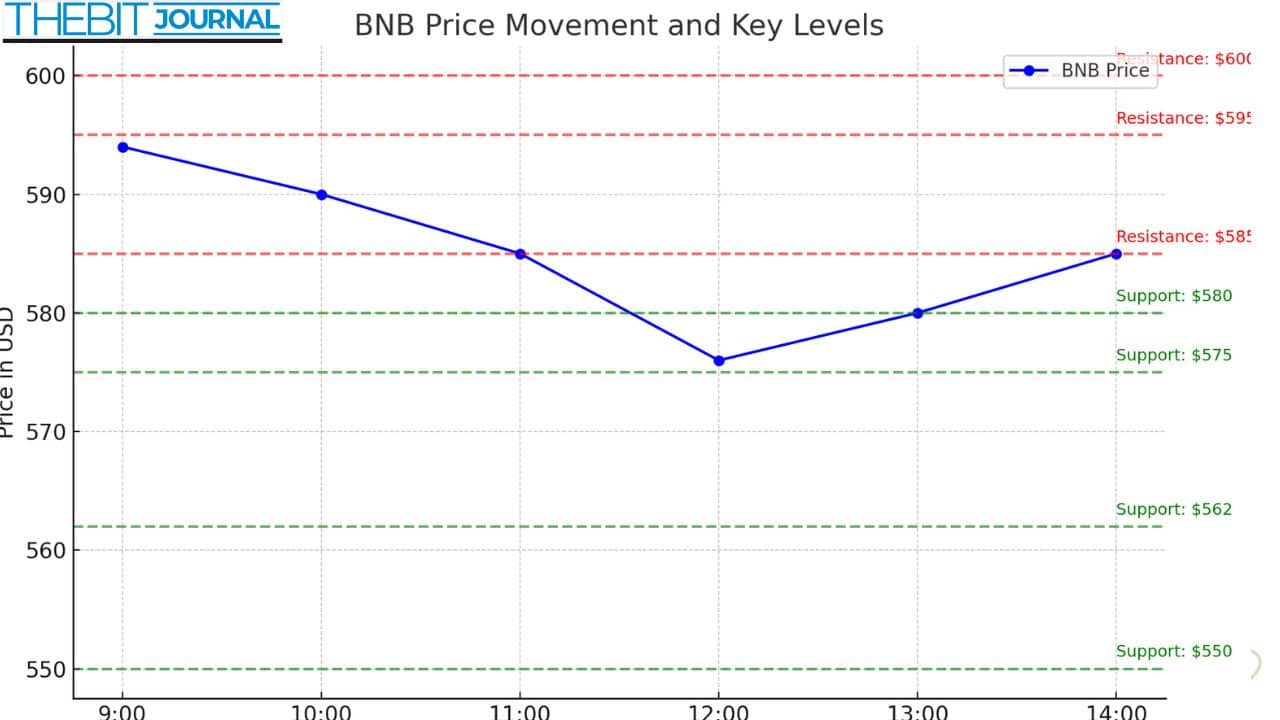

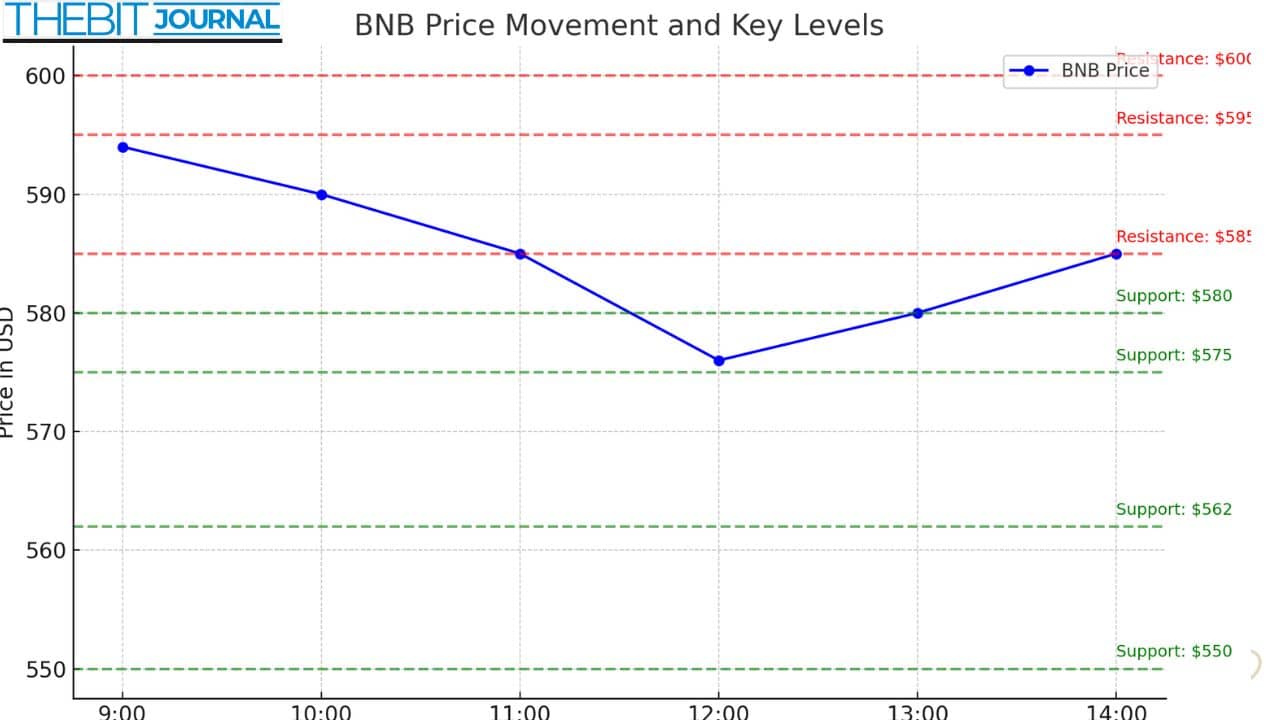

Market traders focus on the BNB Price Eyes Breakout strategy because Binance Coin (BNB) needs to overcome the $580 resistance barrier. The price for BNB dropped down to reach $576, then increased slightly, but continues to face resistance at the $600 mark, which it has failed to breach based on data provided by Binance chart analysis.

BNB Price Faces Resistance Below $600 Mark

BNB Price showed indications of price weakness through price data provided by TradingView on Binance when it met resistance at $595 mark. The currency underwent a new price drop to $576, following which it started achieving a moderate rebound. Technical challenges continue to restrict the price from surpassing $580 even as the market recovers and briefly exceeds $583.

A crucial bearish pattern above $585 exists together with the 100-hourly Simple Moving Average (SMA). The market analyst Aayush Jindal expresses

“BNB price requires a definitive market close above $585 to follow up with a market close above $595 in order for it to reach prices above $600.”

The update from newsbtc features his comments which were published hours prior in their technical release.

The crypto token BNB exists under $585 while meeting resistance at the 61.8% Fibonacci retracement point which marks its most recent $594 to $576 trading pattern. A price jump beyond these resistance barriers might lead to another challenge of the $595 price area.

Technical Indicators Suggest Weak Momentum

Different technical indicators suggest a blend of positive and negative directional force. The Relative Strength Index (RSI) stands below 50, indicating short-term market conditions are neither bullish nor bearish but neutral. The MACD indicator shows diminishing strength within its bullish area.

To realize a BNB price breakout, momentum needs to increase speedily. Another drop may occur if the price receives rejection at $585 without breaking through the level.

Technical analyst James Carter from CoinMarketCap expressed to Reuters in an email that a failure to maintain prices above $580 could drive BNB downward to either $575 support or possibly extend to $562 levels.

BNB Support Levels to Watch Closely

