Bitdeer Technologies Group has reported a substantial increase in gross profits for the second quarter of 2024, largely due to a significant expansion in its Bitcoin mining capacity. According to the company’s earnings report released on 12th August 2024, Bitdeer’s gross profit rose to $24.4 million, reflecting a 50% year-over-year increase from $16.2 million in the same quarter of the previous year.

This profit growth occurred despite ongoing challenges in the cryptocurrency mining sector, such as the rise in the global Bitcoin network’s hash rate and the April 2024 Bitcoin halving. Bitdeer’s decision to significantly boost its Bitcoin mining capacity has been a key driver behind this financial improvement.

Expansion of Mining Operations

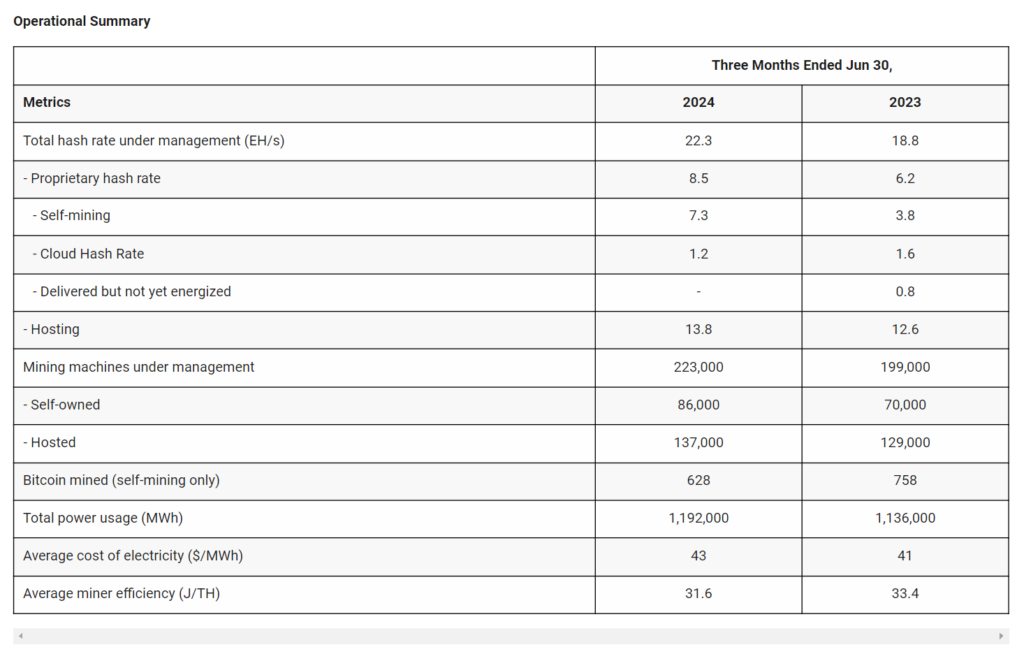

The sharp increase in Bitdeer’s gross profit can be attributed to the company’s near doubling of its in-house Bitcoin mining capacity. Over the past year, Bitdeer expanded its self-mining operations, increasing its capacity from 3.8 exahashes per second (EH/s) to 7.3 EH/s. In cryptocurrency mining, hash rate is a critical measure of computational power, with higher rates typically translating to better Bitcoin mining outcomes and increased revenue.

Matt Kong, Bitdeer’s Chief Business Officer, noted the company’s performance in light of broader industry challenges. “We achieved these results despite significant growth in the global network hash rate and the April 2024 halving,” Kong stated in the earnings report. The global Bitcoin network’s hash rate currently stands at 677.43 EH/s, nearly double what it was a year ago, according to CoinWarz data.

Introduction of SEALMINER Technology

A significant factor in Bitdeer’s increased mining capacity is the deployment of its proprietary SEALMINER mining equipment. The introduction of the SEALMINER A1 chips has enhanced the company’s operational efficiency and contributed to its increased hash rate.

“We have energised the first batch of our SEALMINER A1 chips, with mass production underway and plans to install 3.4 EH/s into our data centres by year-end,” Kong explained. This move is part of Bitdeer’s broader strategy to maintain a competitive edge in the cryptocurrency mining industry by continuing to invest in advanced technology.

Financial Performance and Capital Investment

Despite the increase in gross profits, Bitdeer reported a net loss of $17.7 million for the second quarter of 2024. This is an improvement from the $40.4 million net loss reported in the same period the previous year. The company attributed the net loss to capital expenditures on Bitcoin mining equipment and the non-cash expense related to the fair value change for Tether warrants.

In May 2024, Bitdeer secured $150 million in private financing from Tether International Limited, the issuer of the Tether stablecoin. The financing included $100 million in upfront capital from a share issuance and up to $50 million from a warrant allowing Tether to purchase up to five million additional Bitdeer shares at $10 per share.

Strategic Acquisition and Future Prospects

In June 2024, Bitdeer acquired chip designer Desiweminer in an all-stock deal aimed at enhancing its product development capabilities. The acquisition is expected to bolster Bitdeer’s technological expertise and support its efforts to innovate within the cryptocurrency mining sector. According to Kong, Desiweminer’s team has been integrated with Bitdeer’s existing design team in Singapore.

Moving forward, Bitdeer’s future success will likely depend on its ability to navigate the volatile cryptocurrency market and manage its capital investments effectively. The company’s focus on expanding its mining capacity and investing in advanced technology positions it to remain competitive in the industry. However, external factors such as regulatory changes and fluctuations in Bitcoin prices could impact its future performance. Bitdeer’s second-quarter results highlight the opportunities and challenges faced by cryptocurrency mining companies as they adapt to the rapidly changing market landscape.