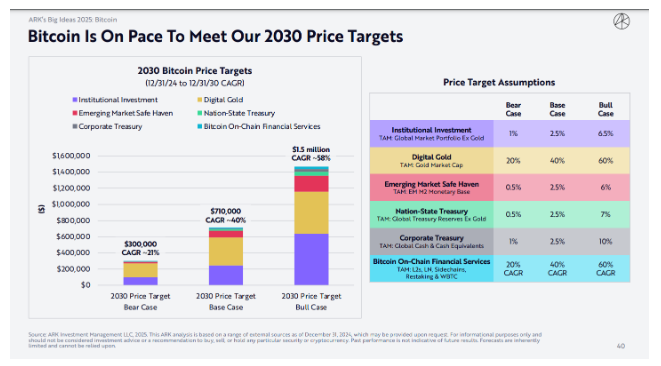

As per Ark Invest’s Cathie Wood, Bitcoin’s price may skyrocket to $1.5 million by 2030. This bold prediction has stirred discussions in the crypto community. Despite the audacious forecast, Wood remains confident in the digital asset’s long-term growth potential. Ark Invest’s roadmap includes a variety of scenarios, offering a range of projections from a conservative $300,000 to an optimistic $1.5 million for Bitcoin. This projection depends on key market developments and adoption trends in the coming years.

Bitcoin May Capture 60% of Gold’s Market

Ark Invest’s prediction relies on increased institutional interest in crypto assets and enlarging market participation during both metric periods. The company shows that Bitcoin may represent a major stake in worldwide investment portfolios, where institutional investments reach up to 6.5% of total assets. The public now views Bitcoin differently from its previous collection of market speculation labels. Ark Invest supports its estimates because Bitcoin now functions as a store of value within emerging markets while protecting investors from rising inflation. The current market indicators show Bitcoin is on track to achieve significant valuation growth in the next few years.

Ark’s projections heavily depend on stablecoins as vital components. The marketplace for stablecoin transactions recorded values exceeding $15.6 trillion in 2024, surpassing the volume of traditional payment systems operated by Mastercard and Visa. Ark identifies this development as a fundamental upgrade in digital finance because it proves cryptocurrency-based payment systems are gaining prominence. Stablecoins prove blockchain technology is gaining momentum as a worldwide transaction solution in the digital market. The development of digital currency infrastructure demonstrates to Ark that Bitcoin will maintain its expanding influence in global finance.

Bitcoin is a strong replacement or alternative option for traditional money reserves and standard metal assets such as gold. The research conducted by Ark indicates that Bitcoin has the potential to acquire between 40% and 60% of the market worth that currently belongs to gold. Research suggests that Bitcoin functions as digital gold as its popularity continues to rise. Bitcoin appeals to investors looking for alternative safe-haven investments because of its fixed-supply mechanics and decentralized characteristics. The changing market beliefs about Bitcoin has the potential to boost its value throughout the next few years substantially.

Ark Invest’s Bold Bitcoin Forecast Scenarios

The investment firm Ark Invest presented three different price projections for Bitcoin throughout the next decade until 2030. The most reserved outlook gives Bitcoin a value of $300,000, predicted by a 21% compound annual growth rate. Based on these conditions, the market adopts centralized technologies moderately. The forecast from the middle range envisions Bitcoin reaching $710,000 while demonstrating a growth rate of 40% annually. This estimate factors in more substantial institutional involvement and broader acceptance of Bitcoin as a legitimate asset.

Forecasters boldly predict that Bitcoin will reach $1.5 million by 2030 because of its projected 58% compound annual growth rate. A “bull case” describes this situation because institutional investors and developing economies are showing quick adoption of Bitcoin. Ark’s research points out that Bitcoin growth relies heavily on its ability to become integrated into standard financial frameworks because governments and corporations now search for digital assets in their treasury management practices.

