With Bitcoin demonstrating a parabolic momentum, altcoins are starting 2025 on the backfoot. Over the past year, a measure called the CoinMarketCap Altcoin Season Index, which is used to monitor “altcoin” performance (the top 100 cryptos), has strongly favored Bitcoin. BTC is sitting above $96k in February of 2025 and has now crushed not just any particular altcoin, but every ALTs combined.

CoinMarketCap Altcoin Season Index

The CoinMarketCap Altcoin Season Index analyzes the performance of the 100 top cryptos in a 90 days timeframe to show whether we are in an ALTs or Bitcoin season. When 75% of ALTs are on the rise, it is called ALT season. In December 2024 the index registered 64, a sign of an ALTs season. The index has dropped since then, though, and currently stands at 36 as of February 17, 2025, indicating Bitcoin is leading the markets once more.

Bitcoin’s Stability is Fueling Market Confidence

The ongoing strength of Bitcoin has comforted many investors in the market. Bitcoin, despite its volatility, has remained above $96,000 — a testament to its presence in the market. This goes against the trend of many ALTs so brings Bitcoin to the front seat of crypto.

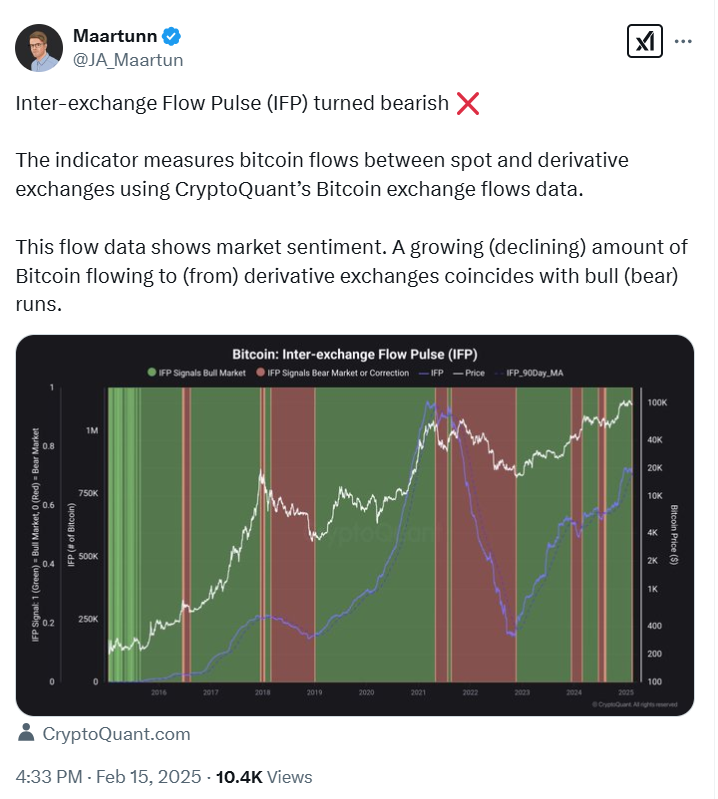

Bearish Market Indicators Sour Bitcoin Sentiment

Most traders remain cautious as Bitcoin appears solid and market continues stabilizing. Maartunn, a CryptoQuant analyst, drew attention to a bearish trend in the Inter-exchange Flow Pulse (IFP)—an indicator that measures Bitcoin flows between spot and derivative exchanges. And a decrease of Bitcoin flow from these exchanges is closely related to Bearish market sentiment, which indicates crypto market could bring a downtrend.

