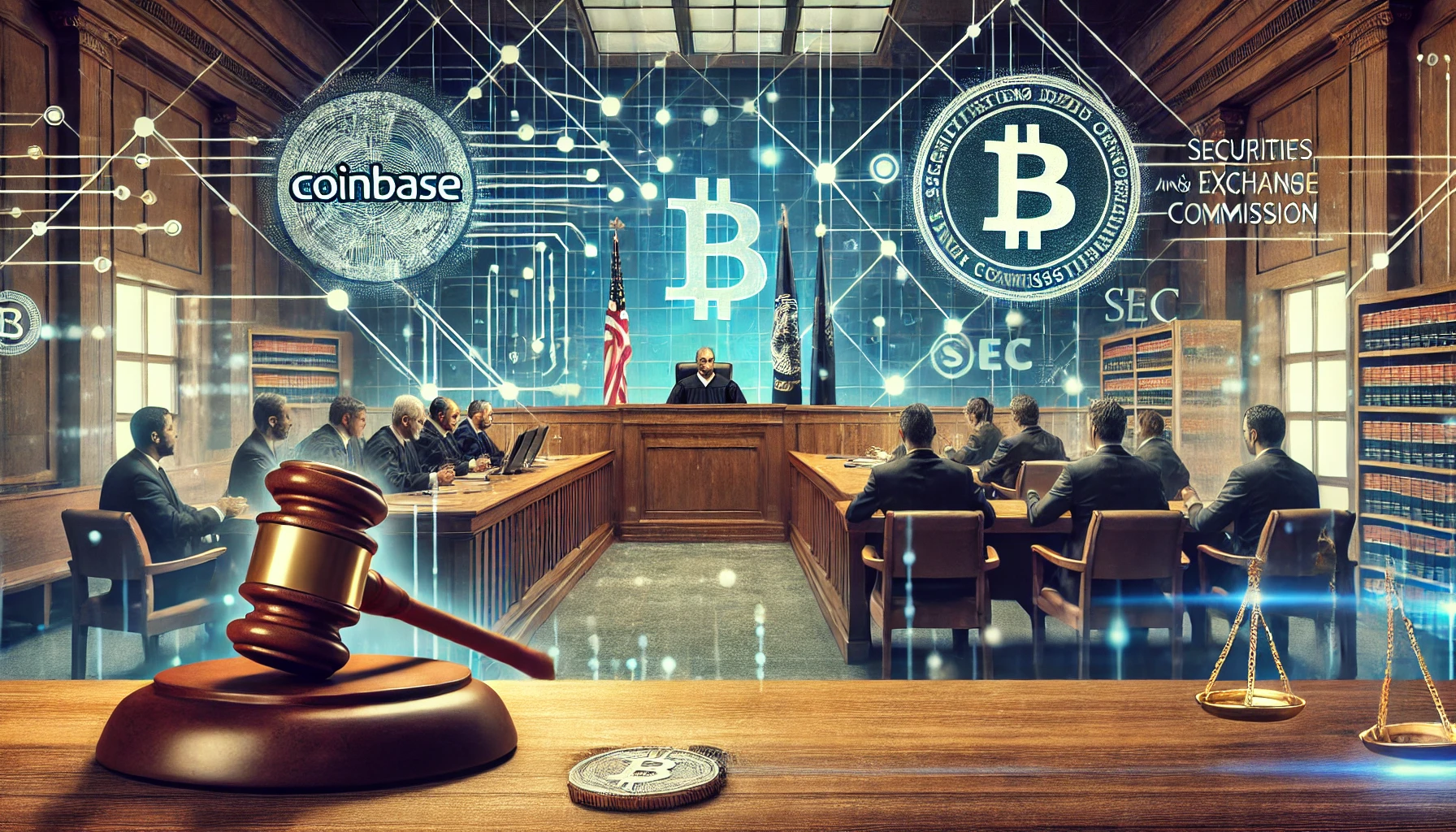

The US Securities and Exchange Commission (SEC) has postponed its decision on a review of the Bitwise 10 Crypto Index ETF Fund to March 3, 2025.

