Trust is the backbone of every financial system. Bitcoin vs. the dollar, the value of money depends on the confidence people have in it. While fiat currencies like the U.S. dollar rely on trust in governments and central banks, Bitcoin operates on decentralized technology and cryptographic security. This fundamental difference is reshaping the global financial landscape. As inflation rises and geopolitical uncertainties increase, more people are questioning the long-term stability of traditional currencies and looking toward alternatives like Bitcoin.

The Role of Trust in Fiat Currencies

Fiat currencies, such as the U.S. dollar, derive their value from the trust placed in the issuing government. The dollar has long been the world’s primary reserve currency, used for international trade, investments, and economic stability. The strength of the U.S. economy and the policies of the Federal Reserve play a critical role in maintaining this trust.

However, fiat currencies have significant vulnerabilities:

- Inflation and Monetary Policy: Over time, the purchasing power of the dollar has drastically declined due to inflation. Since the Federal Reserve’s inception in 1913, the U.S. dollar has lost more than 96% of its value.

- Political and Economic Instability: The credibility of a currency depends on the stability of the government backing it. Economic mismanagement, national debt, and geopolitical tensions can erode confidence in the dollar.

- Centralized Control: Governments and central banks have the power to print money at will, leading to concerns about excessive money supply, devaluation, and loss of purchasing power.

Despite these challenges, the dollar remains dominant because of its historical reliability and global acceptance. But as trust in government-backed money wavers, people are turning to decentralized alternatives like Bitcoin in Bitcoin vs. the Dollar.

Bitcoin: A Trustless Alternative?

Unlike fiat currencies, Bitcoin does not rely on a central authority. Instead, its trust model is built on technology, cryptographic security, and mathematical algorithms. Here’s why Bitcoin is gaining trust as a global financial asset:

