In recent weeks, Bitcoin whales—individuals or entities holding large amounts of Bitcoin—have significantly increased their holdings, accumulating approximately 65,000 BTC. This substantial activity occurs amid growing market uncertainty, prompting discussions about its potential impact on Bitcoin’s price trajectory and overall market dynamics.

Understanding Whale Accumulation

Bitcoin whales are typically defined as addresses holding 1,000 BTC or more. Their actions can significantly influence market trends due to the sheer volume of assets they control. When whales accumulate Bitcoin, it often signals confidence in the asset’s future performance, potentially leading to bullish market sentiment. Conversely, when they sell off large holdings, it can trigger price declines and increased volatility.

Recent Trends in Whale Activity

Data from various sources indicates a notable shift in whale behavior:

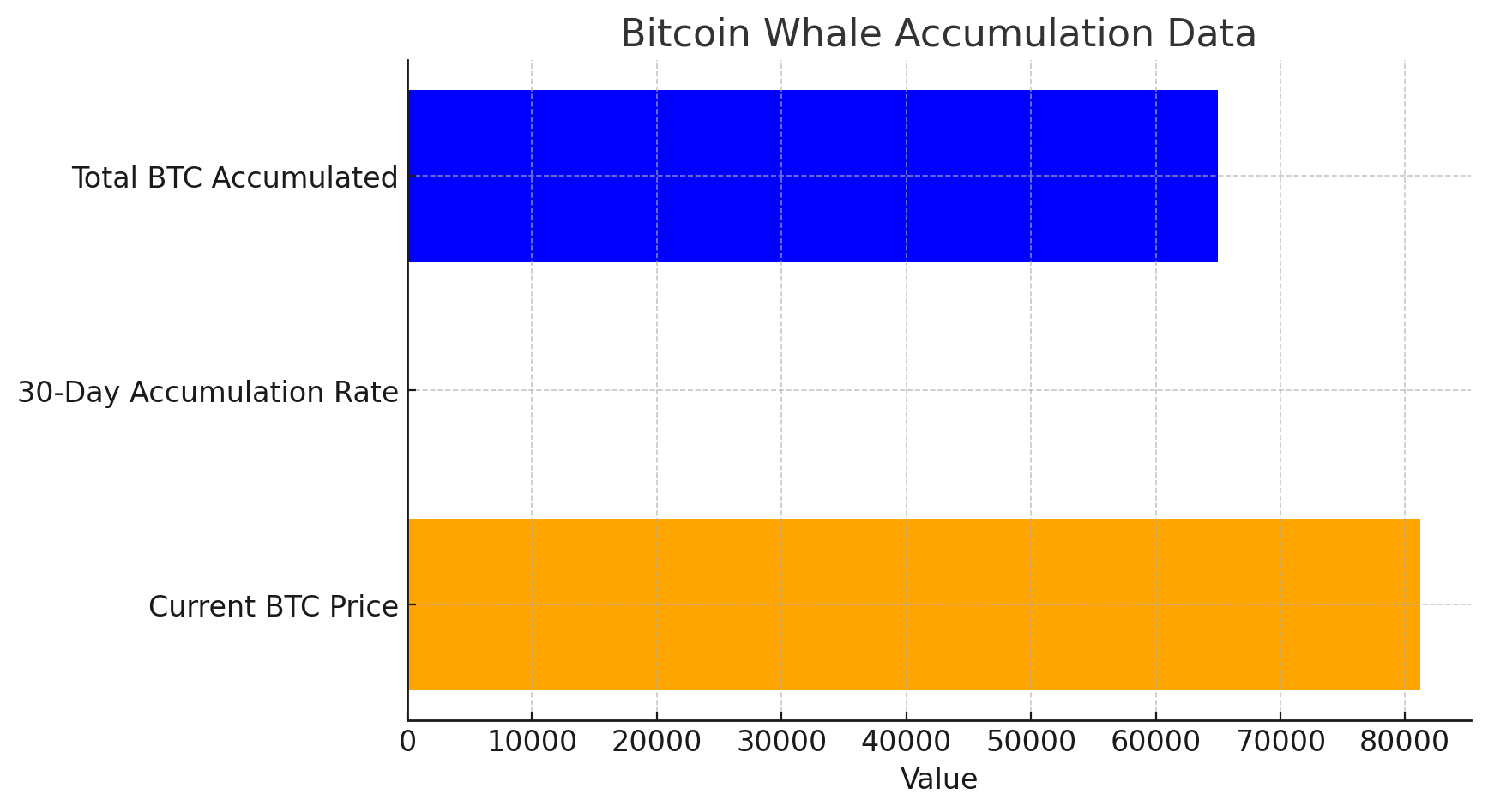

- Accumulation Phase: After a period of net selling, Bitcoin whales have resumed accumulating Bitcoin. Over the past 30 days, their holdings have increased by approximately 65,000 BTC, marking a positive change in the 30-day accumulation rate to +0.7%.

