BitMine Immersion Technologies, chaired by renowned strategist Tom Lee, has ramped up its aggressive Ethereum accumulation, adding 208,137 ETH to its treasury over the past week.

The firm now holds a total of 833,137 Ether worth over $3 billion making it the largest private Ethereum holdings and the fourth-largest overall crypto treasury globally.

🔥 TODAY: Bitmine Immersion now holds over 833,000 $ETH worth $2.9B.

It claims the largest Ethereum treasury in the world. pic.twitter.com/cRDqA0hpG5

— Cointelegraph (@Cointelegraph) August 4, 2025

BitMine’s Ethereum Holdings Soar Amid ETH Spike

The announcement, Monday, will be coupled with a small price surge of Ethereum which saw ETH rise 5.8 percent to a new record of $3,730 then falling to $3,654, according to CoinGecko data.

The spike in prices also increased the cost of the Ethereum holdings in BitMine and defined the rapid growth of the firm in the Ethereum ecosystem. Remarkably, the very concept of the treasury strategy at BitMine was disclosed only 35 days ago.

Lee noted that the company has differentiated itself among crypto treasury peers in terms of the speed at which it has increased crypto NAV per share as well as its stock liquidity in a statement. BitMine moved with lightning speed in its pursuit of the ‘alchemy of 5%’ of ETH, growing our Ethereum holdings to over 833,000 from zero.

Institutional Support Grows for Ethereum Holdings

The approach by BitMine to Ethereum holdings has attracted major institutional support. This has been supported by Billionaire investors such as Bill Miller III, Stanley Druckenmiller, and Cathie Wood, the CEO of ARK Invest. This is a sign of increasing institutional belief in Ethereum, which has rallied triple digits over the last 3 months.

Analysts see this as a direct reaction to the changing status of Ethereum as part of the greater financial system and its stability versus both Bitcoin and Solana two major actors in the current bull market.

The rapid accumulation has sparked a competitive race among firms building large Ethereum holdings, said a spokesperson from StrategicETHReserve, a platform tracking institutional ETH reserves.

Top Firms Compete in Ethereum Holdings Race

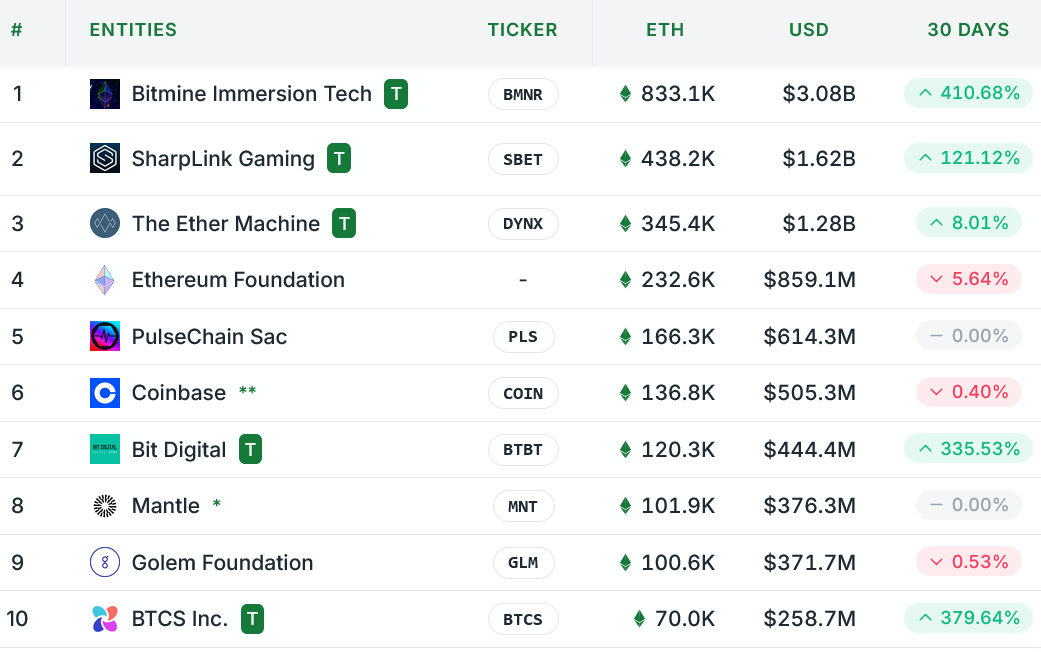

BitMine emerged as one of the competitive Ethereum treasury companies. In the second position is the SharpLink Gaming with 438,200 ETH, worth about 1.61 billion dollars in Ethereum holdings. The Ether Machine is in position no. 3, having 345,400 ETH, having acquired $40 million in purchases earlier this week.

Rounding out the top five are the Ethereum Foundation with 232,600 ETH and PulseChain SAC with 166,300 ETH, according to StrategicETHReserve data, each maintaining significant Ethereum holdings.

Tom Lee is optimistic about the short-term activities of ETH. Speaking to CNBC, he pointed to softening U.S. labor data as a possible driver toward more comprehensive market gains. Lee feels that the likelihood of the Federal Reserve shifting to an easier policy in the near future is high because it would encourage housing and stimulate risk assets.

Tom Lee Predicts Strong August Rally

Lee opined that there would be a strong rally in August. The S&P 500 may reach new heights within the following two weeks. Since the crypto market has a high correlation with equities, Ether and other digital assets, particularly those firms with large Ethereum holdings, should see a boost.”

Led by large investors, with more than 3 billion dollars in ETH, BitMine Immersion Technologies is disrupting the trend towards a crypto treasury with its aggressive acquisition and tune to macroeconomic cycles.

Conclusion

Based on the latest research, Ethereum remains a focal point for institutional investors, with BitMine’s aggressive strategy highlighting a broader shift toward crypto treasury adoption. As ETH maintains strength amid favorable macro trends, BitMine’s $3 billion Ethereum holdings may signal a new era of institutional confidence and treasury competition in digital assets.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

BitMine Immersion Technologies, owned by Tom Lee, has purchased 208,137 ETH, making it have a total of 833,137 ETH worth more than 3 billion dollars. This speed of gain makes BitMine a Treasury of the fourth-largest crypto in the world, only 35 days after implementing its strategy.

BitMine is now the top Ethereum treasury company, with massive financial investors. Lee predicts that ETH will continue increasing in the near future due to the easing economic state in America and growing trust in the long-term potential of Ethereum in the institutional market.

FAQs

Q1: How much Ethereum does BitMine hold?

BitMine holds 833,137 ETH, valued at over $3 billion.

Q2: Who supports BitMine’s Ethereum strategy?

Backers include Bill Miller III, Stanley Druckenmiller, and Cathie Wood.

Q3: How did BitMine grow its ETH holdings?

It added 833K ETH in just 35 days through aggressive accumulation.

Q4: Why are institutions buying Ethereum now?

ETH’s strong rally and macro trends are boosting institutional demand.

Glossary of Key Terms

Ethereum Holdings:

Amount of ETH held by a company or institution.

BitMine:

Crypto firm led by Tom Lee with large ETH reserves.

SharpLink Gaming:

Second-largest ETH-holding crypto treasury firm.

Ether Machine:

Firm ranked third in Ethereum holdings.

Institutional Confidence:

Big investors’ trust in Ethereum’s long-term value.

NAV (Net Asset Value):

Company’s per-share value after liabilities.

Federal Reserve:

U.S. central bank influencing market policies.

ARK Invest:

Investment firm led by crypto-bull Cathie Wood.