Wood describes the scenarios as genuine forecasts that are not based on any conceptualization. The research foundation supports Bitcoin’s suitability for financial services on the blockchain network and its expanding influence in global trade systems. The roadmap shows that Bitcoin will function as an investment asset alongside its role in creating a new global financial structure. The progressive market expansion will thrust Bitcoin into unprecedented capital value domains that have been unreachable until now.

Stablecoins and Digital Finance: A Game Changer

According to Ark Invest, stablecoins drive fast changes within digital finance while playing a crucial role throughout the cryptocurrency ecosystem. Stablecoin transaction volumes rose to $15.6 trillion in 2024, surpassing the transaction capacity of traditional financial networks, including Visa and Mastercard. Large-scale transactions now use digital currencies at rates that exceed the operations of conventional payment systems like Visa and Mastercard. Stablecoins have gained popularity in payment systems, demonstrating that cryptocurrencies offer legitimate alternatives to traditional financial solutions.

As per Ark Invest, increasing stablecoin market values will establish them as key drivers for Bitcoin’s upcoming price expansion. The growth of stablecoin volume will establish cryptocurrencies as legitimate payment methods, pulling in institutional investors who want to participate in digital assets. The expanded adoption rate would likely boost Bitcoin market demand because it benefits from the expanding digital asset ecosystem.

Documentation prepared by Ark demonstrates how Bitcoin possesses significant potential for value growth as a store of value. The market trend indicates Bitcoin price growth as more financial stakeholders join digital assets investment because they are concerned about typical currency instability.

Bitcoin’s Role in Emerging Markets and Global Finance

Ark’s positive assessment of Bitcoin is supported significantly by its role as a protective resource for nations in emerging states. The potential for Bitcoin to serve emerging economies as protection from the devaluation of their local currencies and inflation. According to Ark’s research findings, Bitcoin provides decentralized protection to countries affected by currency instability and nations under economic uncertainty. These nations displaying increasing interest in Bitcoin should facilitate its market value rising substantially.

Bitcoin’s mainstream financial integration will speed up due to its implementation by corporations and governments. Organizations require Bitcoin as an alternative investment method because it offers dependable stability with future market appreciation potential for capital reserves. The predicted institutional involvement will drive up Bitcoin demand, boosting its price. The growing acceptance of this asset class will produce its forecasted long-term trajectory in the market.

Conclusion: Bitcoin’s Future Looks Bright

Ark Invest strongly believes that Bitcoin prices will continue to rise optimistically over the next few years. The potential for Bitcoin to reach $1.5 million by 2030 is more feasible because of its expanding financial sector dominance, growing institutional interest, and stablecoin adoption. The general market trend shows that Bitcoin has a positive outlook even though any market may face potential risks. The multiple growth drivers of Bitcoin will probably lead it to become a standard financial asset that will transform global economic systems.

FAQs

What is Bitcoin?

Bitcoin is a digital currency that operates without a central authority, using blockchain technology for secure transactions.

How could Bitcoin reach $1.5 million?

Bitcoin could reach $1.5 million due to increased institutional adoption and its growing role in global finance.

What are stablecoins?

Stablecoins are cryptocurrencies pegged to stable assets like the US dollar to reduce price volatility.

Why are stablecoins essential for Bitcoin’s growth?

Stablecoins help increase the adoption of digital assets, which could drive up demand for Bitcoin.

How could Bitcoin impact global finance?

Bitcoin could offer decentralized alternatives to traditional financial systems, reshaping global finance and serving as a store of value.

Glossary:

Bitcoin: A digital currency that operates without a central authority, using blockchain technology for secure transactions.

Stablecoin: A cryptocurrency designed to maintain a stable value by being pegged to an asset like a fiat currency.

Blockchain: A blockchain is a digitally distributed, decentralized, public ledger across a network.

Institutional Investors: Large organizations or entities that invest substantial capital in various assets.

Treasury Holdings: The assets or funds a company or government keeps for operations and financial management.