In a significant turn of events, BlackRock’s iShares Bitcoin Trust has seen a substantial inflow of investments, underscoring the growing interest in US spot Bitcoin ETFs. On July 16, the fund gathered an impressive $260 million from Bitcoin investors. This contribution made up more than half of all net inflows into US spot Bitcoin ETFs for the day.

A Record-Breaking Streak for US Spot Bitcoin ETFs

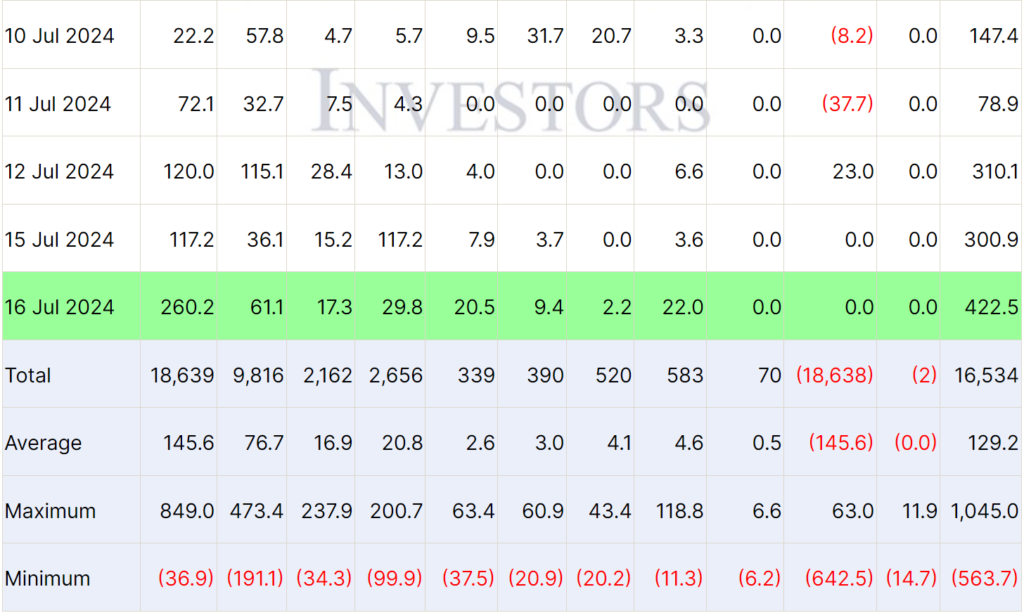

This influx marked the eighth consecutive day of positive net inflows for US spot Bitcoin ETFs, reaching a cumulative total of $422.5 million. According to data from Farside Investors, this was the best-performing day since June 5, showcasing a renewed interest and confidence in Bitcoin as an investment.

The surge in inflows wasn’t limited to BlackRock alone. The Fidelity Wise Origin Bitcoin Fund recorded the second-highest inflows among US spot Bitcoin ETF issuers, with $61.1 million. Trailing behind was the ARK 21Shares Bitcoin ETF, which saw inflows of $29.8 million. Meanwhile, the VanEck Bitcoin ETF and Invesco Galaxy Bitcoin ETF each enjoyed inflows exceeding $20 million. On the other hand, the Grayscale, Hashdex, and WisdomTree-issued spot Bitcoin ETFs did not register any inflows during this period.

BlackRock’s Bitcoin Holdings on the Rise

Following its latest purchase of 4,004 Bitcoin, coupled with a 3% price rise since the previous Monday, BlackRock’s Bitcoin stash is now valued above $20 billion. This milestone marks a significant recovery for the fund, which first exceeded $20 billion in assets under management in late May. At that time, Bitcoin was approaching $70,000, making the iShares Bitcoin Trust the largest Bitcoin ETF in the world.

Nate Geraci, president of The ETF Store, lauded BlackRock’s achievement. He criticised the notion that only “degen retail” investors would buy Bitcoin products, emphasising the broadening appeal of such investments. This comes shortly after BlackRock’s CEO, Larry Fink, referred to Bitcoin as a “legitimate” financial instrument that can shield against currency debasement, reinforcing the growing acceptance of Bitcoin in mainstream financial circles.

Market Movements and Investor Sentiment

Bitcoin’s price has moved significantly over the past week. Currently at $65,470, it has surged by 13.1% from a near five-month low of $53,600 on July 5. This dramatic recovery followed a period of concern among investors, primarily driven by the German government’s decision to sell nearly 50,000 Bitcoins. Additionally, news that Mt. Gox is preparing to repay over $9 billion to creditors added to the market’s volatility.

Substantial inflows into US spot Bitcoin ETFs signal a robust recovery and growing investor confidence in Bitcoin. These developments highlight the cryptocurrency market’s dynamic nature and the pivotal role played by institutional investments in shaping its future.

The Growing Appeal of US Spot Bitcoin ETFs

The success of BlackRock’s iShares Bitcoin Trust is a testament to the increasing popularity of US spot Bitcoin ETFs. With consistent positive net inflows, these ETFs are drawing substantial interest from a broad spectrum of investors. This trend underscores the evolving perception of Bitcoin as a viable investment vehicle.

US spot Bitcoin ETFs are designed to track the price of Bitcoin more closely than futures-based products, providing investors with a straightforward way to gain exposure to the digital currency. The recent inflows suggest that investors are recognising the benefits of this structure, contributing to the growing appeal of US spot Bitcoin ETFs.

Looking Ahead: The Future of US Spot Bitcoin ETFs

As the market for US spot Bitcoin ETFs continues to evolve, the coming months will be crucial in determining their long-term viability and success. The recent surge in inflows is a positive sign, indicating that these investment products are gaining traction.

However, the cryptocurrency market is inherently volatile, and future developments could significantly impact the performance of US spot Bitcoin ETFs. Investors will need to stay informed and be prepared for potential fluctuations in the market.

In conclusion, BlackRock’s iShares Bitcoin Trust has demonstrated that US spot Bitcoin ETFs are becoming an increasingly attractive option for investors. With significant inflows and rising market confidence, these ETFs are poised to play a pivotal role in the future of Bitcoin investment. As the landscape continues to shift, it will be fascinating to see how US spot Bitcoin ETFs evolve and adapt to meet the needs of a growing investor base.