The movements of large Bitcoin holders, known as ” Bitcoin whales,” can significantly influence crypto market trends and investor sentiment. These individuals or entities control vast quantities of Bitcoin, and their actions often ripple through the market, prompting reactions from traders, analysts, and other investors, The Bit Journal reported on Wednesday.

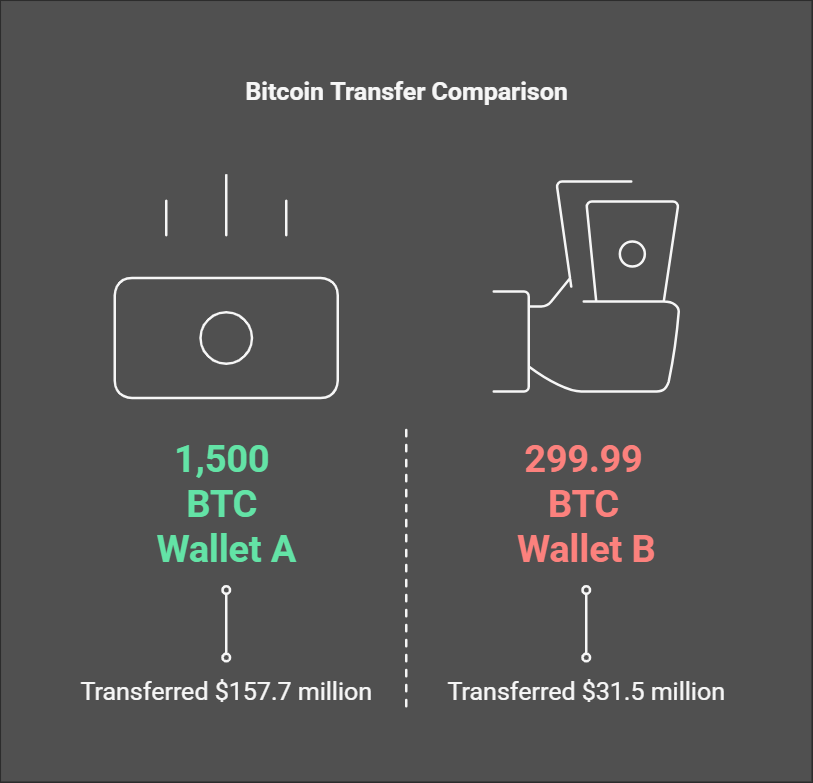

Recently, substantial transactions totaling 1,800 BTC, valued at approximately $189 million, were executed, drawing considerable attention from market participants. These transactions included a transfer of 299.99 BTC (worth $31,521,070) to the wallet address and 1,500 BTC (worth $157,660,339) to the wallet address.

The size and precision of these movements raise intriguing questions about their intentions. Could they signify an impending market move, or are they part of a broader strategy? Understanding these activities requires delving into the motivations and impacts of whale transactions on the cryptocurrency ecosystem.

Understanding the Bitcoin Whales Movements

Whales are pivotal players in the cryptocurrency market due to the sheer volume of assets they control. These entities can include early adopters of Bitcoin, institutional investors, cryptocurrency exchanges, and even large hedge funds. Their actions can influence the market in ways small investors cannot, primarily because their transactions often involve sums large enough to sway supply and demand dynamics.

