Bitso, a leading cryptocurrency exchange based in Mexico, has introduced a new stablecoin called MXNB. This digital asset is pegged to the Mexican peso and built on the Ethereum layer-2 network, Arbitrum. The move is part of Bitso’s broader plan to simplify cross-border transactions and promote financial efficiency across Latin America.

Key Developments

The stablecoin was unveiled by Bitso Business, Bitso’s enterprise-focused division. Mexican pesos will fully back MXNB on a one-to-one basis. It will be managed and issued by a newly formed subsidiary called Juno. Bitso announced this development in a press release dated March 26.

Juno will operate independently to ensure transparency and trust. It will conduct regular audits of its reserves and publish public attestation reports on the stablecoin’s dedicated website. The aim is to provide a clear picture of the financial backing behind MXNB.

Enhancing Trade and Foreign Investment

Ben Reid, Head of Stablecoins at Bitso Business, highlighted that MXNB could significantly reduce the cost and complexity of doing business in Latin America. He stated that many global firms face difficulties with cross-border transactions, which often involve high fees and slow processing times. MXNB aims to provide a more efficient alternative to the current financial infrastructure.

Reid believes the stablecoin can help international companies and investors navigate regional markets more smoothly. This would ultimately support trade and economic development in countries like Mexico, where traditional systems often limit financial tools.

Bitso’s Stablecoin Vision

Bitso selected Arbitrum for the launch due to its speed and lower transaction costs. Arbitrum is a popular Ethereum scaling solution that allows faster processing of transactions while reducing fees. This makes it ideal for everyday business use, including cross-border payments and remittances.

By choosing Arbitrum, Bitso aims to make MXNB practical for both individuals and companies. The network’s scalability will also help the stablecoin grow with increasing demand.

Mexico’s Role in the Global Remittance Market

The launch of MXNB comes at a time when Mexico continues to be a major player in the global remittance sector. The World Bank estimated that the country received $61 billion in remittances in 2023, most of which came from the United States. According to BBVA Research, this figure reached nearly $65 billion in 2024.

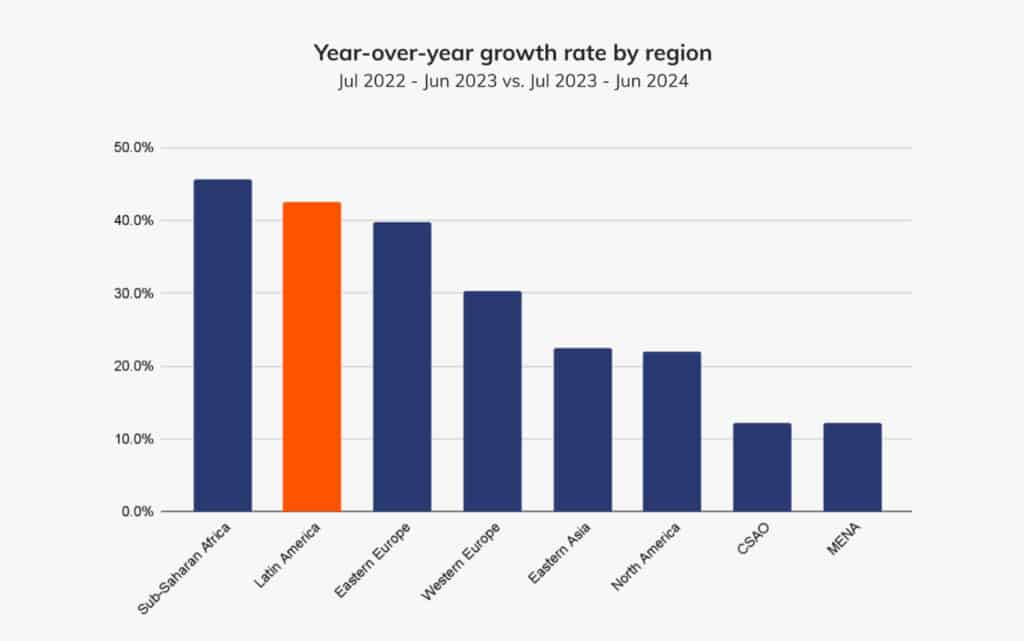

According to Chainalysis, Latin America ranked as the second fastest-growing region globally in crypto transaction volume, trailing only sub-Saharan Africa. Between July 2023 and June 2024, the region saw inflows totaling $415 billion — marking a 42.5% year-over-year surge.

Bitso hopes that MXNB can streamline these remittances by offering a faster and more affordable way to send money home. Digital assets like stablecoins can help reduce reliance on banks and money transfer services, which often charge high fees and have slow turnaround times.

Growing Adoption of Stablecoins in Latin America

Stablecoins have gained popularity in Latin America due to economic instability and inflation. Bitso’s own data shows a 9% increase in stablecoin purchases, particularly in times of local currency devaluation. Many users have turned to dollar-backed stablecoins such as USDC and Tether as a safer way to store value.

