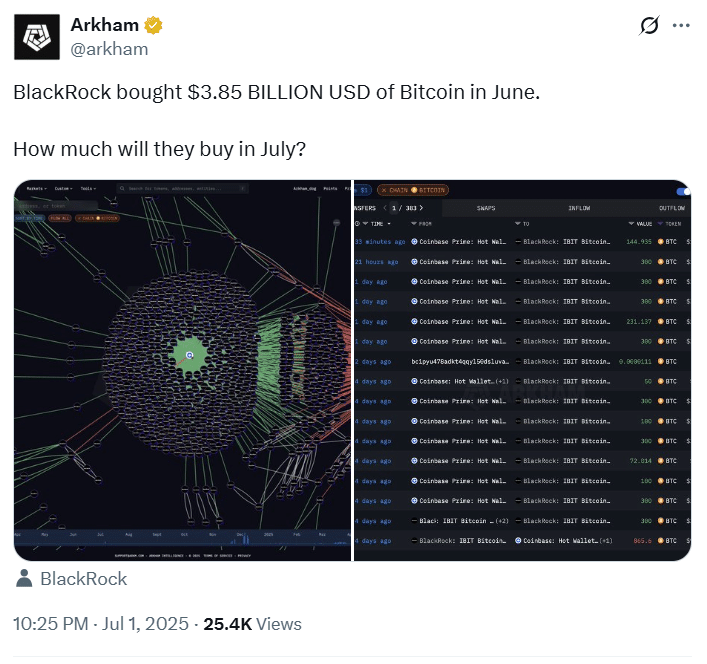

BlackRock’s Bitcoin accumulation strategy intensified in June, sending ripples through the cryptocurrency and financial markets. With over $3.85 billion worth of BTC added to its portfolio in a single month, the asset management giant has cemented its dominance in the digital asset space. This aggressive BlackRock Bitcoin accumulation mirrors growing institutional confidence in regulated crypto investment products.

BlackRock Bitcoin Accumulation Signals Strong Confidence

According to blockchain analysis firm Arkham, BlackRock made a series of Bitcoin acquisitions in June, including a staggering $1.4 billion purchase executed over six consecutive days. This marks one of the most aggressive accumulation streaks seen in recent months, emphasizing the firm’s bullish stance on the long-term value of Bitcoin.

The surge in BlackRock Bitcoin accumulation is closely tied to the rise of its flagship crypto product, the iShares Bitcoin Trust (IBIT), which now outpaces even BlackRock’s S&P 500 ETF in annual revenue generation.

Overview of BlackRock’s Crypto Expansion

BlackRock entered the crypto market cautiously but has since become a leader in institutional Bitcoin adoption. Its growing Bitcoin portfolio—now holding over 696,874 BTC valued at approximately $80.7 billion, reflects a calculated shift toward digital assets, especially amid volatile macroeconomic conditions.

Launched in January 2024, IBIT has grown rapidly, accumulating more than $52.4 billion in assets under management. This represents over 55% of the total U.S. spot Bitcoin ETF market. IBIT’s success has been a major driver behind BlackRock Bitcoin accumulation, with 96% of all net inflows into Bitcoin ETFs now attributed to the fund.

The fund’s 0.25% expense ratio has earned $187.2 million in annual fees, outperforming BlackRock’s own IVV, which generated slightly less revenue despite a much larger AUM.

Surpassing Historical ETF Records

IBIT recently became the fastest ETF in history to cross $70 billion in AUM. It reached the milestone in just 341 days, beating the previous record set by SPDR Gold Shares ETF, which took 1,691 days. This momentum is seen as further validation of the BlackRock Bitcoin accumulation trend and the institutional market’s hunger for Bitcoin exposure.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| July | $108,058.08 | $123,117.58 | $138,177.08 | 28.3% |

| August | $105,205.36 | $111,189.73 | $117,174.09 | 8.8% |

| September | $105,542.38 | $108,918.95 | $112,295.51 | 4.2% |

| October | $100,022.51 | $99,823.89 | $99,625.26 | -7.5% |

| November | $104,684.85 | $101,564.59 | $98,444.32 | -8.6% |

| December | $100,386.05 | $99,934.83 | $99,483.61 | -7.7% |

Institutional Voices Back the Move

Industry figures have echoed the importance of BlackRock’s moves. Crypto trader Cade O’Neill remarked that BlackRock Bitcoin accumulation shows institutions are no longer “just curious—they’re committed.” James McKay, founder of McKay Research, called the trend “bullish,” reflecting a broader sentiment that crypto is now entering mainstream asset allocation models.

