Bitcoin (BTC) has recently made headlines once again, experiencing an 8.5% rise in the past few weeks, bringing its price to $64,000. The big question is, will Bitcoin’s upward trajectory continue into the fourth quarter? Some analysts predict that BTC could see a 171% increase, pushing the price to a staggering $172,800. In this article, we explore Bitcoin’s potential Q4 performance and the factors driving this surge.

Will Bitcoin Peak in the Fourth Quarter?

Following the U.S. Federal Reserve’s 50 basis point rate cut this month, all eyes are on Bitcoin’s fourth-quarter performance. After the halving event, BTC fluctuated between $50,000 and $70,000. Now, with the Fed’s liquidity measures, could a major rally be on the way for Bitcoin?

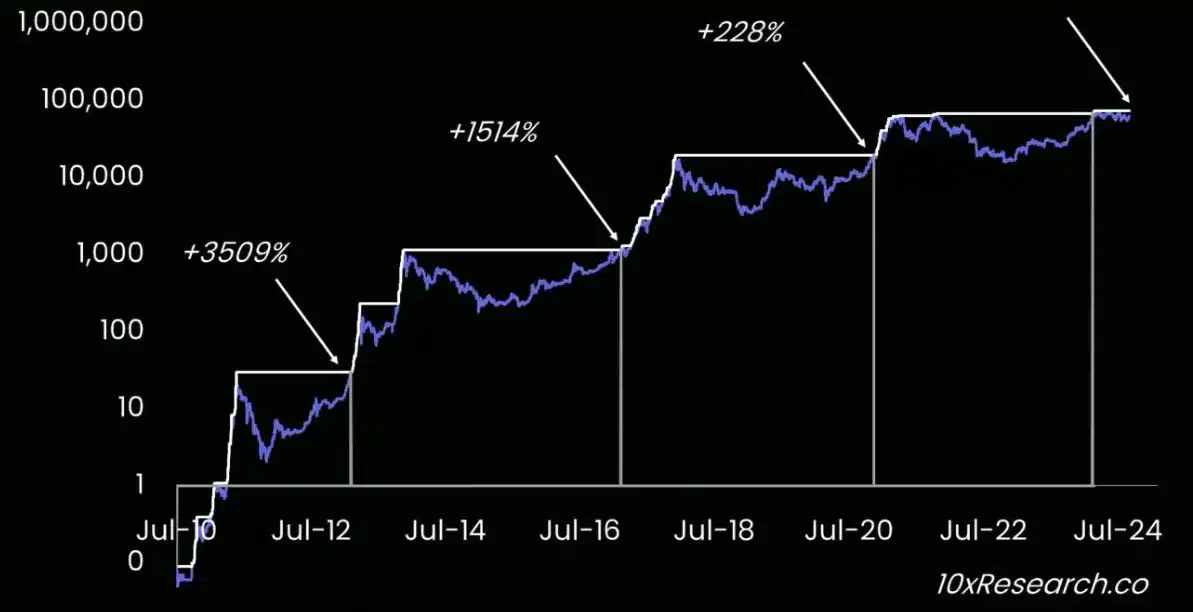

Renowned crypto analyst Ali Martinez has examined Bitcoin’s Q4 performance following halving events in 2016 and 2020. During Q4 of 2016, Bitcoin saw a 61% increase, while in 2020, it surged by 171%. If BTC follows a similar pattern this year, it could reach between $100,000 and $172,800. To see this rally, however, Bitcoin must break through the critical $65,000 resistance level. As of now, BTC is trading at $63,549 with a market cap of $1.255 trillion.

#Bitcoin gained +61% in Q4 of 2016 and +171% in 2020. Interestingly, 2024’s price action so far mirrors both years—could history be repeating itself? pic.twitter.com/M6KxT0unE0

— Ali (@ali_charts) September 23, 2024

Factors Supporting Bitcoin’s Price Increase

Several factors are driving Bitcoin’s potential rise. According to a recent report by 10X Research, the market is seeing notable improvements. The report highlights an increase in stablecoin issuance and a rise in leverage use in the futures market, both of which could boost Bitcoin’s price. However, BTC needs to hold above $65,000 to secure a significant breakout.

On-chain metrics are also flashing positive signals. Institutional investors have shown renewed confidence in Bitcoin. For instance, MicroStrategy recently purchased $450 million worth of BTC, demonstrating its faith in Bitcoin’s future performance and signaling continued institutional interest.

Additionally, the plan by the now-bankrupt crypto exchange FTX to distribute $16 billion to its creditors could boost market liquidity. Many analysts believe much of this liquidity will flow back into Bitcoin and other cryptocurrencies, creating significant market movement.

Is Altcoin Season Coming?

Bitcoin’s rally has brought a positive sentiment to the broader crypto market. Analysts suggest that an altcoin season may be on the horizon. Ethereum (ETH), for example, has seen a 16% increase recently, although large whale transfers to exchanges have raised some doubts about its future direction.

Meanwhile, Bitcoin ETFs have regained momentum. Last week alone, $397 million flowed into Bitcoin ETFs, with the majority of these investments coming from Fidelity ETF FBTC. This growing interest in Bitcoin ETFs reflects continued institutional confidence in BTC, potentially driving the price even higher.

As the fourth quarter unfolds, the crypto market looks poised for significant developments. Keep an eye on The Bit Journal for the latest updates and insights.