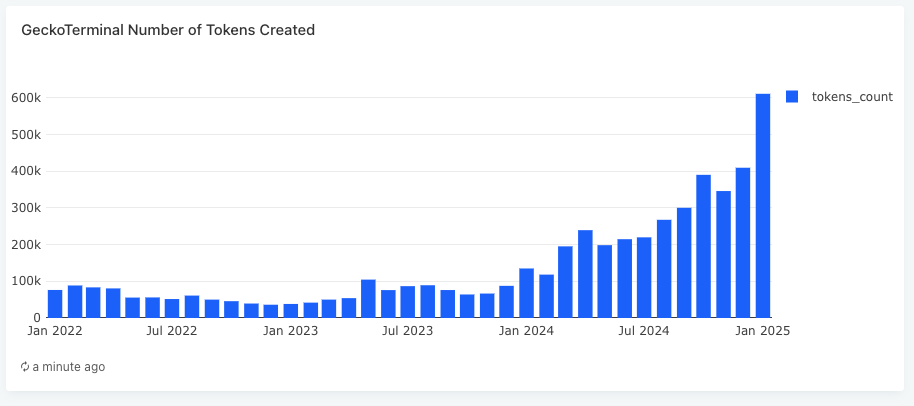

The Surge in New Tokens

One key challenge that ALTs face is the boom in the creation of new tokens. Bobby Ong, co-founder of CoinGecko reported that the number of minted tokens has grown at an exponential rate. About 600,000 new tokens were minted in January 2025, which is several times the average of only about 50,000 a month in 2022-23. This influx has by now spread out liquidity across the market, preventing ALTs from sustaining their bullish run.

Considering the past 90 days, some altcoins performed exceptionally well, while many of them are underperforming. The top performers for the quarter include Hyperliquid and Ripple, up 735% and 143%, respectively. Yet AI tokens, featuring RENDER (RNDR) and Near Protocol amongst others, have tumbled hard with losses exceeding 40% over that time frame.

Macro Influences Affecting ALTs

The future performance of altcoins will also be driven mostly by broader macroeconomic factors. Inflation, interest rates and global economic stability will all heavily influence their success or failure. There could be support or hindrance to their growth as these factors continue to change.

Regulation is still arguably the biggest hurdle for the ALTs space. While Bitcoin has been largely spared any heavy regulatory scrutiny, the same cannot be said for many ALTs, which are under increasing focus from authorities. More stringent rules might hinder innovation and pose further challenges to ALTs looking to market.

Do Altcoins Have Another Phase?

For those unaware, ALTs seasons are generally followed up by consolidation phases in Bitcoin. If the tide turns, however, ALTs could take flight again. The upcoming ALTs part will most likely be based against macroeconomic conditions, administrative cleanliness and financial backhand in general.

Conclusion

BTC continue to outperform the ALTs in 2025. An overabundance of new tokens has diluted liquidity, while regulatory concerns continue to loom large. Yet, having re-established itself over the course of two years, Bitcoin’s stability and dominance have paved the way for a new phase where ALTs could once again have new opportunities. Although the short-term outlook for ALTs is unclear, the next major market transition may deliver fresh gains for these tokens.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQs)

Why is Bitcoin dominating over ALTs?

Bitcoin’s price stability above $96,000 is keeping it at the forefront, while altcoins struggle to gain momentum.

What does the CoinMarketCap Altcoin Season Index indicate?

It measures the performance of the top 100 cryptocurrencies over a 90-day period, indicating whether it’s a time for altcoins or Bitcoin.

How could regulation affect ALTs?

As regulatory scrutiny increases, stifling innovation and growth, Bitcoin continues to mostly fly under the radar.

Why are altcoins struggling in 2025?

A surge in new tokens, liquidity spread, and regulatory pressures are limiting altcoins’ bullish momentum.

Appendix Glossary of Key Terms

Altcoin Season – A phase during which most altcoins outperform Bitcoin (usually in a case where 75% of them are in green).

CMC Altcoin Season Index – Tool assesses top 100 cryptocurrencies performance to determine whether an altcoin season or Bitcoin season is ongoing.

Bitcoin Season – When Bitcoin outpacing Alts– generally this would leave a low Altcoin Season Index score.

Inter exchange Flow Pulse (IFP) – Metric demonstrating the flow of Bitcoin between spot and derivative exchanges, used evaluating market sentiment.

Liquidity – Refers to the forces at play in the market that allows an investor to buy or sell an asset; it can significantly affect if any ALTs can hold a price.

Macroeconomic Factors – general economic conditions impacting inflation and interest rates that impact cryptocurrencies.

References

CryptoNews – crypto.news.com

CoinMarketCap – coinmarketcap.com

CryptoQuant – cryptoquant.com