The BlackRock Ethereum ETF has reached an unexpected milestone, reaching $10 billion in assets under management (AUM) and becoming the third-fastest exchange-traded fund (ETF) in US history to do so.

This historic milestone demonstrates the fast-increasing institutional demand for Ethereum, indicating a greater integration of the digital asset into traditional finance.

Institutional Demand Drives BlackRock Ethereum ETF Growth

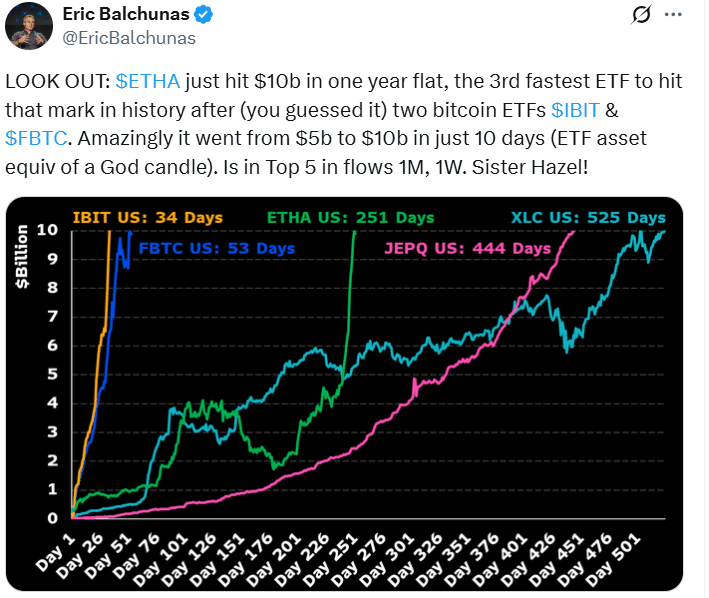

Since its introduction, the BlackRock Ethereum ETF has seen exceptional inflows, rising from $5 billion to $10 billion in only ten days. This impressive development trend demonstrates how institutional demand for regulated Ethereum exposure is rapidly increasing.

The ETF allows investors to have access to Ethereum without physically holding the asset, and its attraction is bolstered by the larger trend of digital asset investing by hedge funds, companies, and everyday investors.

Bloomberg ETF analyst Eric Balchunas referred to the increase as “the equivalent of a God candle in ETF terms,” highlighting how uncommon such quick asset buildup is in the financial markets. This milestone solidifies the BlackRock Ethereum ETF‘s position as a defining product in 2025’s developing investing environment.

Ethereum ETFs Outpace Market Expectations

Ethereum ETFs saw over $4.7 billion in net inflows in July alone, outperforming equivalent Bitcoin ETFs on many trading days. Notably, the BlackRock Ethereum ETF garnered $602 million on July 17, outperforming Bitcoin ETFs on that day.

Such demand shows that Ethereum is gaining traction among institutional investors as a unique utility asset, thanks to its proof-of-stake (PoS) network and expanding staking environment.

Analysts believe regulatory clarity contributed significantly to this accomplishment. Recent judgments have recognized staking payments as taxable income rather than securities, paving the way for future improvements to Ethereum ETFs, including possible staking features. If adopted, this might create more income-generating options for investors.

Regulatory Clarity and Ecosystem Expansion

The BlackRock Ethereum ETF’s performance is linked to Ethereum’s continued development. The network’s move to proof-of-stake has positioned it as a more energy-efficient and scalable blockchain, and its role in powering decentralized finance (DeFi) and other applications is expanding.

These considerations have made Ethereum an appealing option for institutional investors wanting exposure to the larger digital economy.

As the ETF market matures, Ethereum ETFs may soon include staking, providing investors with extra return. Market analysts believe that such qualities might make the BlackRock Ethereum ETF even more appealing than existing Bitcoin ETFs.

Setting a New Standard for Crypto ETFs

While the BlackRock Ethereum ETF lags behind its Bitcoin equivalent in terms of speed to $10 billion (IBIT reached the mark in only 34 days), the feat is nevertheless noteworthy.

The fact that the three quickest ETFs in US history are all spot cryptocurrency ETFs reflects a significant shift in investor preferences. Nate Geraci, head of a large wealth management business, stated that “crypto ETFs have completely redefined investor interest in digital assets,” highlighting how Ethereum has emerged from Bitcoin’s shadow.

Conclusion

The BlackRock Ethereum ETF’s quick climb to $10 billion in AUM is a watershed moment for Ethereum and the larger cryptocurrency sector. With institutional demand increasing, regulatory frameworks becoming clearer, and the prospect of future features like as staking, the ETF has established a new standard for investor trust. This result shows that Ethereum’s position in the global financial system will only grow in the coming years.

To be updated on the latest crypto insights, visit our platform.

FAQs

What is the BlackRock Ethereum ETF?

It is a spot Ethereum exchange-traded fund that offers regulated exposure to Ether without requiring investors to hold the asset directly.

How quickly did the ETF reach $10 billion in AUM?

It reached $10 billion in assets under management in just 251 days, doubling from $5 billion to $10 billion in only ten days.

Why is institutional demand for Ethereum increasing?

Ethereum’s proof-of-stake network, regulatory clarity, and strong DeFi ecosystem have made it a preferred asset for institutions.

Glossary

AUM (Assets Under Management): The total market value of assets managed by a fund.

Spot ETF: An ETF that directly holds the underlying asset, such as Ether, instead of derivatives.

Proof-of-Stake (PoS): A consensus mechanism that secures blockchains by requiring participants to stake tokens.

Staking Rewards: Earnings generated by holding and staking cryptocurrency to support network operations.