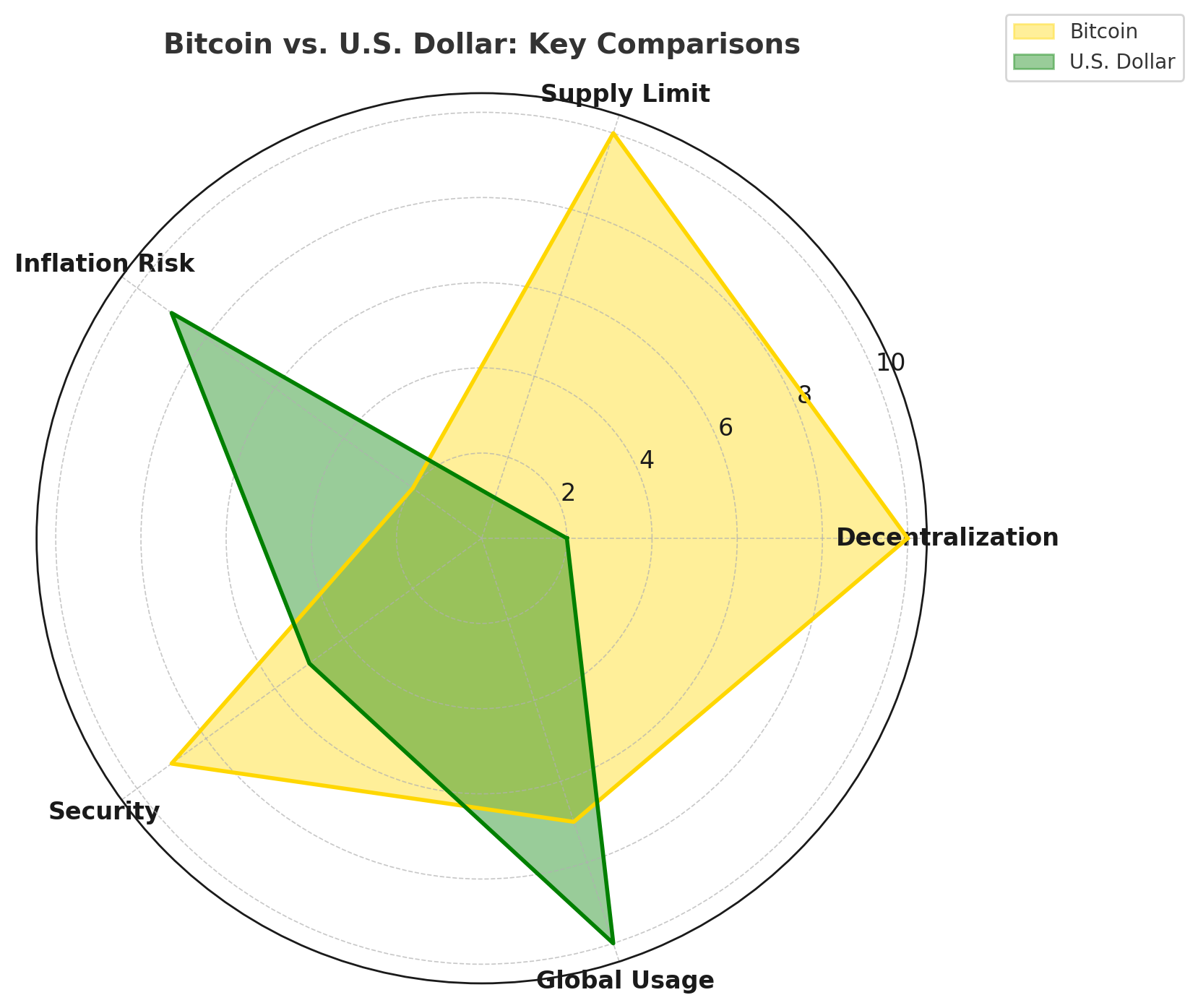

- Decentralization: Bitcoin operates on a distributed network, making it resistant to censorship and government control.

- Scarcity and Monetary Policy: Unlike the U.S. dollar, which can be printed in unlimited quantities, Bitcoin has a fixed supply of 21 million coins. This scarcity makes it a strong hedge against inflation.

- Transparency and Security: Transactions on the Bitcoin blockchain are public and immutable, reducing the risk of fraud and manipulation.

- Borderless Transactions: Bitcoin enables people to store and transfer value globally without relying on banks or financial institutions.

For these reasons, Bitcoin has become particularly appealing in countries facing economic crises, capital controls, and hyperinflation. It offers financial freedom and an alternative to traditional banking systems.

The Shift in Global Trust

As trust in fiat currencies erodes, governments and financial institutions are exploring alternatives. Notably, Russian President Vladimir Putin has raised concerns about the risks of holding reserves in foreign currencies, suggesting that assets like Bitcoin could provide an alternative store of value.

This shift in perspective is driven by:

- Geopolitical Risks: Countries facing economic sanctions or diplomatic tensions are exploring Bitcoin as a means of financial independence.

- Inflation Concerns: With rising inflation and monetary expansion, investors are diversifying into Bitcoin and other scarce assets like gold.

- Institutional Adoption: Major corporations and financial institutions are integrating Bitcoin into their portfolios, further legitimizing it as a valuable asset.

Will Bitcoin Replace the Dollar?

While Bitcoin is gaining traction, it is unlikely to replace the U.S. dollar entirely—at least in the near future. The dollar remains deeply embedded in the global economy, with governments, businesses, and institutions continuing to rely on it for trade and investment.

However, in Bitcoin vs. the Dollar, Bitcoin is establishing itself as a complementary asset rather than a direct competitor. It provides an alternative financial system, particularly for those seeking protection against inflation, financial censorship, and centralized control.

Conclusion on Bitcoin vs. the Dollar

To consider Bitcoin vs. the Dollar, trust is the foundation of money, and its sources are evolving. While fiat currencies rely on governmental credibility, Bitcoin derives trust from its technology and decentralized nature. As economic uncertainties grow, more individuals and institutions are turning to Bitcoin as a hedge against traditional financial risks.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs: Bitcoin vs. the Dollar

1. Why is trust important in both Bitcoin and the U.S. dollar?

Trust determines the value and usability of any currency. The U.S. dollar relies on trust in the government and Federal Reserve, while Bitcoin’s trust comes from decentralization, cryptographic security, and its fixed supply.

2. How does Bitcoin differ from the U.S. dollar in terms of monetary policy?

Bitcoin has a fixed supply of 21 million coins, making it resistant to inflation. The U.S. dollar, on the other hand, is subject to monetary policies where central banks can print more money, leading to potential devaluation.

3. Can Bitcoin replace the U.S. dollar?

While Bitcoin is growing in adoption, it is unlikely to fully replace the dollar in the near future. However, it is increasingly being used as an alternative store of value and hedge against inflation.

4. Why do people lose trust in the U.S. dollar?

Trust in the U.S. dollar declines due to factors like high inflation, excessive money printing, national debt, and economic instability. These issues cause investors to seek alternatives like Bitcoin and gold.

5. Is Bitcoin more secure than fiat currency?

Bitcoin is considered more secure in terms of fraud resistance and censorship, thanks to blockchain technology. However, it is also volatile, and price fluctuations can impact trust in its use as a currency.

Glossary of Key Terms

Fiat Currency: Government-issued money, such as the U.S. dollar, that is not backed by a physical commodity like gold.

Bitcoin: A decentralized digital currency that operates on a blockchain and has a fixed supply of 21 million coins.

Blockchain: A distributed ledger technology that records transactions in a secure and transparent manner.

Inflation: The decline of purchasing power over time, often due to an increase in the money supply.

Decentralization: The absence of a central authority in Bitcoin’s system, making it independent from government control.

Store of Value: An asset that retains its value over time, such as Bitcoin or gold.

Monetary Policy: The policies set by central banks, like the Federal Reserve, to regulate money supply and control inflation.

Cryptographic Security: The use of encryption techniques to secure transactions and protect Bitcoin from fraud.

Hedge Against Inflation: An investment that helps preserve purchasing power when inflation rises, like Bitcoin or gold.