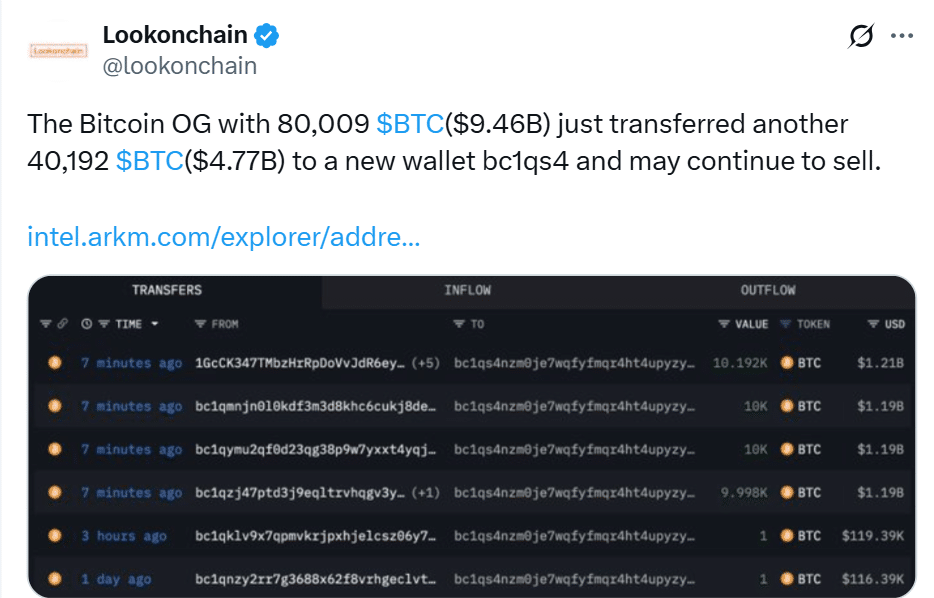

A major Bitcoin whale has suddenly reemerged after over a decade of silence, initiating a massive Bitcoin whale transfer totaling 40,192 BTC. With an estimated value of $4.77 billion, this movement has sent shockwaves through the crypto market. The wallet in question had remained inactive since 2011, making it one of the oldest and largest dormant addresses on record.

Bitcoin Whale Transfer Begins With Over $1B Sent to Galaxy Digital

The Bitcoin whale transfer began earlier this week with 9,000 BTC sent to wallets linked to Galaxy Digital. This initial move, worth approximately $1.06 billion, raised eyebrows across the industry. Shortly after, another 7,823 BTC, valued at $927 million, followed. By the end of the spree, more than 40,000 BTC had changed hands.

Following confirmation of the transfer, Bitcoin’s price dropped nearly 0.70% in the past 24 hours. The cryptocurrency is currently trading at $118,603, down from recent highs near $123,000. In the last 24 hours, the price ranged between $117,284 and $120,065. Trading volume also decreased by 18%, suggesting lower enthusiasm from market participants in response to the whale’s activity.

Galaxy Digital Routes BTC to Major Exchanges

Adding to speculation, on-chain data shows Galaxy Digital transferred 6,000 BTC to exchanges like Binance and Bybit. These platforms are typically used to convert large holdings into fiat or stablecoins. This move indicates that the Bitcoin whale transfer may not simply be a wallet upgrade—it could be a setup for a large-scale liquidation.

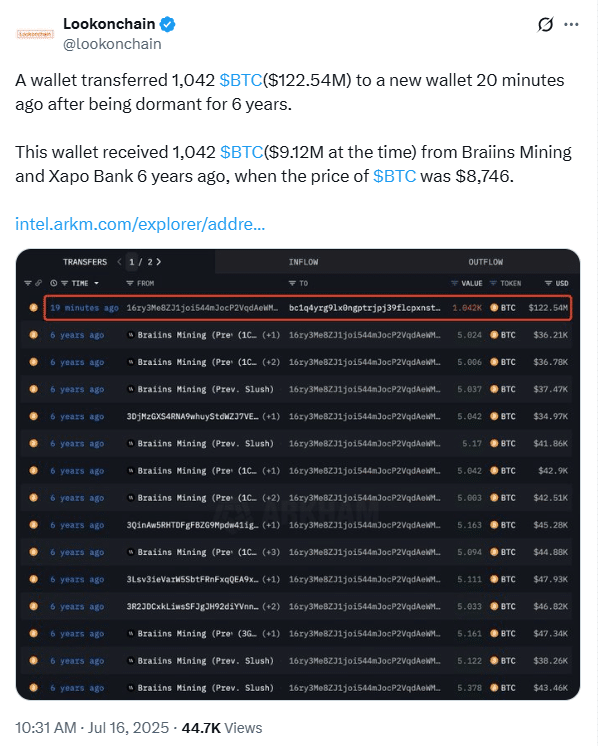

Another Dormant Wallet Joins the Movement

The 80,000 BTC whale was not alone. A separate dormant wallet also became active, transferring 1,042 BTC—now worth about $122.5 million—to a new address. This second wallet had been idle for six years. It originally received BTC when the coin was valued under $9,000. Now, that same stash has multiplied in worth more than 13 times.

Analysts Warn of Broader Market Impact

Crypto analysts and institutional watchers have flagged the timing and magnitude of the Bitcoin whale transfer as potentially bearish. The market has seen increased whale activity in recent weeks, particularly from older wallets. Many believe these movements could indicate preparation to cash out while Bitcoin remains near its peak.

