Binance Coin (BNB) has shown significant upward momentum, breaking past the $600 mark for the first time since late September. This rise has strengthened BNB’s market momentum, leading investors to question whether the highly anticipated $800 level is within reach. According to technical analysis, BNB could see a 35% increase, which could push its price to $800—but only if critical resistance levels are surpassed.

Technical Outlook for BNB

Currently, BNB price action is supported by strong upward momentum, with a rising trendline and triangle formation pointing towards further accumulation. This signals that a breakout past the horizontal resistance level is possible. The key resistance zone lies between $605 and $620, which has been tested several times but remains unbroken for now.

Given the height of the triangle formation, a breakout could lead to gains of approximately 35.9%, pushing the price towards the $800 mark. The Relative Strength Index (RSI) is currently at 66.72, indicating that while BNB is nearing the overbought region, there is still room for further upward movement. However, investors should remain cautious as the price approaches this critical resistance zone.

Market Sentiment and Support Levels

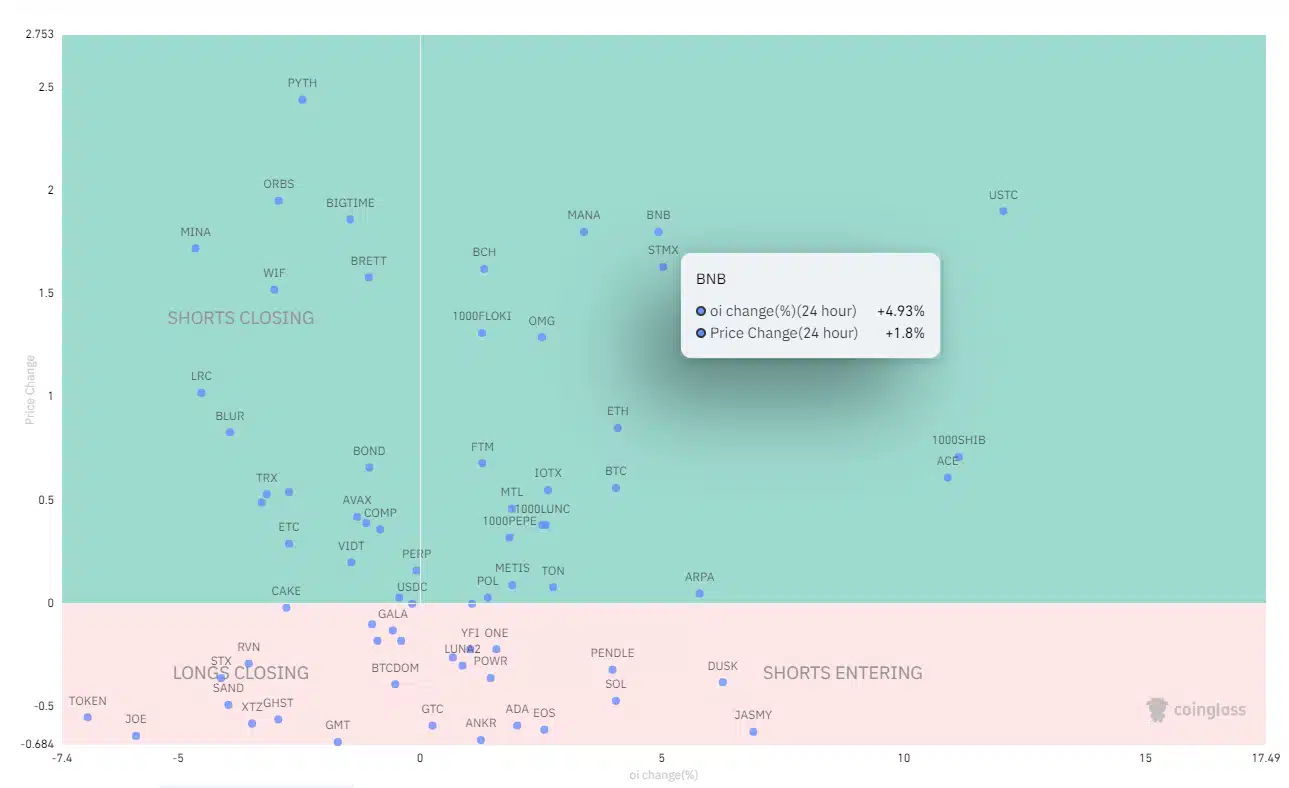

Market sentiment surrounding BNB is also highly positive. Data from Coinglass shows that derivatives traders favor long positions on BNB, with daily liquidation charts reflecting $22.30 million in long positions versus $21 million in short positions. This imbalance suggests confidence in BNB’s upward potential.

Moreover, on a weekly basis, the disparity grows, with long positions reaching $64.98 million compared to $34.04 million in shorts. This growing bullish sentiment has provided BNB with solid momentum in the market. Support is found at the $580 level, marked by the rising trendline. Should bears attempt to drag the price lower, the $550 level offers secondary support. However, a break below this level would invalidate the current bullish scenario, making it crucial for investors to keep an eye on these key support zones.

Future Outlook

The positive technical signals and market sentiment indicate that further upside for BNB is likely in the short term. Market participants believe that if BNB can break through the $620 resistance, a rally toward $800 is on the horizon. If successful, BNB’s market capitalization could reach $116 billion, bringing it closer to Tether’s valuation. A breakout could also have a ripple effect on other investors and market participants.

However, failure to maintain current support levels could invalidate this bullish outlook. As such, investors should closely monitor price movements in the coming days. If BNB can break through resistance, the future potential for the coin looks bright. As always, it’s important for investors to conduct their own research, as the crypto market remains highly volatile.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!