Comparing IBIT with Traditional Funds

Although BlackRock’s S&P 500 ETF, IVV, boasts $624 billion in assets, its earnings have been eclipsed by the smaller but higher-fee IBIT. This performance differential has reshaped how asset managers view crypto as a revenue-generating tool.

BlackRock Bitcoin accumulation is not just a bet on price appreciation but also a financial strategy aimed at capitalizing on higher management fees and surging investor interest.

Why June’s Buying Spree Matters

The timing of this latest accumulation phase is critical. June’s purchases reflect confidence during a market consolidation phase. The multi-part acquisitions indicate long-term planning rather than short-term speculation, a strategy that aligns with BlackRock’s typical investment approach.

Long-Term Strategy and Market Signals

With more institutions entering the space, BlackRock Bitcoin accumulation signals a pivot in asset allocation priorities. As traditional portfolios expand to include digital assets, funds like IBIT are becoming essential tools for exposure and growth.

This shift suggests that Bitcoin is evolving from a speculative asset into a core component of institutional portfolios.

Conclusion

BlackRock’s deepening Bitcoin strategy underscores a growing institutional embrace of digital assets. With IBIT outperforming legacy ETFs and capturing the lion’s share of market flows, BlackRock Bitcoin accumulation has become a leading indicator of broader financial trends. As crypto becomes further embedded in institutional frameworks, BlackRock continues to shape the future of regulated Bitcoin investment.

Summary

BlackRock intensified its Bitcoin accumulation in June, purchasing over $3.85 billion worth of BTC, including a $1.4 billion buy over six consecutive days. This aggressive strategy highlights the firm’s growing conviction in Bitcoin’s long-term value and its commitment to leading institutional adoption.

Much of this accumulation is driven by the success of BlackRock’s iShares Bitcoin Trust (IBIT), which now generates more annual revenue than its S&P 500 ETF. IBIT’s rapid growth reflects rising institutional demand for regulated Bitcoin exposure.

Frequently Asked Questions (FAQ)

1- What is BlackRock Bitcoin accumulation?

BlackRock Bitcoin accumulation refers to the company’s continued purchase of Bitcoin, primarily through its spot ETF, IBIT.

2- How much Bitcoin does BlackRock currently hold?

As of now, BlackRock holds over 696,874 BTC, valued at approximately $80.7 billion.

3- Why is BlackRock buying more Bitcoin?

The firm is responding to growing demand for regulated Bitcoin exposure and using its ETF to tap into higher fee structures.

4- What is IBIT?

IBIT is BlackRock’s iShares Bitcoin Trust, a spot Bitcoin ETF launched in January 2024 that has quickly grown to over $52.4 billion AUM.

Appendix: Glossary of Key Terms

BlackRock Bitcoin Accumulation – The ongoing purchase of Bitcoin by asset manager BlackRock to expand its crypto holdings.

IBIT (iShares Bitcoin Trust) – BlackRock’s spot Bitcoin ETF launched in 2024, now a leading crypto investment vehicle.

BTC (Bitcoin) – The native cryptocurrency of the Bitcoin network, often used as a store of value or investment asset.

ETF (Exchange-Traded Fund) – A type of investment fund traded on stock exchanges, offering exposure to various assets.

AUM (Assets Under Management) – The total market value of assets an investment firm or fund manages on behalf of clients.

Spot Bitcoin ETF – An ETF that holds actual Bitcoin rather than Bitcoin futures, offering direct exposure to the asset.

Net Inflows – The total amount of new money entering a fund, indicating investor interest and fund performance.

References

Crypto.News – crypto.news

CoinTelegraph – cointelegraph.com