According to the latest SEC filing, the extension was necessitated by a thorough assessment of the proposal to list the Bitwise 10 Crypto Index ETF Fund as an exchange-traded product. The application was initially submitted on November 15, 2025.

Freedom to Extend Review Period

After receiving the application, the SEC published a proposed rule change in the Federal Register on December 2, 2024, thereby initiating the public comment period. Under the SEC Act, the Commission can extend its review period to comprehensively evaluate potential implications before it finally approves any such product.

The Bitwise 10 Crypto index fund is valued at $1.4 billion and trades at that OTCQX Best Market. Launched in 2017, the fund tracks the performance of at least 10 leading digital assets by market capitalization, including Bitcoin, Ethereum, Solana, and XRP. Bitwise CEO Hunter Horsey believes in the benefits of converting the fund into an exchange-traded fund that includes improved efficiency and investor protection, as well as being closely aligned with the Net Asset Value (NAV).

Analysts Not Surprised at Delay in Approval

The deadline initially set for January 17, 2025, has been delayed. Still, according to the SEC Act, the agency has at least 45 days from the day of filing to decide on the Bitwise 10 Crypto Index ETF Fund application. Should the agency go ahead and approve the proposal, it will mark a significant milestone for the SEC in terms of how it handles crypto investment vehicle applications. The Commission has maintained that the decision to push the review ahead aligns with its cautious approach when dealing with digital assets.

Commenting on the X platform, Bloomberg ETF Analyst James Seyffart said the delay doesn’t come as a surprise. He observed, “As expected, the SEC has punted/delayed the decision on BitwiseInvest’s filing to convert the Bitwise 10 Crypto Index ETF Fund (BITW) into an ETF. The final deadline is in late July.” Seyffart opined that the SEC was also likely to delay Grayscale’s approval of an application for its GDLC fund. While the deadline for Grayscale’s application has been set for February 2, Seyffart believes that market players should expect a delay from the SEC.

Bitwise 10 Crypto Index ETF Fund is a Broad-based Product

According to the filing by the SEC, no public comments have been received regarding the Bitwise 10 Crypto Index ETF Fund on the proposed rule change. However, the Commission stated it would focus on understanding any implications of introducing the broad-based crypto Bitwise 10 Crypto ETF Index Fund. Commenting on the development, Bitwise Chief Investment Officer Matt Hougan highlighted the fund’s groundbreaking role in providing index-based exposure to the crypto market. Hougan stated, “Since its inception, BITW has aimed to offer investors diversified exposure to the groundbreaking potential of crypto markets.”

Conclusion

The Asset Manager applied to list the broader Bitwise 10 Crypto Index ETF Fund in November 2024 after successfully running a sport Bitcoin ETF and Ethereum ETF in the US. The firm has designed the Bitwise 10 Crypto Index ETF Fund to expose investors to the 10 leading cryptocurrencies by market capitalization.

According to the filing, the applicable digital assets include Bitcoin, Ethereum, Solana, XRP, Cardano, Avalanche, Chainlink, Bitcoin Cash, Polkadot, and Uniswap. While the crypto community remained wary of approvals during the tenure of the outgoing SEC Chair Gary Gensler, there is increased optimism that the Donald Trump administration’s choice of Paul Atkins as incoming SEC chair will make things more favorable.

Frequently Asked Questions (FAQs)

What are the risks associated with crypto ETFs?

Like other investments, crypto ETFs are subject to several risks that are mostly related to the underlying digital assets they expose investors to. These could include volatility and unpredictability, among others.

Are crypto ETFs regulated?

Crypto ETFs are financial products, and in many jurisdictions, the issuer has to be licensed.

Can I trade crypto ETFs on international markets?

Some crypto ETFs are available to international investors as they trade on global cryptocurrency exchanges. Before buying a crypto ETF, conduct thorough research to find out what regulatory, currency, and taxation risks are associated with it.