The crypto market witnessed a sharp crash following former U.S. President Donald Trump’s new executive order. While many investors faced heavy losses, one Bitcoin (BTC) whale capitalized on the chaos, securing a staggering $7.5 million in profit. Now, speculation is mounting over whether this individual had insider knowledge of the market-moving decision.

How the Bitcoin Whale Profited from Trump’s Order

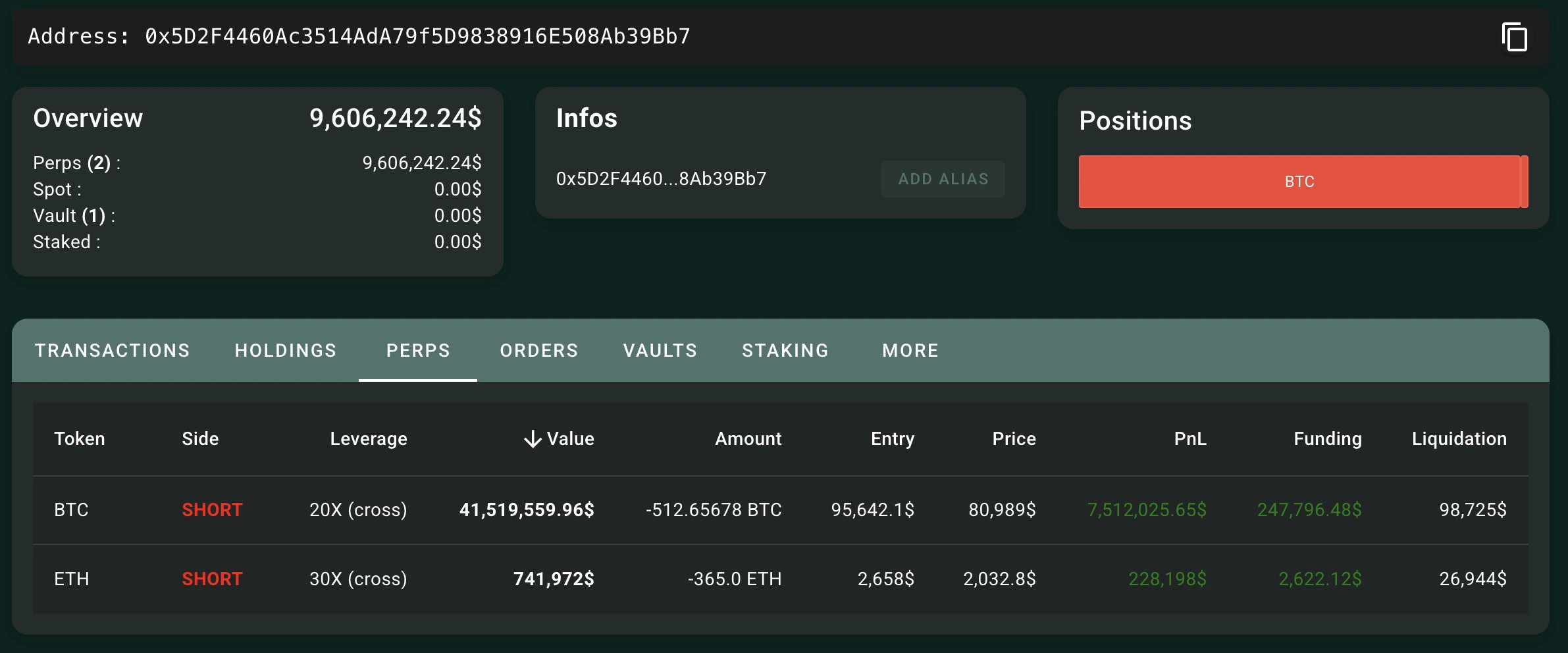

According to on-chain analytics firm Lookonchain, a Bitcoin whale placed a massive short position on February 22 when BTC was trading at $96,500. Shortly after, Bitcoin plunged to $78,900, generating millions in profit for the trader.

As the dust settled, the whale made another calculated move. When Bitcoin surged past $94,000 following Trump’s announcement, they reopened a short position, betting on another price drop. This prediction proved accurate, resulting in a total profit of $7.5 million.

