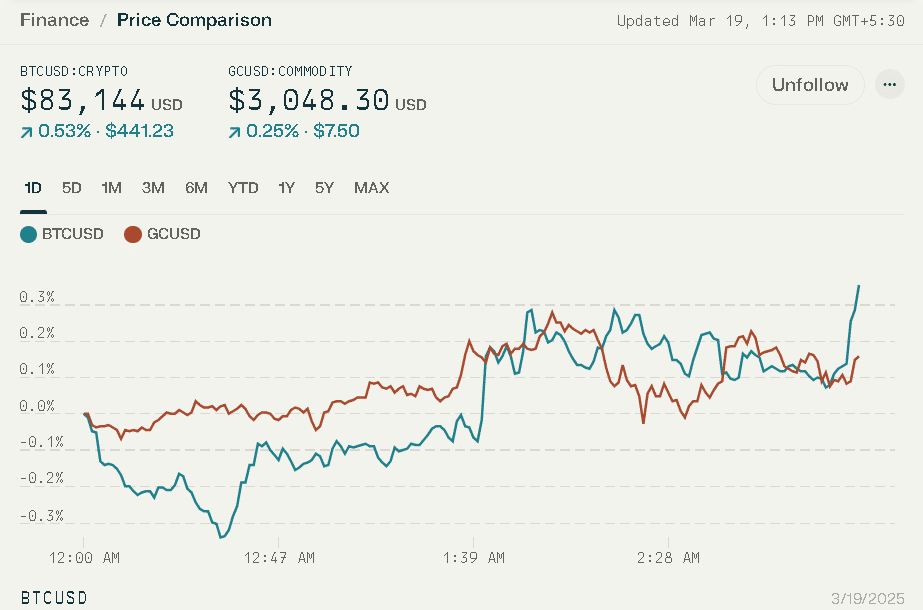

According to recent data from CoinGecko and Glassnode, the price of gold on March 19 has increased. It reached a new record of $3,047 per ounce. On the other hand, the value of digital gold is no longer as high as real gold. Bitcoin is facing a tremendous drop in its price, causing investors to shift their investing approach.

The price of BTC decreased by 15% in just one month. This change between gold and Bitcoin has attracted global attention. The financial market remains unstable due to recent global issues. The growing Israel-Hamas conflict and trade tension caused by President Donald Trump’s policies have caused uncertainties in the crypto market.

Gold Breaks Record as Bitcoin Dips

On March 19, 2025, the price of Gold crossed $3,025. This suggests that the price of real gold has risen by 13% and 40% over the past year. Many crypto leaders view this as a consequence of Global issues like the Israel conflict. This has made more people and investors buy gold-backed ETFs and trust this as a safe investment.

On the other hand, the price of BTC has dropped significantly. According to a recent survey by coinGecko, the price of digital coin has fallen by 25% from the top value of $108,786. It is now valued at $81,967, which shows a clear price difference in comparison with the rising price of gold. On March 19, 2025, the price of BTC fell to $83,042, which is down by 10% from January.

Bitcoin’s Disconnect from Gold

Bitcoin is often known as digital gold as people saw it as a potential store of value. However, in recent years, the prices of BTC have been similar to U.S. tech stocks like Nasdaq 100 rather than gold. BTC and tech stocks go together with market trends. This suggests that investors now treat BTC like a risky investment rather than seeing it as a safe asset like gold.

Eric Balchunas, who is an expert on ETF from Bloomberg, stated that Bitcoin is still too volatile to be considered a stable store of value. He explained that the coin is still growing and maturing. Its price jumps up and down a lot, sometimes dropping by more than 50% in tough times, while Gold remains stable. Due to its unpredictable nature, it is more likely to act as a tech stock rather than saying it as gold.

Gold Prices Rises Amid Global Uncertainty

The prices of gold are going up not only because of its safe investment feature but also because of President Donald Trump’s trade policies, especially the renewed tariff talks. As there is uncertainty due to global issues, investors are looking out for gold, as it has been seen as a safe option to protect from inflation and market uncertainty.

The founder of ByteTree, Charlie Morris, describes the recent movement in gold as a ” proper gold rush”.He pointed out that this rally happened last time in 2011.

Bitcoin Struggles with Liquidity and Investors’ Sentiment

According to recent data from Glassnode, BTC is facing a liquidity problem, along with less money flowing in. This is caused due to some trades which are unwinding and due to shifts in market sentiment. The ongoing global crisis and economic uncertainty in the U.S. are making it as a risky investment. At the same time, this is benefiting gold as more people are looking for safer options.

Conclusion

Gold has achieved a new high record as it appears to be a safer option for investment in rising global risk and economic uncertainty. On the other hand, Bitcoin is still struggling to fulfill its role as “digital gold.” It cannot be predicted whether BTC will stabilize in time and follow the lead of gold. Investors are keeping an eye on both assets as they move in different directions in a volatile market.

Stay updated with BTC price trends by following The Bit Journal

FAQ

1. Why is Bitcoin price dropping?

BTC price drop due to market instability and geopolitical tension.

2. How much has Bitcoin dropped?

It dropped by 15% in a month.

3. What is gold’s current price?

The gold price is $3,047 per ounce

4. Is Bitcoin still digital gold?

It acts are more like tech stocks rather than gold.

5. What global events affect Bitcoin price?

Global events like the Israel-Hamas conflict, and U.S. trade tensions affects BTC.

Glossary

Bitcoin – A digital currency and digital gold

Volatility – Rapid price change.

Nasdaq 100 – A stock market index

Tariff – A tax on imported goods

Liquidity – How easily an asset can be bought or sold.