Bitso’s recent report highlights how people across the region are increasingly adopting digital currencies to cope with rising prices and a lack of reliable banking options. MXNB is expected to add a new local option for those seeking stability in their financial transactions.

Competing Peso-Pegged Stablecoins

MXNB will face competition from other stablecoins pegged to the Mexican peso. Tether’s MXNT, launched in 2022, operates on Ethereum, Tron, and Polygon networks. Other competitors include MMXN, developed by Monetary Digital, and MXNe, launched in 2024 by Brale on the Solana and Stellar networks.

While MXNB is not the first peso stablecoin, Bitso is counting on its strong local presence, regulatory awareness, and technical transparency to give it a competitive edge in the market.

Stablecoins Reshape Global Finance

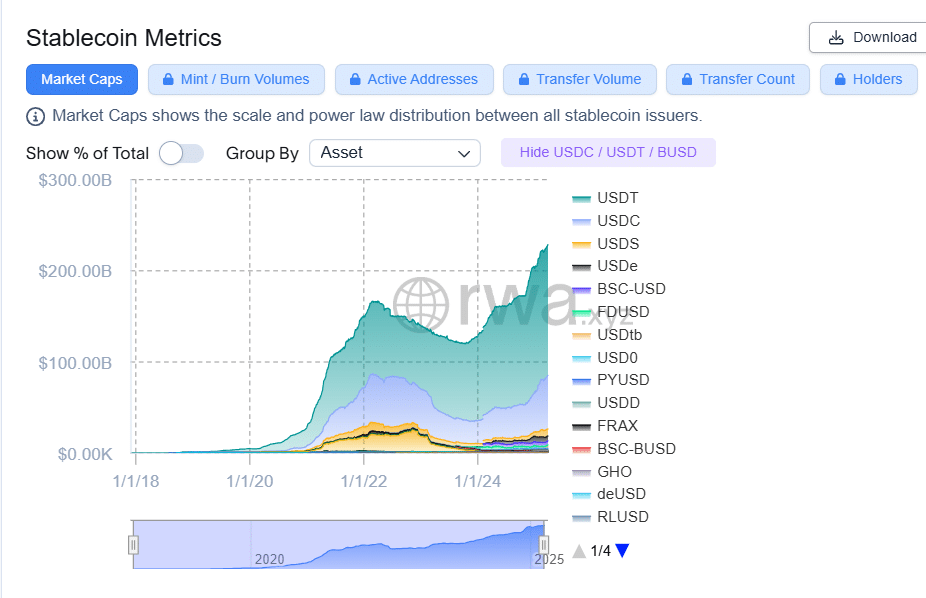

Stablecoins have become a crucial part of the cryptocurrency market, now valued at over $230 billion. Pegged to fiat currencies, they provide a stable alternative for payments, savings, and international transfers. In developing countries, stablecoins offer financial access to people without bank accounts or with limited access to stable currencies.

Bitso believes MXNB can play a similar role in Mexico, offering users a reliable and efficient method to manage their finances, especially in cross-border scenarios.

Conclusion

Bitso’s introduction of MXNB marks a significant step in Mexico’s digital finance journey. With a solid infrastructure, independent management, and focus on transparency, the stablecoin aims to reshape the way people and businesses handle money across borders. Whether it gains traction over its competitors remains to be seen, but it is a timely response to the region’s financial needs.

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

1- What is MXNB?

MXNB is a stablecoin pegged to the Mexican peso, issued by Bitso Business and managed by Juno.

2- What blockchain is it on?

MXNB is built on Arbitrum, a layer-2 solution on Ethereum.

3- How is MXNB backed?

It is fully backed by Mexican pesos held in reserve on a one-to-one basis.

4- Is Bitso regulated?

Bitso operates under various regulatory frameworks in Latin America and emphasises compliance and transparency.

Appendix: Glossary of Key Terms

Bitso – A leading Mexican crypto exchange offering digital asset services across Latin America.

MXNB – A stablecoin pegged to the Mexican peso, launched by Bitso on the Arbitrum network.

Stablecoin – A cryptocurrency designed to maintain a stable value by being pegged to a fiat currency.

Juno – Bitso’s independent subsidiary responsible for issuing and managing MXNB.

Arbitrum – An Ethereum layer-2 network that enables faster and cheaper blockchain transactions.

Fiat-Backed – Backed by traditional government-issued currency, ensuring 1:1 value support.

Remittance – Money sent by individuals, typically from abroad, to family or individuals in their home country.

References

CoinTelegraph – cointelegraph.com

CoinDesk – coindesk.com

Bitcoin News – news.bitcoin.com

Chainalysis – chainalysis.com

World Bank – worldbank.org

BBVA Research – bbvaresearch.com