BlackRock, the world’s largest asset manager, has made a significant move into the European cryptocurrency market by launching its inaugural Bitcoin Exchange-Traded Product (ETP). This strategic expansion aims to cater to the growing demand for cryptocurrency investments among European investors.

A Strategic Expansion into Europe

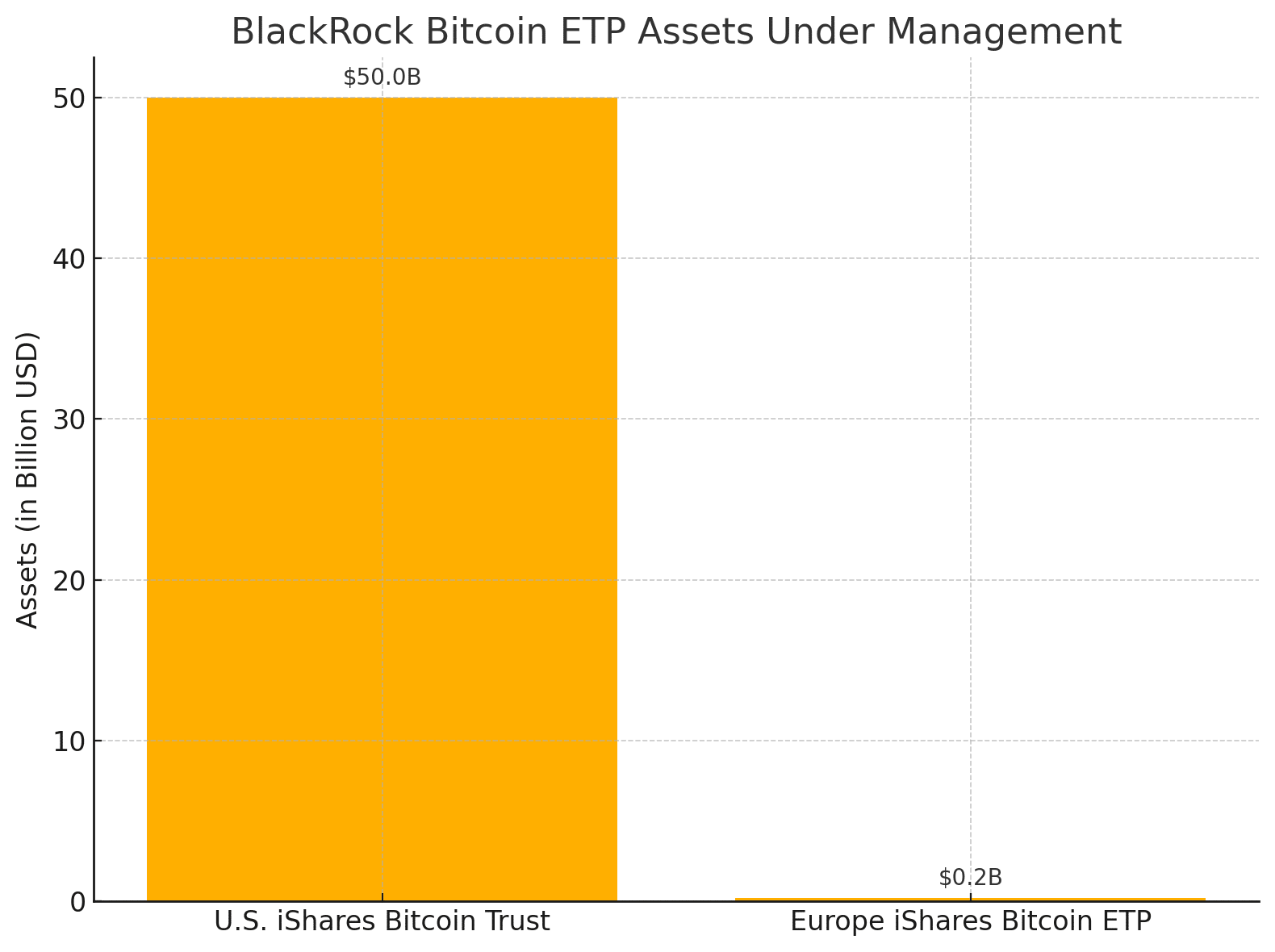

The newly introduced iShares Bitcoin ETP is domiciled in Switzerland and is available for trading across major European exchanges, including Paris, Amsterdam, and Frankfurt. This initiative mirrors BlackRock’s successful foray into the U.S. crypto market, where its iShares Bitcoin Trust amassed over $50 billion in assets since its January 2024 debut.

Collaborative Partnerships and Custody Solutions

To ensure the security and integrity of the underlying Bitcoin assets, BlackRock has partnered with Coinbase as the custodian and Bank of New York Mellon as the administrator for the European ETP. These collaborations leverage the expertise of established financial institutions to provide robust infrastructure and trust for investors.

Navigating Regulatory Landscapes

The European launch comes as the region implements the Markets in Crypto-Assets Regulation (MiCA), which aims to establish a comprehensive regulatory framework for cryptocurrencies. BlackRock’s proactive approach to aligning with these regulations underscores its commitment to compliance and positions it favorably within the evolving European crypto landscape.

Investor Sentiment

Introducing BlackRock’s Bitcoin ETP in Europe is poised to have significant implications for the market. It provides both institutional and retail investors with a regulated and accessible avenue to gain exposure to Bitcoin, potentially leading to increased adoption and liquidity within the European crypto markets. However, it’s noteworthy that the launch coincides with a period of substantial outflows from crypto ETPs globally, indicating a complex and dynamic market environment.

Conclusion

BlackRock’s expansion into the European cryptocurrency market through the launch of its iShares Bitcoin ETP marks a pivotal development in the financial landscape. By providing a secure and regulated investment vehicle, BlackRock is addressing the growing demand for cryptocurrency exposure among European investors. As the market continues to evolve, this strategic move underscores the increasing integration of digital assets into mainstream finance and highlights the importance of regulatory compliance and robust partnerships in fostering investor confidence.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is an Exchange-Traded Product (ETP)?

An ETP is a financial instrument that tracks the performance of an underlying asset, such as commodities, currencies, or indices and is traded on stock exchanges similar to equities.

How does BlackRock’s Bitcoin ETP differ from other cryptocurrency investment options?

BlackRock’s Bitcoin ETP offers a regulated and institutionally backed avenue for investors to gain exposure to Bitcoin without directly holding the cryptocurrency, providing enhanced security and compliance features.

What are the risks associated with investing in Bitcoin ETPs?

Investing in Bitcoin ETPs involves risks such as market volatility, regulatory changes, and potential liquidity issues inherent to the cryptocurrency market.

How does the MiCA regulation impact cryptocurrency investments in Europe?

MiCA aims to establish a harmonized regulatory framework for cryptocurrencies across Europe, enhancing investor protection and market integrity, which could influence the operation and adoption of crypto-related financial products.

What role does Coinbase play in BlackRock’s Bitcoin ETP?

Coinbase serves as the custodian for the ETP, responsible for securely storing the underlying Bitcoin assets, ensuring their safety and integrity.

Glossary of Key Terms

Exchange-Traded Product (ETP): A type of security that tracks underlying assets and is traded on stock exchanges.

Custodian: A financial institution responsible for holding and safeguarding financial assets on behalf of clients.

Markets in Crypto-Assets Regulation (MiCA): A proposed European Union regulation aimed at creating a comprehensive framework for crypto-assets.

Liquidity: The ease with which an asset can be quickly bought or sold in the market without affecting its price.

Volatility: A statistical measure of the dispersion of returns for a given security or market index, indicating the level of risk associated with the asset’s price changes.