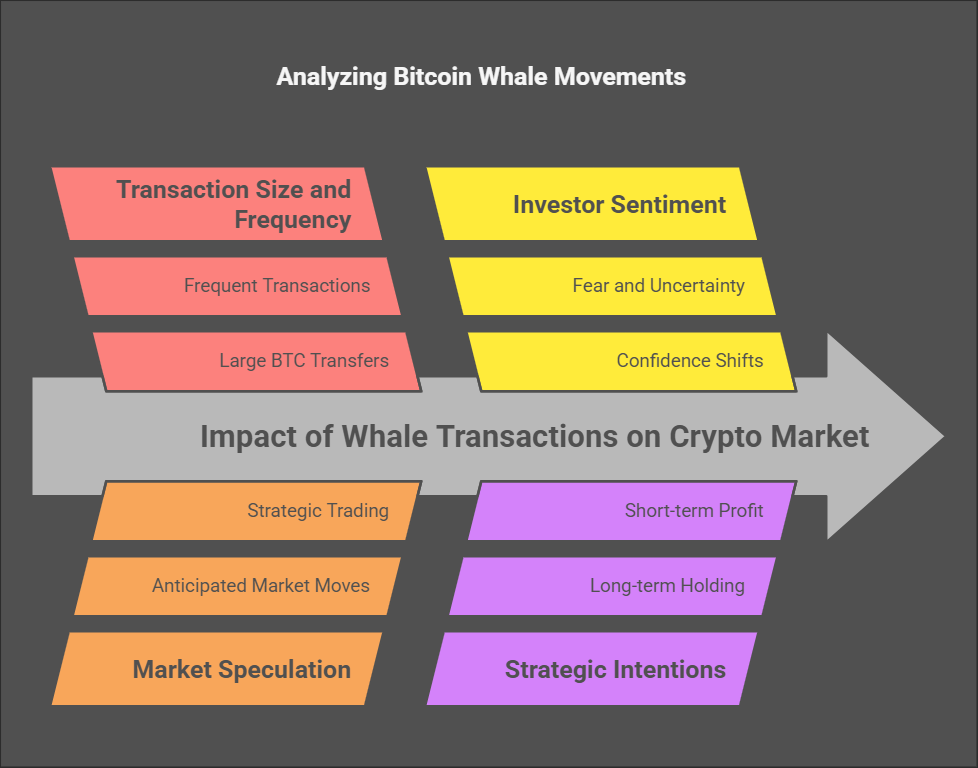

When whales move significant amounts of Bitcoin, it can signal various strategic intentions. For instance, they may engage in portfolio rebalancing to diversify their holdings or take profits after substantial price increases. In some cases, these movements occur in anticipation of market shifts, where whales position themselves advantageously to maximize returns or minimize losses.

Another key factor is the transparency of the blockchain. Unlike traditional financial systems, Bitcoin transactions are recorded on a public ledger, making it easier for analysts and enthusiasts to monitor whale activities. This transparency has led to a cottage industry of “whale watching,” where analysts track large transactions to predict market trends. While these movements do not always result in immediate price changes, they provide valuable clues about market sentiment and potential future directions.

Impact on Market Dynamics

The transfer of large Bitcoin amounts can significantly affect market dynamics, particularly in a volatile ecosystem like cryptocurrency. When whales move Bitcoin to exchanges, it often signals a potential intent to sell. Increased selling pressure can drive prices downward as supply outweighs demand. Traders monitoring these movements may also react preemptively, amplifying the effect on price.

Conversely, transferring Bitcoin to private wallets may indicate a long-term holding strategy. This behavior often reduces the available supply of Bitcoin on exchanges, potentially supporting price stability or even growth. Such actions can also boost investor confidence, as they signal faith in Bitcoin’s long-term value proposition.

Whale movements also have psychological effects on the market. The visibility of these transactions can trigger speculation among traders, leading to increased trading volumes. For instance, if a whale moves a large amount of Bitcoin to an exchange, it might create fear of an impending sell-off, prompting other investors to sell preemptively. On the other hand, movements to private wallets can instill a sense of security, encouraging investors to hold their positions or buy more.

Recent Noteworthy Bitcoin Whales Activities

Recent months have seen several significant whale movements that underscore their influence on the market:

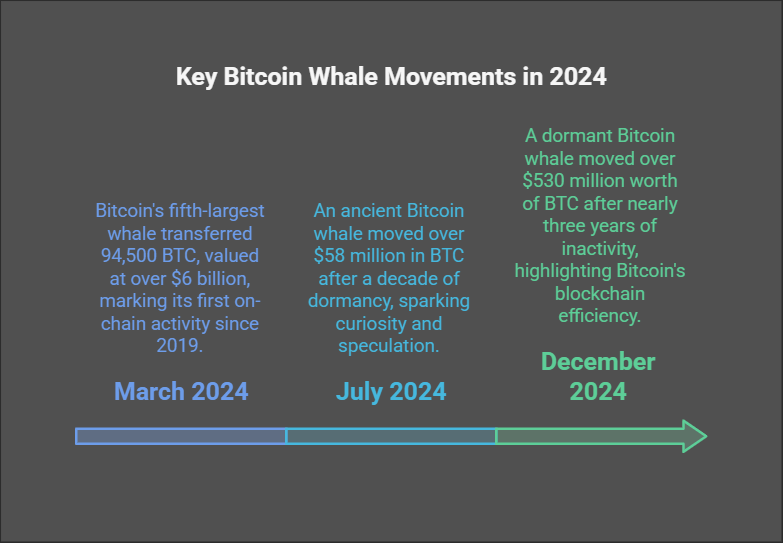

- December 2024: A dormant Bitcoin whale moved over $530 million worth of BTC after nearly three years of inactivity, paying just $46 in transaction fees. This event drew widespread attention, as it highlighted the efficiency of Bitcoin’s blockchain despite the massive value of the transaction. (Source: The Daily Hodl)