Not all analysts believe the transfers are voluntary. Coinbase Head of Product Conor Grogan suggested the original whale wallet might have been compromised. If the private keys were stolen or leaked, this would explain the sudden Bitcoin whale transfer after more than a decade of silence. Security concerns continue to grow, especially as more legacy wallets reawaken.

Traders Shift Strategy as Sell Pressure Rises

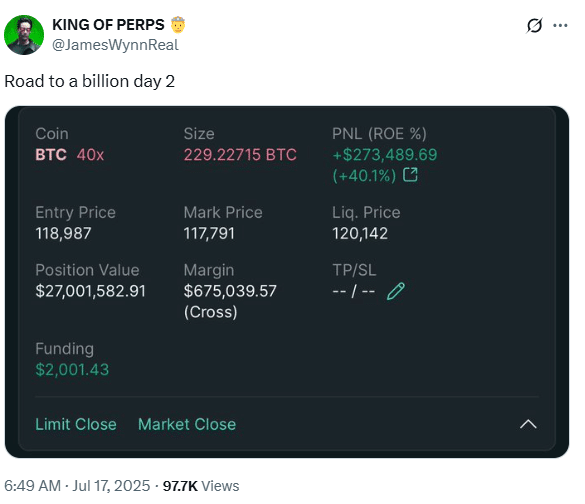

High-leverage traders have responded swiftly to the unfolding events. James Wynn, a well-known crypto trader, closed a 40x long position with a profit of $368,120 and quickly opened a 40x short. His liquidation level was set just above $120,000. This shift is part of a broader trend, with many whales and traders moving from long to short positions.

Selling the Remaining BTC Could Trigger Price Volatility

With half of the 80,000 BTC already moved, concerns are rising about what happens if the remaining half is sold. If another major Bitcoin whale transfer occurs, it could overwhelm exchange liquidity and drive prices down further. The market remains highly sensitive to large inflows of BTC, especially from whales with deep reserves.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| July | $118,682.77 | $122,213.01 | $125,743.25 | 6% |

| August | $107,077.37 | $121,192.20 | $135,307.03 | 14.1% |

| September | $107,097.60 | $118,730.21 | $130,362.81 | 9.9% |

| October | $100,164.58 | $106,181.60 | $112,198.61 | -5.4% |

| November | $100,583.05 | $100,252.46 | $99,921.87 | -15.7% |

| December | $102,222.15 | $100,986.59 | $99,751.02 | -15.9% |

The sentiment in the crypto space has shifted sharply. Investors who were once celebrating new highs are now adopting a wait-and-see approach. The sudden Bitcoin whale transfer has altered market psychology. Traders are watching blockchain data closely for more signs of incoming sales. Until clarity returns, short-term volatility may dominate.

Conclusion

The unexpected Bitcoin whale transfer of over $4.7 billion has reshaped the narrative in the cryptocurrency market. What began as a quiet week turned into one dominated by fear and caution. Whether the whale continues liquidating or not, the damage has been done. Traders now face a more uncertain landscape shaped by every major movement on the blockchain.

For more expert reviews and crypto insights, visit our platform for the latest news and predictions.

Summary

A long-dormant Bitcoin whale has reemerged after 14 years, triggering a massive Bitcoin whale transfer of 40,192 BTC worth $4.77 billion. The initial $1 billion transfer to Galaxy Digital was followed by further large movements, sparking fears of a potential market sell-off.

Bitcoin’s price dipped nearly 2% amid rising concerns, with analysts warning of broader impacts if more transfers follow. On-chain data shows part of the BTC reaching exchanges, raising questions about liquidation, compromised wallets, and shifting trader strategies across the crypto market.

Frequently Asked Questions (FAQ)

1- What is a Bitcoin whale transfer?

It refers to a large transaction made by a wallet holding thousands of BTC. These can influence market behavior due to their size.

2- Why is this transfer significant?

The whale had been dormant for 14 years. The scale and timing of the activity raise suspicions of a major sell-off.

3- Did Galaxy Digital sell the BTC?

Galaxy Digital transferred 6,000 BTC to exchanges. This is usually done before selling, though the actual sale hasn’t been confirmed.

4- What happens if more BTC is moved?

Further transfers may trigger larger price drops. Traders and exchanges are closely monitoring all whale movements.

Appendix: Glossary of Key Terms

Bitcoin Whale – An individual or entity that holds a large amount of Bitcoin—typically over 1,000 BTC—and whose actions can influence market trends.

Bitcoin Whale Transfer – The movement of a significant quantity of Bitcoin by a whale, often signaling strategic positioning or an upcoming market event.

Dormant Wallet – A crypto wallet that has remained inactive for an extended period, sometimes over a decade, before suddenly showing activity.

On-Chain Data – Blockchain-verified information that records transactions, wallet activity, and asset flows in real time, visible to the public.

Galaxy Digital – A financial services firm focused on digital assets, frequently involved in large institutional cryptocurrency transactions.

Exchange Inflow – The transfer of crypto assets into an exchange wallet, typically seen as a precursor to a sell-off or market trade.

Private Keys – Unique cryptographic codes that provide ownership and access to cryptocurrency wallets. Loss or theft of private keys results in lost funds.

References

Cryptotimes – cryptotimes.io

Crypto News – crypto.news