Bitcoin ETFs in the United States are nearing the assets managed by gold ETFs. Experts have estimated that if the growth of Bitcoin ETFs remains steady, they may outpace gold ETFs by Christmas, which would be a major win for the digital currency space.

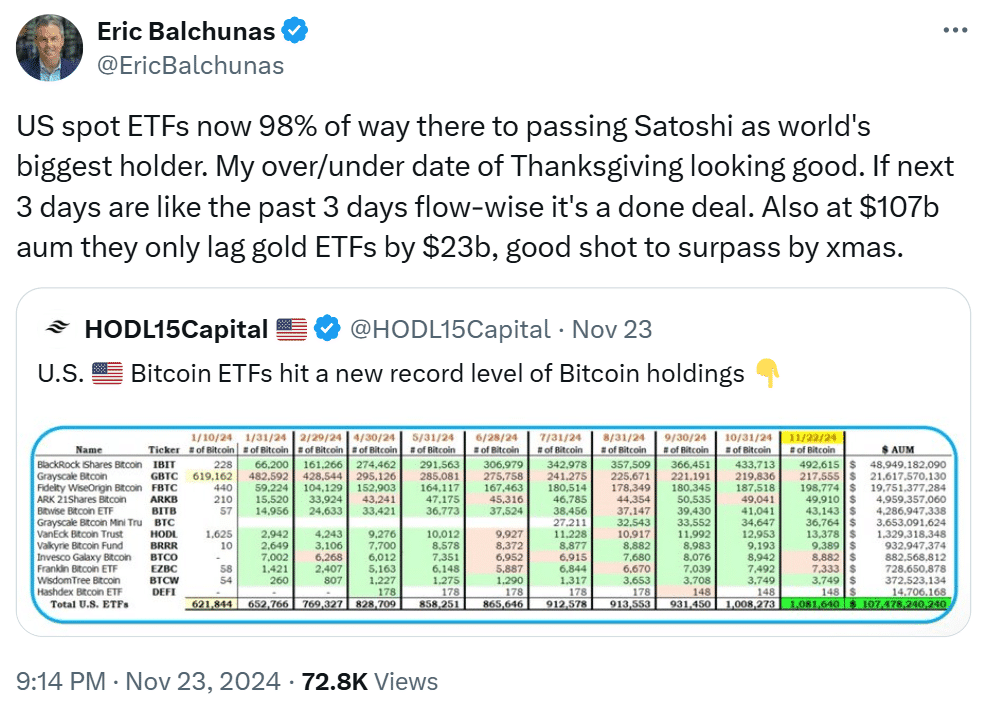

Bitcoin ETFs as of November 23 had a total asset base of $107 billion. This is equivalent to 86% of the total assets under management by gold ETFs implying that there is still some room for closing the gap at $23 billion. The fast growth rate has made many people believe that it will not be long before Bitcoin ETFs equal or even go beyond the gold ETFs.

Bitcoin ETFs Dominate

Besides, Bitcoin ETFs are now almost capable of outperforming the estimated BTC reserves of Satoshi Nakamoto. Nakamoto, the unknown person who set up the digital currency, is estimated to have mined some one million BTC when the currency was still in its infancy. Bitcoin ETFs now have approximately 98% of these funds, which makes them the biggest single owner of BTC in the world.