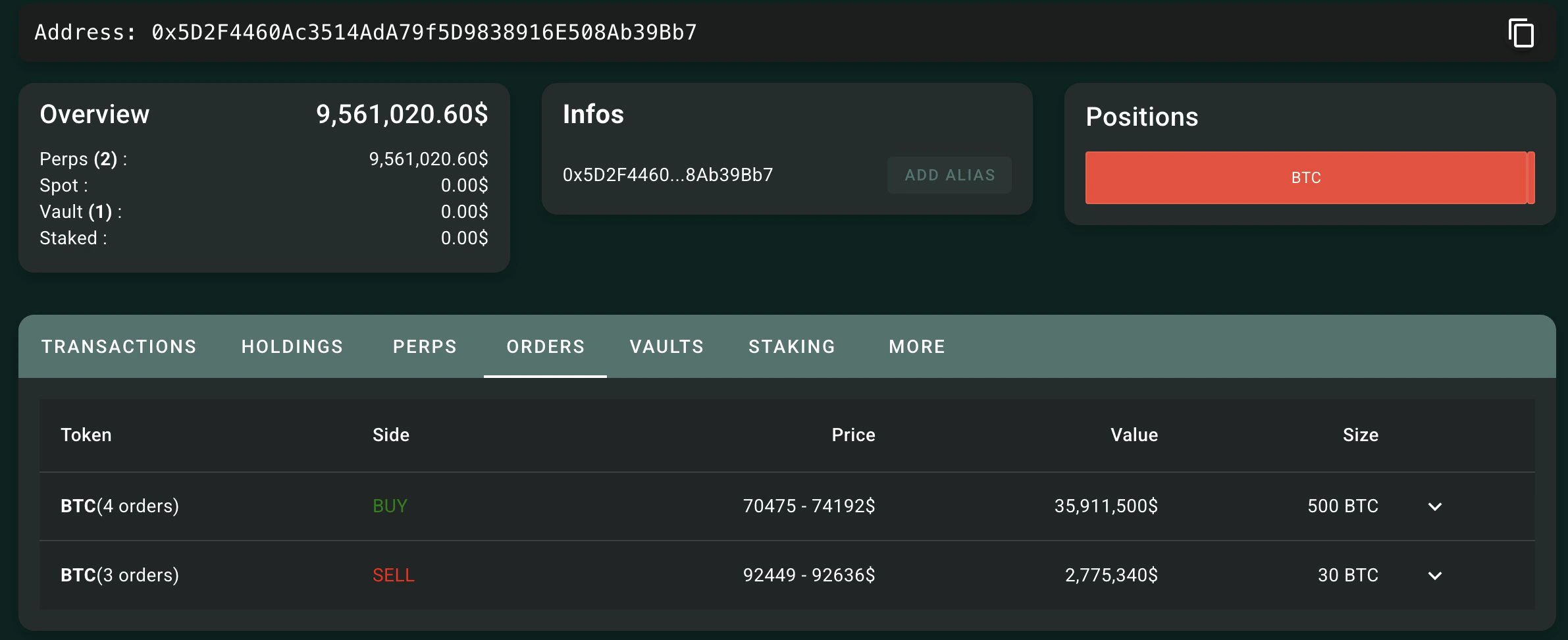

Currently, Bitcoin is hovering around $82,000, and the whale has opened fresh short positions between $92,449 and $92,636. If BTC experiences another drop, the trader could potentially pocket an additional $70,000–$74,000.

What’s Next for Bitcoin?

Bitcoin has fallen 4.5% in the last 24 hours, reaching a low of $80,350. Investors are now bracing for further volatility as the U.S. Consumer Price Index (CPI) report looms. Veteran trader Peter Brandt has noted that BTC is forming a “bearish pennant” pattern, signaling a possible continuation of the downtrend. Former BitMEX CEO Arthur Hayes predicts BTC will first test the $78,000 level and, if unsuccessful, could dip to $75,000.

Adding to the intrigue, another investor allegedly linked to Trump reportedly made $81 million in just two days by shorting Ethereum (ETH). The crypto community is abuzz with insider trading concerns, questioning whether these gains stem from sheer skill or privileged access to market-moving information. With Trump’s influence on Bitcoin’s price action growing, all eyes are on potential regulatory implications.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!