Bitfinex Securities has never chased the crowded field of tokenised Treasuries. Instead, Bitfinex Securities is carving a niche in risk-adjusted, community-minded real-world assets (RWAs).

On 25 June the exchange listed two new products in the U.K., TITAN 1 and TITAN 2, each issued on Blockstream’s Liquid side-chain with 24/7 secondary trading. The launch underscores Bitfinex Securities’ stated mission to “fill the capital gap banks leave behind” while giving crypto users a shot at double-digit yield.

A Different Breed of Real-World Assets

Most of 2025’s RWA hype revolves around tokenised money-market funds. Bitfinex Securities is taking the opposite route: targeting underserved borrowers and niche financing that traditional banks overlook. By doing so, Bitfinex claims it can pass on chunky risk premiums rather than single-digit yields to token holders. Analysts note that the strategy also keeps the exchange inside its Bitcoin-centric comfort zone, because both TITAN tokens live on Bitfinex Securities’ Liquid rails rather than Ethereum or Polygon.

Inside TITAN 1: Community Banking Meets 20 % Yield

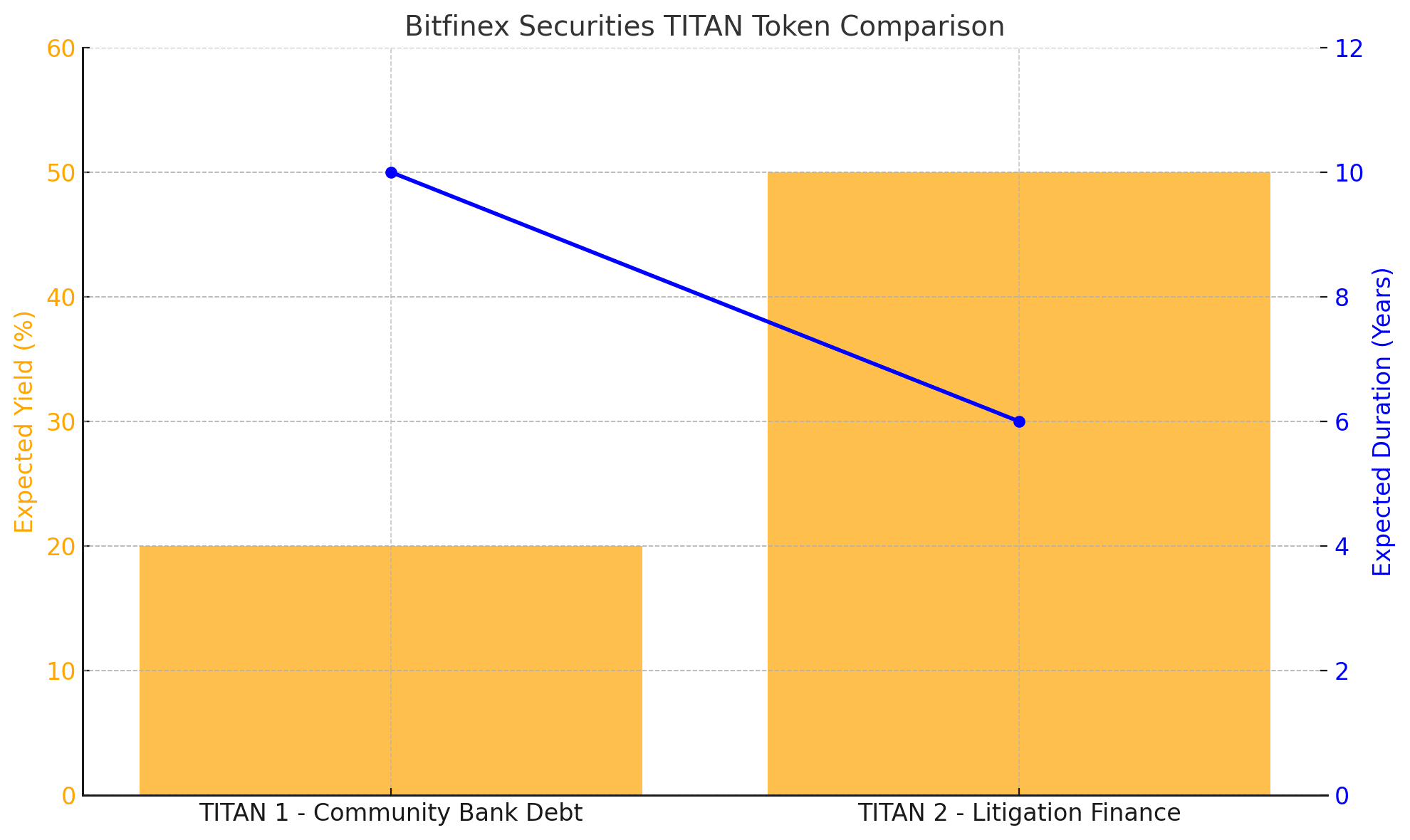

TITAN 1 funnels £5 million ($6.8 million) into subordinated debt issued by Castle Community Bank in Edinburgh, a lender focused on low-income households. Investors receive a 20 % annual dividend, paid quarterly for up to ten years, with the note non-callable for the first five.