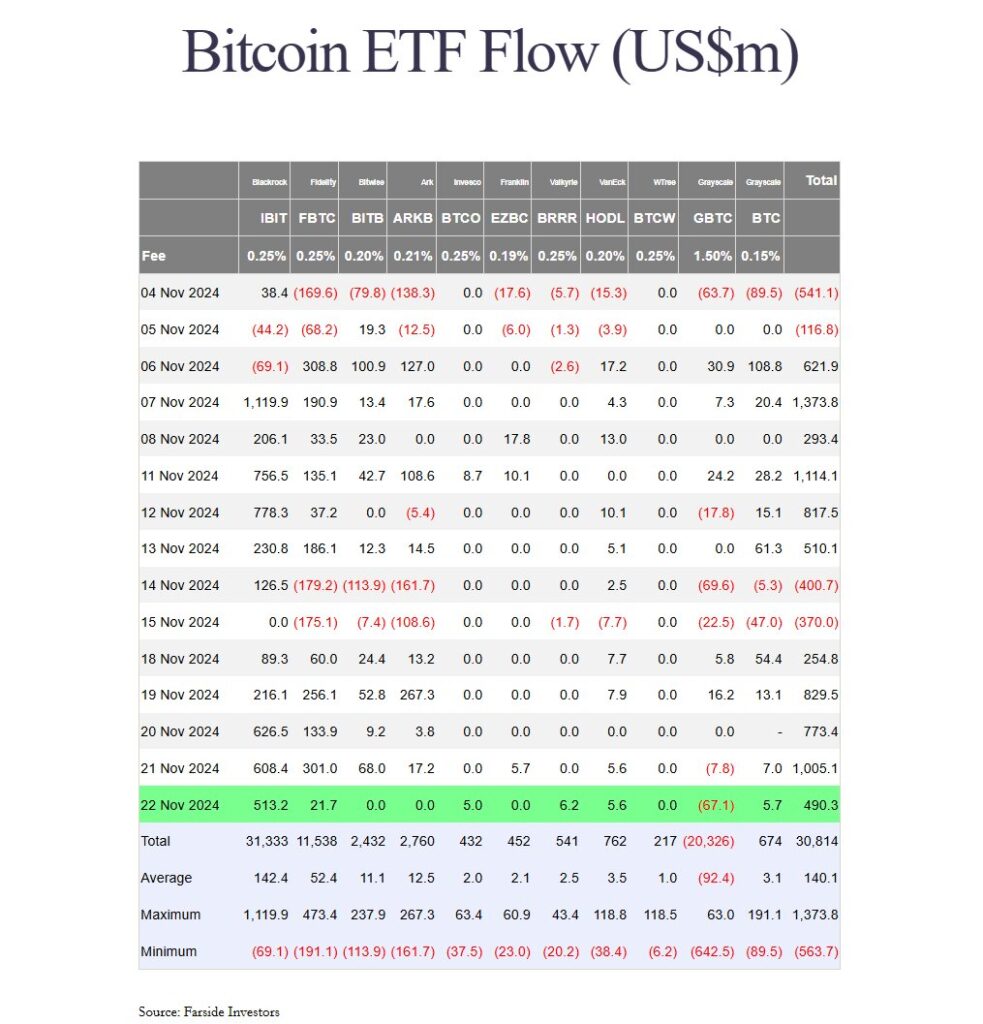

This particular week alone, U.S. spot Bitcoin ETFs have garnered an astonishing $3.3 billion of net assets. Recent information from Farside Investors indicates that BlackRock’s iShares Bitcoin Trust (IBIT) was the biggest beneficiary of these inflows, account for approximately 62% of the total. The fact that the BlackRock is in such a commanding position in this space underlines that there is institutional demand for BTC-related investment products.

BlackRock’s IBIT has also expanded the distance between it and its gold ETF peer, the iShares Gold Trust (IAU). At the close of business on November 22, IBIT’s asset stood at $48.4 billion while that of IAU was at $34 billion. This divergence is even starker as investors now prefer BTC to more conventional forms of asset like gold.

This has been driven by whole market interest in Bitcoin which has been boosted by the recent price rise of the cryptocurrency. On Friday, the price of BTC hit $99,500 for the first time ever and is now approaching the six-figure milestone.

Skepticism Over Bitcoin

Major asset manager VanEck has put a $180,000 price target on BTC for the current cycle. The firm’s confidence may be attributed to favourable funding rates, high Relative Unrealised Profit (RUP) and increased retail participation. These indicators hint that the current rally is well backed and affirms the view that price gains may continue.

Nevertheless, the recent success of Bitcoin, which boasts a 160% YTD return, has not convinced everyone that the appreciation is to continue. Some analysts believe that such high volatility of the cryptocurrency is not safe for investors. World’s largest asset manager with over $4 trillion in assets under management, State Street has expressed doubt about BTC’s sustainability.

According to George Milling-Stanley, the chief gold strategist at State Street Global Advisors, returns on Bitcoin investment may be more illusory than real. He pointed out that now many investors are buying Bitcoin as an asset only to earn profits without actually knowing the downsides. BTC, he pointed out, has only been around for a decade while gold has been used as a store of value for hundreds of years.

Digital Vs. Physical Debate

Milling-Stanley also took issue with the efforts to compare BTC mining with traditional gold mining. It was his contention that referring to it as “mining” is a calculated attempt at piggybacking on the perceived positive connotations associated with the precious metal – gold. According to him, Bitcoin mining is computational in nature and not as physically and resource demanding as the mining of gold.

However, growth of BTC has outshined all other cryptocurrencies and its market capitalization has crossed silver and even the oil giant Saudi Aramco. This change has led to a lot of controversies as to the positions of BTC and Gold in the world economic system. The coming weeks are likely to show whether the Bitcoin ETFs will be able to catch up with or even overtake the gold ETFs in terms of assets.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!