Digital asset management company Bitwise has come a step closer to the launch of a spot Solana exchange-traded fund (ETF) by registering a statutory trust for the product in Delaware. This decision hints that Bitwise is planning to submit a draft of S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) to get the green light for the fund launch, which may signal the firm’s entry into a crowded space.

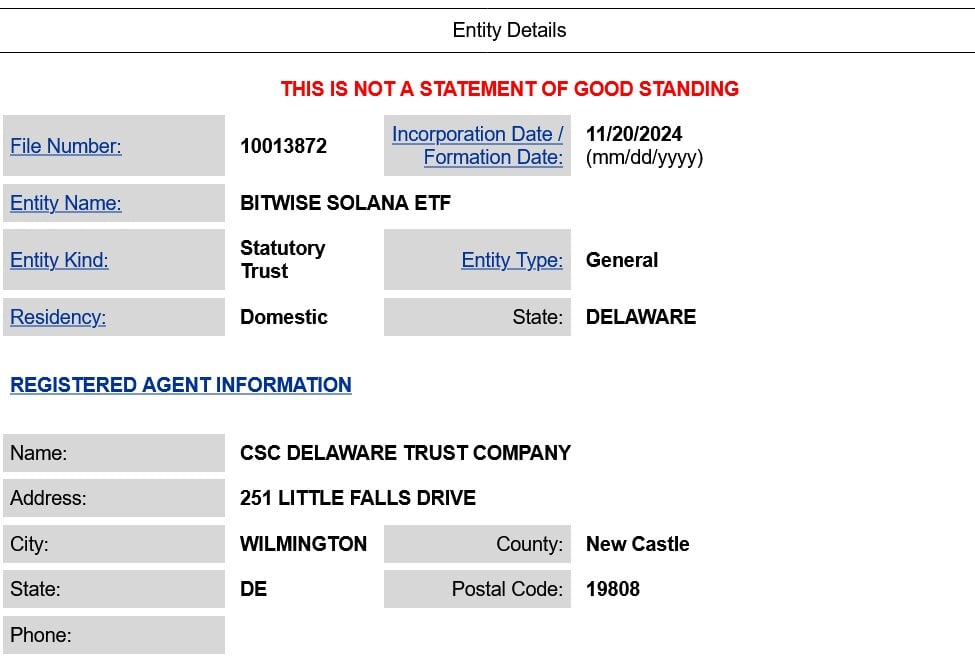

The filing was made public on November 20, and the information is available on the State of Delaware’s Division of Corporations website. The Bitwise Solana ETF is administered by the registered agent CSC Delaware Trust Company located in Wilmington, Delaware. This is another major development for Bitwise in the provision of investment products tied to cryptocurrencies.

Bitwise Competes for Solana ETF

Nevertheless, the trust has been set, but Bitwise still has much work to do to get the ETF up and running. The company has to fill out a 19b-4 form and an S-1 registration statement to get approved by the SEC, and to do this, it will have to compete with VanEck and Canary Capital, the current other potential providers of Solana ETFs.

This comes in the wake of another application that Bitwise submitted to the Delaware authorities on October 1st this year for a spot XRP ETF. One day later, the firm filed its S-1 with the SEC to demonstrate its desire to be the first to launch cryptocurrency ETFs.

If the proposal is greenlit, the Bitwise Solana ETF will aim to mirror the Solana token, the fourth-largest cryptocurrency by market capitalization. Still, it is uncertain on which exchange the ETF will be listed; however, other Bitwise ETFs that focus purely on cryptocurrency, such as the Bitwise Bitcoin ETF and the Bitwise Ethereum ETF, are currently listed on the New York Stock Exchange Arca.

At present, the Solana ETF that is proposed does not have an official ticker symbol assigned to it. This, however, raises questions on how the product will be named and endowed with a brand in view of the intensifying rivalry in the market for digital asset-backed ETFs.

VanEck Optimistic About Solana ETF

Matthew Sigel, the Head of Digital Asset Research at VanEck, is quite positive about the chances of a U.S.-approved spot Solana ETF; he expects it to be approved “overwhelmingly high” by the year 2025. Some of this confidence is based on the hope of a more favorable regulatory climate for cryptocurrency under the incoming Trump administration that is set to commence on January 20, 2025.

Although such a movement may seem exciting, industry experts have opined that the Solana ETF might not attract as much capital as other products such as the Bitcoin and Ether ETFs. For instance, in the current bull cycle, Solana saw a stunning 2,390% price appreciation with a peak of $241.87, based on CoinMarketCap data. However, during the last bear market, the asset did not produce an all-time high in the ongoing cycle.

SEC Delays Other Crypto ETF Decisions

The Bitwise Solana ETF filing is submitted as the SEC remains in limbo on a number of other crypto products proposals. Also, the SEC has delayed its decision on the Franklin Templeton Crypto Index ETF to early 2025, which only increases the vagueness of the approval procedure of new digital asset investment products.

Besides these developments, there are growing plans among asset managers to expand the focus of crypto-backed ETFs. A number of new filings for spot Litecoin ETFs have also been submitted in the last few weeks, which means more crypto products may enter the ETF market in the near future.

With the market for crypto ETFs still in its infancy, Bitwise’s latest move shows that the firm plans to become a key player in this rapidly shifting market. Despite the hazy legal landscape that the firm is facing, its future position in defining the future of digital asset investment will be defined by how it manages the challenges.

Stay connected to TheBITJournal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!