Bitfinex Securities touts the product as a “win-win”: the bank secures growth capital that mainstream markets ignore, and token holders enjoy a coupon that dwarfs T-bill token yields. Bitfinex emphasises strict whitelist KYC and real-time proof-of-reserve attestations, aiming to calm yield-chasing retail buyers burned by 2022’s CeFi implosions.

Cash-Flow Mechanics

Quarterly dividends sweep from Castle’s profit pool to the Liquid address controlling TITAN 1.

Bitfinex Securities nodes validate flows on-chain; auditors verify off-chain books.

After year 5, Castle may redeem early at par plus accrued interest, an option that could crystallise gains if rates fall.

Inside TITAN 2: Litigation Finance Turns Token

If TITAN 1 is about steady coupons, TITAN 2 shoots for asymmetric upside. The £100 million vehicle finance claims are tied to Britain’s £40 billion car-loan mis-selling scandal. Token holders are entitled to 50 % of recovered proceeds after legal fees. Bitfinex structured TITAN 2 through a Guernsey protected-cell company, insulating investors from unrelated liabilities.

Because litigation payouts can take years, Bitfinex allows peer-to-peer trading of TITAN 2 for liquidity while cases unfold. Industry lawyers call the design a “retail-friendly slice of an alternative-credit strategy” once reserved for hedge funds.

Risk-Reward Snapshot

| Metric | TITAN 1 | TITAN 2 |

|---|---|---|

| Asset Type | Subordinated debt | Litigation claims |

| Target Yield | 20 % fixed | 50 % profit share |

| Expected Duration | 5–10 yrs | 3–6 yrs |

| Liquidity Window | 24/7 secondary mkt | 24/7 secondary mkt |

| Whitelist & KYC | Yes | Yes |

What This Means for the RWA Landscape

By spotlighting community loans and court-case receivables, Bitfinex challenges the narrative that tokenisation is only for safe-yield seekers. If TITAN volumes grow, rival venues such as Securitize and Ondo may feel pressure to broaden beyond Treasuries. Regulators will watch closely: the U.K. Financial Conduct Authority has already flagged tighter oversight of retail litigation-finance schemes.

Yet Bitfinex Securities believes its transparent on-chain audits and investor accreditation checks satisfy upcoming rules. Market strategists argue that success could vault Bitfinex Securities into the top tier of RWA exchanges by year-end.

Potential Catalysts

Secondary-Market Depth: If TITAN tokens trade with tight spreads, confidence in Bitfinex Securities builds.

Yield Compression Elsewhere: A Fed pivot could make 20 % coupons look even richer, funnelling flows to Bitfinex.

Visa-Style Partnerships: Rumours suggest Bitfinex Securities is courting U.K. fintechs for direct fiat ramps, lowering entry friction.

Conclusion

While many platforms tokenise low-risk bonds, Bitfinex Securities pushes the frontier with community-bank debt and litigation-finance notes that could deliver outsized returns, at higher risk to everyday crypto users. If the TITAN twins succeed, they will validate the thesis that tokenisation can democratise even the most esoteric corners of finance. For now, all eyes are on whether Bitfinex can turn promise into real liquidity and sustained investor trust.

Summary

Bitfinex Securities has launched two innovative real-world asset (RWA) tokens in the U.K.: TITAN 1, a 20% yield community-bank debt, and TITAN 2, a £100 million litigation-finance vehicle. Unlike traditional RWA offerings tied to government bonds, these products offer crypto investors access to high-risk, high-reward opportunities on Bitcoin-native rails. With 24/7 trading and transparent audits, Bitfinex is redefining how tokenisation can serve underserved sectors.

FAQs

What is Bitfinex Securities?

Bitfinex Securities is a tokenised asset platform that issues real-world financial instruments like debt and equity on blockchain rails, primarily using the Liquid sidechain.

What are TITAN 1 and TITAN 2?

TITAN 1 is a 20% fixed-income subordinated debt token for a Scottish bank. TITAN 2 is a £100 million litigation-finance product offering 50% of recovered proceeds.

How is Bitfinex different from other RWA platforms?

Unlike platforms focused on tokenised T-bills or institutional products, Bitfinex targets underserved credit markets like community banking and court claims.

Is it safe to invest in Bitfinex products?

All tokens are issued with KYC/AML compliance, real-time proof-of-reserve attestations, and legal structuring via SPVs. However, the yields come with higher risks.

Glossary of Key Terms

Bitfinex: A regulated platform offering tokenised real-world assets on the Liquid Network.

RWA (Real-World Asset): Traditional financial instruments like bonds, loans, or legal claims that are tokenised and traded on blockchain platforms.

TITAN 1: A tokenised, 20% yield, subordinated debt note issued by Castle Community Bank.

TITAN 2: A token backed by proceeds from litigation-financing related to the UK’s car-loan mis-selling scandal.

Liquid Network: A Bitcoin sidechain used by Bitfinex Securities to issue and trade tokenised assets.

Max pain: A term in options and structured products describing the price point where investors lose the most value, often used to predict price gravitation.

Sources and References