like the altcoin’s use case, development team, market capitalization, and community support before investing.

Is Bitcoin a safer investment than altcoins?

Bitcoin’s longer track record and larger market capitalization often make it a more stable investment compared to altcoins, which can be more susceptible to market fluctuations.

Glossary

Cryptocurrency: A digital or virtual form of currency that uses cryptography for security and operates independently of a central authority.

Market Capitalization: The total value of a cryptocurrency, calculated by multiplying its current price by its circulating supply.