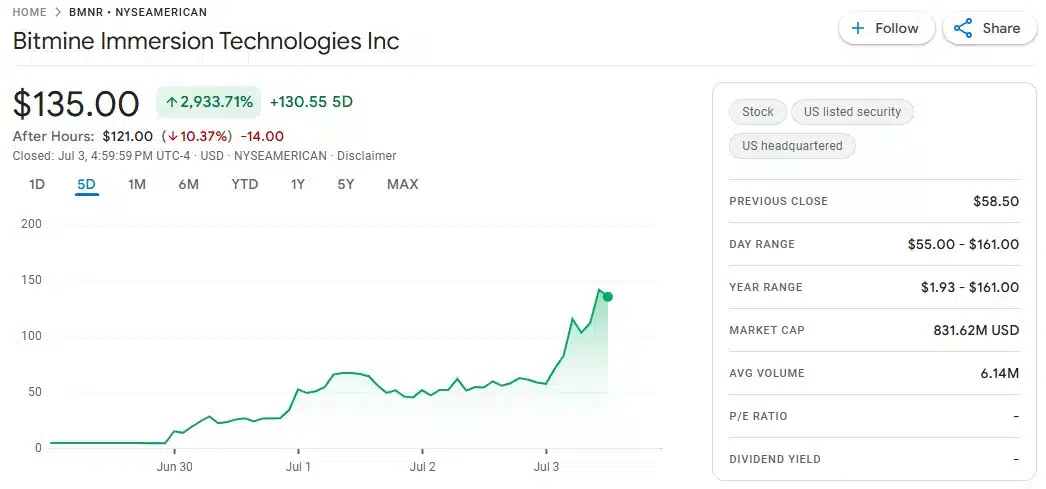

BitMine stock (NYSE American: BMNR) skyrocketed more than 3,200% this week after the company unveiled a groundbreaking Ethereum-centric treasury strategy.

The rally came on Monday as the BitMine stock rocketed to the $33.90 mark in normal trading hours before shooting over the $50 mark in after-trading operations.

By Thursday the heated air was at its peak and shares traded as high as an intraday high of 156 before settling down to close at approximately 135. The full profit-taking saw the BitMine stock still trading above $115 with one of the most dramatic short period gains in memory.

BitMine Stock Fueled by ETH Reserves

To stoke the mania, BitMine made plans of a $250 million private capital raise that directly targeted piling up Ethereum (ETH) to its corporate coffers.

The action is reminiscent of the MicroStrategy path with Bitcoin that is adhered by the co-founder of the company Michael Saylor, who used treasury funds to make bets on BTC. The new Chairman of BitMine, who is a crypto analyst and co-founder of Fundstrat Tom Lee, argues that the aim is the same but with Ethereum.

In the press release, Lee said, we want BitMine to become the MicroStrategy of Ethereum. ETH is becoming central to the future of finance, and our strategy reflects that conviction.

Crypto Giants Back BitMine Ethereum Strategy

The strategy is also supported by some of the industry titans such as the Founders Fund founded by Peter Thiel, Pantera Capital, FalconX, Galaxy Digital and Digital Currency Group, which were all involved in the mega $250 million round. Their participation has gone a long way towards convincing investors that BitMine stock is a long-term Ethereum play.

The private placement entailed an issuance of 55 million shares sold on the price of $4.50 per share. The publicly tradable float of BitMine is a mere 1.4 million shares, which made the demand in BitMine stock surge faster than the supply and sent the price into parabola and paper gains of the securities placement participants remain locked up as they are not permitted to trade yet.

BitMine Plans Ethereum Protocol Integration

Although similar comparisons have been drawn to earlier phenomena of meme stock mania given the sudden surge in BitMine stock, there has also been evidence of more persistent institutional backing and irreproachable strategic vision concerning the long term value of the stock.

One market analyst said, that calling this just another pump misses the point. Not only will BitMine be purchasing Ethereum, but will also be engaged in protocol level integration on a structural basis to enable settlement and payment.

BitMine Puts Ethereum in Treasury Spotlight

BitMine already has Bitcoin mining operations in Texas and Trinidad, but its transition to Ethereum is a wider shift toward blockchain infrastructure, which further supplies the bullish narrative that the BitMine stock may follow.

The trading volume faded briefly before the July 4 holiday which provided a relief to the week long volatility. Nevertheless, investors are waiting eagerly at the opening of the market next week. Will the rally continue or give a way to a further correction?

The thing is certain that BitMine stock placed Ethereum into the limelight of corporate treasury. Its bold action can lead to a new tradition of management companies no longer treating digital assets only as a speculative investment, but as a building block in the balance sheets.

Conclusion

BitMine is the story of the week in Wall Street with the tremendous spike which has followed it as markets have closed over the 4th of July weekend. Regardless of whether the rally endures or reverts, its Ethereum-focused rotation means more than just corporate finance: it heralds a more structural change where digital assets like ETH are slated to become core to treasury strategy moving forward.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

The firm, BitMine Immersion Technologies (BMNR), stunned the stock market when it rose by 3,200% following its announcement that it was performing a $250 million private placement to purchase ETH as a means of augmenting its reserves. The firm has made the crypto strategist Tom Lee Chairman, with the goal of becoming the MicroStrategy of Ethereum. Supported by such big crypto players as Pantera Capital and Founders Fund, the move indicates an increasing institutionalized belief in ETH and shows the increasing reach of crypto into corporate treasury initiatives.

FAQs

1. Why did BitMine stock jump?

Because it announced a $250M plan to buy Ethereum.

2. Who backed BitMine’s ETH strategy?

Pantera, Galaxy Digital, Founders Fund, and others.

3. What is BitMine aiming for?

To become the “MicroStrategy of Ethereum.”

4. Is this just meme stock hype?

Analysts say it has real backing and vision.

Glossary Of Key Term

BitMine Immersion Technologies (BMNR)

A crypto-focused public company that shifted to Ethereum reserves.

Ethereum (ETH)

A leading blockchain for smart contracts and DeFi.

Treasury Strategy

Company plan to hold crypto (ETH) as reserves.

Tom Lee

BitMine’s new Chairman; Ethereum strategy lead.

MicroStrategy

Company known for using reserves to buy Bitcoin.