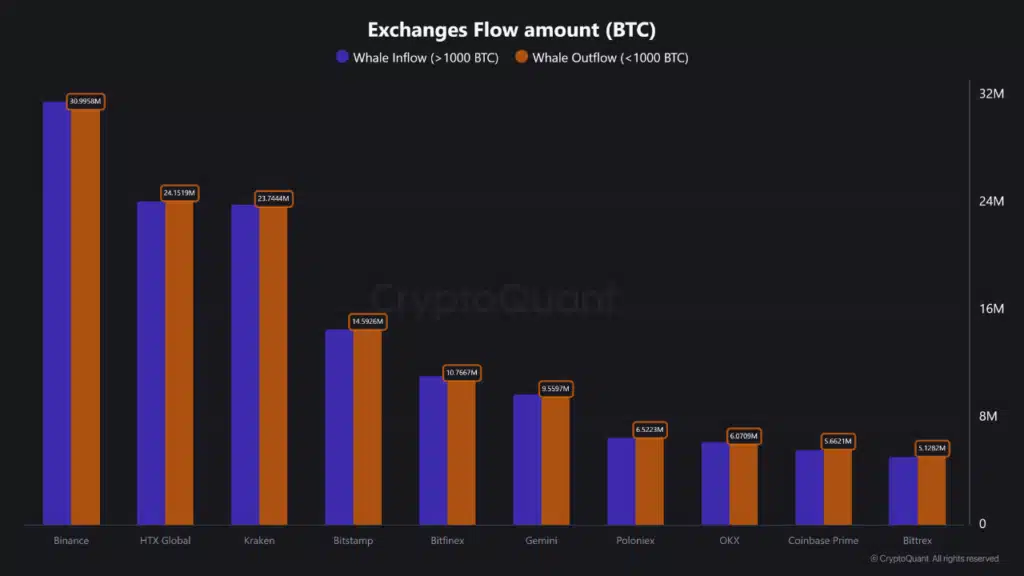

Recent on-chain data from CryptoQuant indicates an unprecedented surge in large-scale Bitcoin transactions—commonly known as “whale activity”—with Binance leading significantly. Over $56 million worth of high-value transactions occurred on Binance, nearly triple the amount seen on its closest competitor, HTX Global.

This elevated whale activity raises significant market concerns, signaling potential volatility ahead. Historically, such transactions correlate with sharp price movements, either upward or downward.

Bitcoin Faces Volatility After Recent Pullback

Over the weekend, Bitcoin (BTC) experienced a notable correction, briefly touching a low of $112,296 before stabilizing around $114,420. This represents a 4% weekly decline, marking one of the most substantial short-term corrections in recent weeks.

Market analysts highlight two primary driving forces behind these fluctuations: the significant influence of whale transactions on short-term price movements, and the unwavering support from long-term holders (LTH), who continue to underpin the market’s stability.

Binance Becomes the Go-To Platform for Whales

CryptoQuant analyst “Crazzyblockk” reports Binance as the undisputed hub for whale transactions. Data reveals Binance processed over 30 million BTC worth of whale entries and exits, far surpassing HTX Global and Kraken.

The sheer number of whale transactions on Binance—exceeding 56 million—is particularly noteworthy compared to roughly 16 million at HTX. Analysts suggest Binance’s superior liquidity allows whales to execute substantial trades without drastically influencing Bitcoin’s market price, making it crucial to monitor Binance’s order books closely.

Long-Term Holders: Bitcoin’s Solid Foundation

Despite the immediate risks posed by increased whale activity, Bitcoin’s price finds consistent support from long-term investors. CryptoQuant’s analyst “Abrahamchart” highlights the Net Unrealized Profit/Loss (NUPL) metric, emphasizing that long-term holders remain comfortably profitable, with the NUPL ratio holding above 0.5.

This group’s resilience has created a substantial buyer wall around the critical $104,000 level, effectively cushioning the market from significant downturns.

Short-Term Traders Drive Recent Correction

The recent price drop below the $113,000 threshold is attributed primarily to short-term holders (STH), who capitalize on brief price increases for immediate profit-taking. This group periodically creates temporary selling pressures, contributing to Bitcoin’s short-lived downturns.

Conclusion: Is Another Crash on the Horizon?

The recent $56 million whale activity on Binance undoubtedly increases the risk of market volatility, but analysts caution against panic. While short-term movements remain susceptible to whale-driven shifts, the strong foundation provided by long-term holders suggests that a significant crash is less likely.

Investors should stay informed, closely monitoring Binance’s transaction flows and market sentiment to navigate the current volatility effectively.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

Sources:

- CryptoQuant

- Binance Official Website

- Bitcoin Historical Price Data – CoinDesk

- Long-Term Holder Analysis – Glassnode

- Cryptocurrency Risk Analysis Report – SEC