- March 2024: Bitcoin’s fifth-largest whale transferred approximately 94,500 BTC, valued at over $6 billion, to multiple new addresses. This marked its first on-chain activity since 2019 and raised questions about the whale’s intentions. (Source: Cointelegraph)

- July 2024: An ancient Bitcoin whale moved over $58 million in BTC after a decade of dormancy. Such reactivations of long-held assets often spark curiosity and speculation about the reasons behind the transactions. (Source: The Daily Hodl)

These examples illustrate the varied motives and impacts of whale activities. They also highlight the importance of monitoring such movements to gain insights into potential market trends.

Analyzing the 1,800 BTC Transfer

The recent transfer of 1,800 BTC is particularly noteworthy due to its size and potential implications:

Transaction Details:

- 299.99 BTC (approximately $31.5 million) was sent to the wallet address bc1ql7ddt4a35hztmmuxjm8wd3qqk4nj9q4vs0lkc0.

- 1,500 BTC (approximately $157.7 million) was transferred to bc1qsxaed9rr0laktuducxm9p0u2n55c42s2tydrks.

Potential Implications:

- Exchange Activity: If these wallet addresses are associated with cryptocurrency exchanges, the movements could indicate a forthcoming sale. Such actions might increase supply on the market, exerting downward pressure on Bitcoin’s price.

- Private Holdings: If these wallets are personal or institutional holdings, the transactions might signify a strategy to secure assets for long-term holding. This behavior would suggest confidence in Bitcoin’s long-term value and could reduce available supply, supporting price stability or growth.

Market Reactions to Bitcoin Whales Activity

Large whale movements often lead to heightened speculation and volatility in the cryptocurrency market. Some common reactions include:

Price Volatility

Substantial transfers can trigger immediate price fluctuations as traders react to perceived market signals. For example, if traders interpret a whale transfer to an exchange as a sign of impending selling pressure, they may begin offloading their holdings, amplifying the price decline.

Investor Sentiment

Bitcoin whales’ activities can significantly influence investor sentiment. Transfers to exchanges may create fear or uncertainty, leading to panic selling. Conversely, movements to private wallets often generate optimism, encouraging investors to hold or accumulate Bitcoin.

The Concluding Remarks

Monitoring the activities of Bitcoin whales provides valuable insights into potential market movements. While these transactions are not definitive predictors, they offer clues about the intentions of major Bitcoin holders. For traders and investors, understanding these movements is crucial for developing informed strategies in the volatile cryptocurrency market. As the ecosystem continues to evolve, the role of whales will remain a key factor in shaping market trends.

FAQs About Bitcoin Whale Movements

- Who are Bitcoin whales?

A Bitcoin whale is an individual or entity that holds a large quantity of Bitcoin. These whales often include early Bitcoin adopters, institutional investors, cryptocurrency exchanges, and hedge funds. Their transactions can significantly influence market trends due to the vast amounts of Bitcoin they control. - Why do Bitcoin whales’ movements matter?

Bitcoin whales’ movements are important because they can impact market supply and demand. For instance, when whales move Bitcoin to exchanges, it may signal an intent to sell, potentially driving prices down. Conversely, transferring Bitcoin to private wallets can indicate long-term holding, reducing supply on the market and potentially supporting price stability or growth. - What are the potential reasons behind recent Bitcoin Whales transactions?

Bitcoin whales transactions, such as the recent transfer of 1,800 BTC worth $189 million, may serve various purposes, including portfolio rebalancing, profit-taking, or securing assets for long-term holding. These actions may also reflect strategic positioning ahead of anticipated market changes. - How can Bitcoin whales activities affect market dynamics?

Whale activities can lead to increased market volatility. For example, large transfers to exchanges may create selling pressure, leading to price declines. Alternatively, movements to private wallets may boost investor confidence and contribute to a more stable or rising Bitcoin price. - What are some recent examples of noteworthy Bitcoin whales movements?

- In December 2024, a dormant Bitcoin whale moved $530 million worth of BTC after three years of inactivity.

- In March 2024, Bitcoin’s fifth-largest whale transferred 94,500 BTC (valued at $6 billion) to multiple addresses.

- In July 2024, an ancient whale moved $58 million in BTC after a decade of dormancy.