Bitcoin recovery is making headlines once more, driven by notable developments that are shaping its trajectory. Recent reports from The BIT Journal have highlighted a significant upturn in Bitcoin’s value, which quickly rebounded after a drop to $49,000. This data, sourced from CoinGecko, showcases a swift and substantial recovery, sparking widespread interest and optimism in the cryptocurrency market.

This renewed surge in Bitcoin’s value is capturing the attention of investors and enthusiasts alike, underlining a positive shift in sentiment towards the cryptocurrency’s potential.

Source: CoinGecko

The rapid recovery not only reflects the volatile nature of the digital currency market but also reinforces the growing confidence among stakeholders in Bitcoin’s enduring appeal and resilience.

BlackRock’s $1B Surge Fuels Bitcoin Recovery

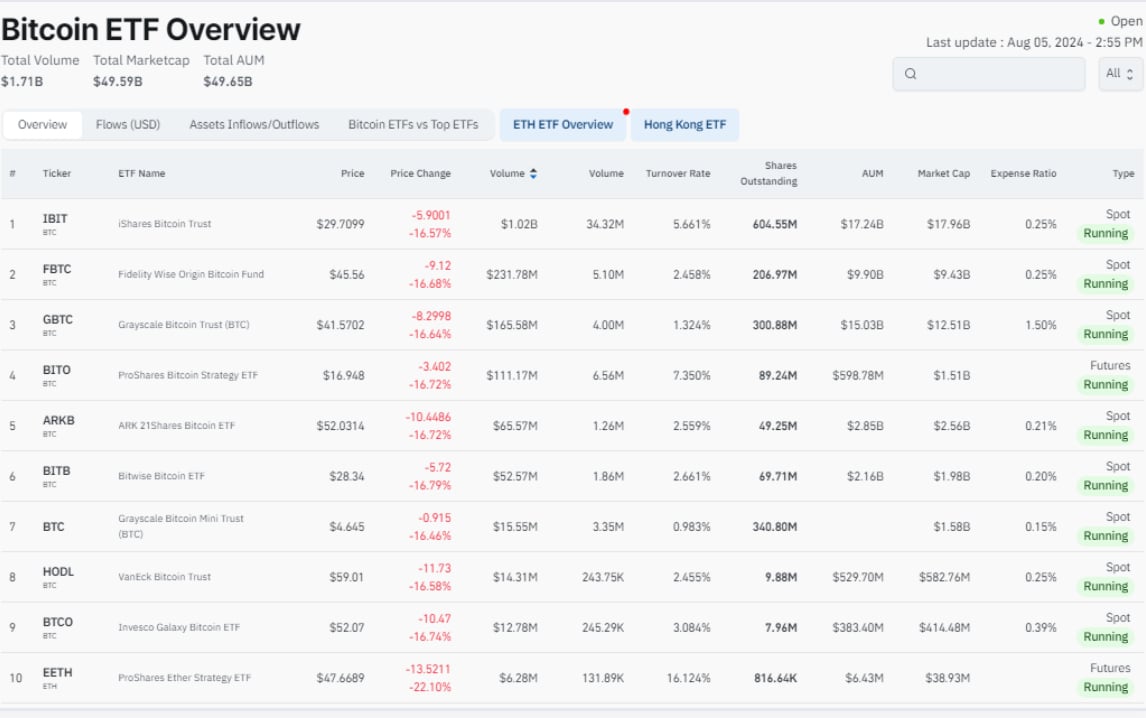

A key driver of this Bitcoin recovery is the substantial investments pouring into the market, notably from BlackRock’s IBIT. This investment instrument has achieved a new high in trading volume, signaling a growing confidence among investors in Bitcoin’s future prospects.

As BlackRock’s activities continue to influence the market, interest in Bitcoin’s recovery is also increasing. This influence underscores the significant impact that major institutional investments have on the cryptocurrency landscape, bolstering the overall market sentiment.

Source: CoinGlass

BlackRock’s IBIT ETF has made a remarkable comeback, reaching new heights and securing its position among the top ten traditional ETFs. The BIT Journal reports that within the first 30 minutes of trading, IBIT achieved a groundbreaking $1 billion in trading volume. This milestone not only signifies a strong performance but also positions IBIT ahead of IVV, which registered $930 million, and close to HYG’s $1.07 billion in the same timeframe. This significant achievement underscores the growing investor confidence in the potential for Bitcoin recovery.

The swift accumulation of trading volume by IBIT highlights the ETF’s appeal and the robust market demand for innovative financial products linked to digital currencies. As BlackRock continues to influence the investment landscape with its cryptocurrency-focused offerings, this trend reflects broader investor interest and optimism about the future of Bitcoin and other digital assets. This enthusiastic market response suggests a positive outlook for the continued growth and acceptance of cryptocurrencies in mainstream investment portfolios.

Other funds, including Grayscale’s GBTC and Fidelity’s FBTC, have also seen strong performances, contributing to the overall market surge. GBTC reported trading volumes of $160 million, while FBTC recorded $219 million, bringing the total Bitcoin ETF trading volume to $1.71 billion in just 30 minutes. These figures reflect a broader market rally, signaling a robust phase of Bitcoin recovery.

Bitcoin’s Bullish Rebound

The overall sentiment in the cryptocurrency market is cautiously optimistic. Recent data indicates that the global crypto market cap has reached $1.94 trillion, with a total trading volume of $244.49 billion in the last 24 hours. Bitcoin is currently trading at $54,814.51, holding a dominant 55.9% share of the total market cap. This significant trading volume and stable price point highlight ongoing investor engagement and confidence in Bitcoin recovery.

Ethereum and other cryptocurrencies are also experiencing positive movements. Ethereum, priced at $2,482.85, holds a market dominance of 15.4%. The best-performing sector in this recovery phase is the EUR Stablecoin, which has gained 1%. Despite the overall market sentiment of extreme fear, as indicated by a low score of 26 on the Crypto Fear & Greed Index, the swift Bitcoin recovery signals potential stability and growth.

Today’s BTC recovery is a significant indicator of market confidence and renewed investor interest. With BlackRock’s IBIT setting records and Bitcoin’s price stabilizing above $54,000, this day marks a pivotal moment for both investors and market observers.

In conclusion, the recent market activities signify a robust Bitcoin recovery, marked by more than just fluctuating numbers. These trends represent a renewed sense of trust from investors, suggesting a strong resurgence in confidence toward Bitcoin.

As Bitcoin and other digital currencies may be entering a period of sustained recovery, The BIT Journal remains committed to delivering the latest news and insights on cryptocurrencies. We aim to keep our readers informed and ahead of these exciting market changes.