As a commitment to Bitcoin, Strategy Inc.—formerly known as MicroStrategy—has announced plans to raise an additional $2 billion through a zero-coupon convertible bond offering. This initiative is a significant component of the company’s ambitious “21/21 Plan,” aiming to amass $42 billion for Bitcoin acquisitions over the next three years.

The “21/21 Plan”: A Strategic Blueprint

Unveiled in late 2024, the “21/21 Plan” outlines Strategy’s approach to bolstering its Bitcoin holdings by raising $21 billion through equity sales and another $21 billion via fixed-income instruments, including debt, convertible bonds, and preferred stock.

The recent $2 billion bond offering is a pivotal step in this strategy, with the net proceeds primarily allocated for purchasing Bitcoin. These zero-coupon convertible bonds, maturing in 2030, provide holders the option to convert them into equity at an initial rate of $433.43 per share, reflecting a 35% premium over the current market price.

Expanding Bitcoin Holdings Amid Market Dynamics

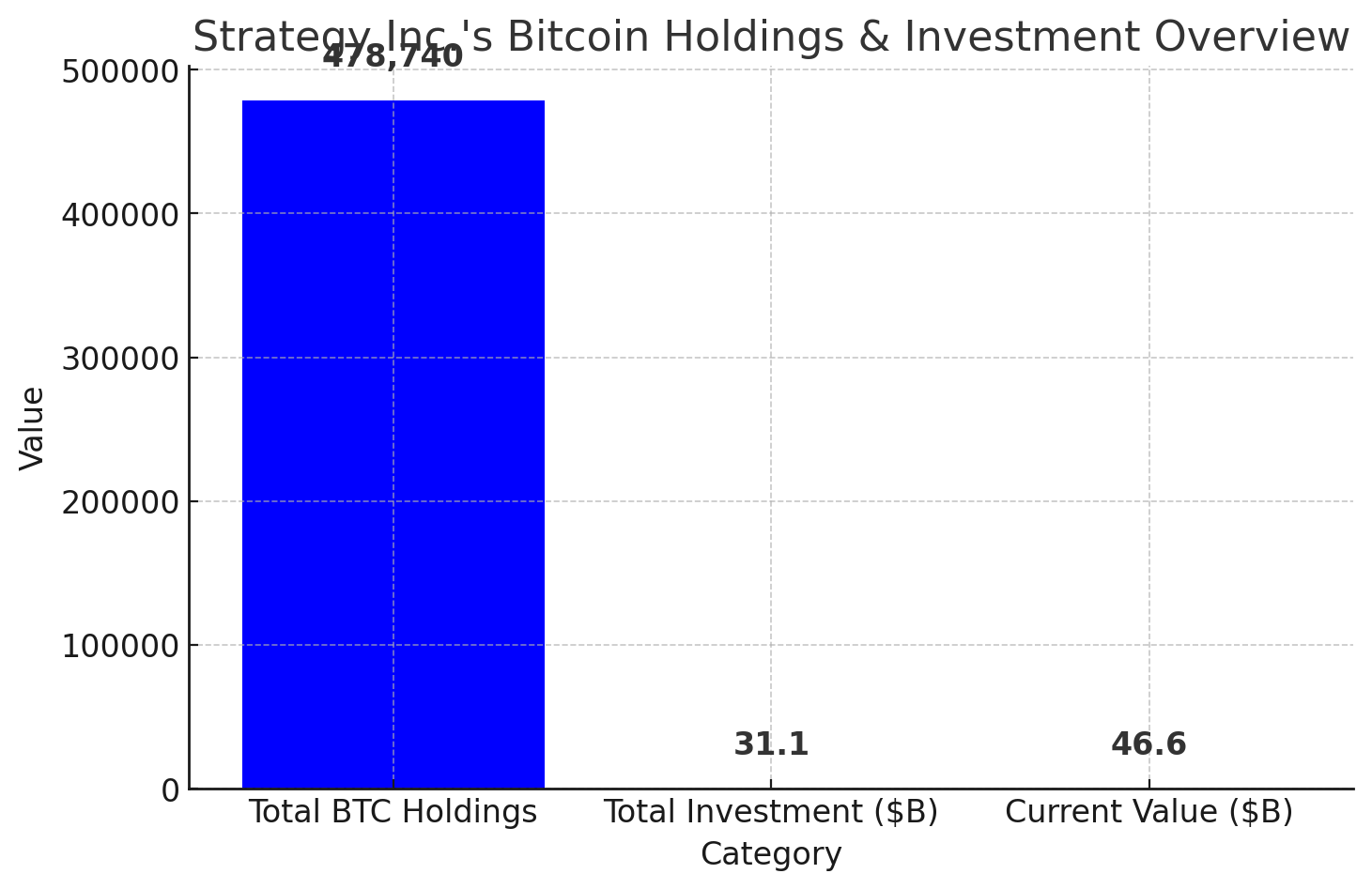

As of February 17, 2025, Strategy’s Bitcoin reserves have reached approximately 478,740 bitcoins, acquired at a total expenditure of $31.1 billion, averaging $65,033 per Bitcoin. With Bitcoin trading between $93,000 and $100,000 in February 2025, the current market value of these holdings is estimated at $46.6 billion.

To finance its aggressive Bitcoin acquisition strategy, Strategy has been actively raising capital through various means, including share sales and debt offerings. Notably, the company has issued convertible bonds and preferred stock, leveraging its equity to fund these purchases. This approach has led to a significant increase in the company’s market valuation, with its stock price surging over 352% in the past year.

Market Implications and Future Outlook

Strategy’s unwavering commitment to Bitcoin has positioned it as a prominent corporate holder of the cryptocurrency. This aggressive accumulation strategy reflects a strong belief in Bitcoin’s potential as a long-term store of value and a hedge against inflation. The company’s actions have not only influenced its stock performance but have also contributed to increased institutional interest and confidence in the broader cryptocurrency market.