- Market Impact: This accumulation coincides with Bitcoin’s price stabilizing around $81,220, suggesting that whale activity may be providing support amid broader market fluctuations.

Factors Driving Whale Accumulation

Several factors may be contributing to this renewed interest from Bitcoin whales:

- Market Corrections: Recent price corrections have presented buying opportunities for long-term investors seeking to acquire Bitcoin at lower prices.

- Regulatory Developments: Anticipation of favorable regulatory changes, such as the establishment of a Bitcoin Strategic Reserve by the U.S. government, may be bolstering confidence among large investors.

- Inflation Hedge: Persistent inflation concerns continue to drive investors toward Bitcoin as a store of value, reinforcing its appeal as “digital gold.”

Potential Implications for the Market

The resurgence in whale accumulation could have several implications:

- Price Support: Increased demand from whales may provide a price floor, reducing the likelihood of further significant declines in the short term.

- Market Sentiment: Whale accumulation often signals confidence in the asset, potentially attracting retail investors and fostering a more bullish market environment.

- Volatility Considerations: While whale buying can stabilize prices, it can also lead to increased volatility, especially if these large holders decide to sell in the future.

Historical Context: Whale Activity and Market Movements

Historically, whale behavior has been a precursor to notable market movements:

- Bullish Indicators: Periods of significant whale accumulation have often preceded bullish runs. For instance, before Bitcoin’s surge to its all-time high in January 2025, whales were actively increasing their holdings.

- Bearish Signals: Conversely, substantial whale sell-offs have been associated with market downturns, as increased supply can drive prices downward.

Bitcoin Whales Accumulation Data Overview

The table below provides a summary of the latest Bitcoin whales accumulation data:

| Metric | Value | Implication |

|---|---|---|

| Total BTC Accumulated | 65,000 BTC | Increased buying pressure from whales |

| 30-Day Accumulation Rate | +0.7% | Positive shift in whale holdings |

| Current BTC Price | $81,220 | Stabilization amid uncertainty |

| Historical Accumulation Trends | Correlated with price surges | Potential for bullish momentum |

Conclusion

The recent accumulation of approximately 65,000 BTC by Bitcoin whales underscores a pivotal shift in market dynamics amid prevailing uncertainty. This behavior suggests renewed confidence among large investors, potentially providing price support and influencing broader market sentiment. However, while whale accumulation can be a bullish indicator, it also necessitates caution due to the potential for increased volatility. As always, investors should conduct thorough research and consider various factors before making investment decisions in the cryptocurrency market.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

Who are Bitcoin whales?

Bitcoin whales are individuals or entities that hold large amounts of Bitcoin, typically defined as addresses with 1,000 BTC or more. Their trading activities can significantly influence the cryptocurrency market.

Why is whale accumulation significant?

Whale accumulation indicates that large investors are buying and holding Bitcoin, which can signal confidence in the asset’s future performance and potentially lead to price increases.

How does whale activity affect retail investors?

Whale activity can impact market sentiment and price volatility. Retail investors often monitor whale movements to inform their trading strategies, as significant whale transactions can precede major market shifts.

Can whale sell-offs crash the market?

Large-scale sell-offs by whales can increase supply rapidly, potentially leading to sharp price declines and heightened market volatility.

How can I track whale activity?

Various blockchain analytics platforms provide real-time data on large Bitcoin transactions and whale holdings, allowing investors to monitor whale activity.

Glossary of Key Terms

- Bitcoin (BTC): A decentralized digital currency without a central bank or single administrator, allowing peer-to-peer transactions on the blockchain network.

- Whale: A term used to describe individuals or entities that hold large amounts of cryptocurrency, capable of influencing market prices through their trading activities.

- Accumulation: The process of continuously buying and holding an asset over time, often to build a substantial position.

- Market Sentiment: The overall attitude of investors toward a particular asset or financial market, influencing trading behaviors and price movements.

- Volatility: A statistical measure of the dispersion of returns for a given asset, indicating the level of risk and price fluctuations over time.