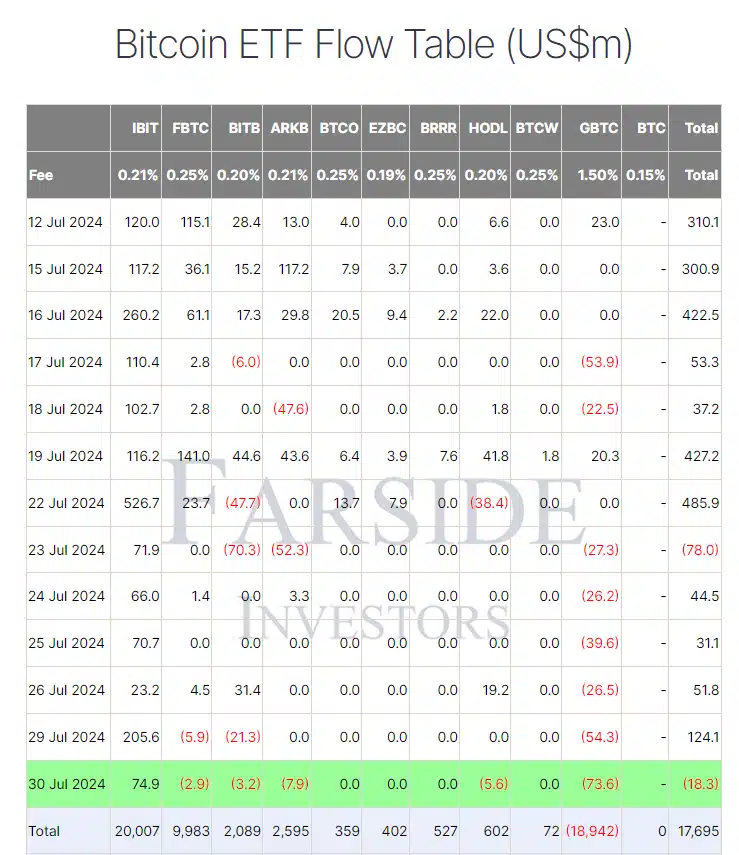

On July 30, a pivotal shift occurred in the cryptocurrency market as BlackRock Ethereum ETF inflows dramatically outpaced those of Bitcoin. According to data from Farside, this notable trend emerged against a backdrop of Bitcoin ETF withdrawals amounting to $18.3 million, marking the first outflow since July 23. In stark contrast, Ethereum’s inflows told a different story.

Several prominent Bitcoin ETFs, such as Bitwise’s BITB, ARK’s ARKB, and Fidelity’s FBTC, experienced outflows. Conversely, BlackRock’s Ethereum-focused IBIT ETF reported a significant $74.9 million inflow, marking its second consecutive day of positive inflows. This surge boosted its total net inflow to over $20 billion, illustrating a marked investor shift.

The rising inflows into BlackRock’s Ethereum ETF suggest growing investor confidence in Ethereum’s potential. This is particularly significant given the evolving landscape of blockchain applications and market dynamics. The sharp contrast between Ethereum ETF inflows and Bitcoin ETF outflows indicates a changing sentiment among investors, who are diversifying their portfolios beyond Bitcoin’s traditional dominance.

BlackRock Ethereum ETF Inflows Continue to Climb

In an unprecedented development on July 30, Ethereum ETFs recorded a net inflow of $33.7 million, marking a first since July 23. Grayscale’s ETHE saw its smallest outflow of $120.3 million, while BlackRock Ethereum ETF inflows for ETHA achieved an impressive $118.0 million, its largest inflow since July 23. This brought the total outflows in Ethereum ETFs to $406.4 million. This significant inflow for BlackRock’s ETHA not only marked a substantial increase but also outpaced the inflow of its Bitcoin ETF counterpart, IBIT.

In contrast, Bitcoin ETFs such as Grayscale’s GBTC experienced their largest outflow since June 24, with $73.6 million exiting. This outflow brought GBTC’s total outflow to $18.9 billion. Despite these fluctuations, total ETF inflows amounted to $17.7 billion, highlighting the dynamic nature of the cryptocurrency market.

A Market Shift Indicated by BlackRock Ethereum ETF Inflows

The surge in BlackRock Ethereum ETF inflows signals a shift in investor sentiment towards Ethereum. With $118.0 million in inflows, BlackRock’s ETHA ETF has shown robust investor confidence, eclipsing the $74.9 million inflow recorded by its Bitcoin counterpart, IBIT. This trend underscores Ethereum’s growing appeal among institutional investors.

BlackRock’s ability to attract substantial inflows for both its Bitcoin and Ethereum ETFs highlights the firm’s strategic positioning in the cryptocurrency market. The firm’s consistent success in drawing significant investments, particularly in its Ethereum ETF, suggests a potential long-term shift in market dynamics. Investors are increasingly recognizing Ethereum’s value and potential as it continues to evolve and expand its use cases.

The Implications for Future Market Trends

As the cryptocurrency market continues to evolve, the performance of BlackRock’s ETFs will be closely monitored by investors and analysts.

The firm’s ability to attract substantial inflows for its Ethereum ETF, despite broader market volatility, underscores its strong market presence and strategic foresight.

Observing the Impact of BlackRock Ethereum ETF Inflows

In conclusion, the recent surge in BlackRock Ethereum ETF inflows marks a significant milestone in the cryptocurrency market. With $118.0 million in inflows for its ETHA ETF, BlackRock has surpassed its Bitcoin ETF counterpart, indicating a potential shift in investor sentiment towards Ethereum. This development underscores the growing confidence in Ethereum’s potential and highlights BlackRock’s strategic positioning in the market.

Stay tuned to The BIT Journal for more updates on this evolving story and other breaking news in the cryptocurrency sector. The impact of BlackRock Ethereum ETF inflows will continue to be a key focus for investors and market analysts as we monitor the dynamic shifts in the cryptocurrency landscape.