As Strategy continues to execute its “21/21 Plan,” financial markets and cryptocurrency enthusiasts will closely monitor the outcomes of this bold investment strategy. The success of this plan could set a precedent for other corporations considering significant investments in digital assets.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is Strategy Inc.’s “21/21 Plan”?

The “21/21 Plan” is Strategy Inc.’s initiative to raise $42 billion over three years, with the funds allocated for Bitcoin acquisitions. The plan involves generating $21 billion through equity sales and another $21 billion via fixed-income instruments.

How does a zero-coupon convertible bond work?

A zero-coupon convertible bond is a debt security that doesn’t pay regular interest. Instead, investors can convert the bonds into a predetermined number of the company’s shares at specific times before maturity.

Why is Strategy Inc. investing heavily in Bitcoin?

Strategy Inc. views Bitcoin as a valuable asset for long-term investment and a hedge against inflation. The company’s leadership believes in the cryptocurrency’s potential to appreciate over time, enhancing shareholder value.

How has Strategy’s stock performance been affected by its Bitcoin investments?

The company’s stock has experienced significant growth, rising over 352% in the past year, largely attributed to its substantial Bitcoin holdings and the appreciation of the cryptocurrency’s value.

What are the potential risks associated with Strategy’s investment strategy?

Investing heavily in Bitcoin exposes the company to the cryptocurrency’s inherent volatility. Market fluctuations can significantly impact the value of Strategy’s holdings, potentially affecting its financial stability and stock performance.

Glossary

Zero-Coupon Convertible Bond: A debt instrument that doesn’t pay periodic interest but can be converted into a specified number of company shares.

Equity Sales: The process of raising capital by selling shares of the company’s stock.

Fixed-Income Instruments: Financial assets that provide regular returns, such as bonds or preferred stocks.

Hedge Against Inflation: An investment strategy aimed at protecting the value of assets from the eroding effects of inflation.

Convertible Bonds: Bonds that can be converted into a predetermined number of the issuing company’s shares.