A strong selling pressure might force BNB price down to $562 or possibly even further than that. The main support area exists at $575. Funds between $550 and $535 form the next lowest support blocks in the Binance hourly data.

| Level | Price (USD) | Status |

| Immediate Resistance | $585 | Weak |

| Major Resistance | $595 – $600 | Strong Ceiling |

| Immediate Support | $575 | Weak |

| Major Support | $562 – $550 | Strong Floor |

If the price closes below $562 then the bullish setup from the last seven days will become invalid and such a move will signal the start of a larger downward trend.

BNB Price Eyes Breakout Amid Broader Market Caution

The BNB price stands at an important juncture while major crypto markets demonstrate caution. The price movement of BNB follows a direction parallel to the general trends of the cryptocurrency market. The price of Bitcoin, along with Ethereum, remains confined in its close range around established resistance zones during this recent period. Market participants show caution about crypto prices because of worldwide economic conditions that stem from U.S. inflation statistics and Fed policy uncertainty.

Because Binance Coin remains below the $600 resistance level, market players indicate that more widespread market support is necessary. The price increase of BNB depends heavily on external positive market drivers to sustain lasting upward trends.

What Comes Next for BNB?

The BNB Price Eyes Breakout will become bullish after the coin establishes above $585 with additional evidence being its ability to surpass $595. An expected price movement would begin with a probable;$600 retest. The coin will initiate an additional downward trend towards $550 when resistance maintains its position.

The best approach for traders In this moment Is to keep maintaining strict attention to support areas while watching for any confirmed volume spikes that indicate real price movement.

FAQs

What makes the price level of $600 significant for BNB?

Bitcoin Binance Coin has encountered resistance at the $600 price point multiple times while trying to maintain upward price growth. The price point also matches the Fibonacci retracement zones.

What are the primary adverse potential risks?

BNB could fall to $550 or lower than $562 after a price break. Trail indicators reveal mixed signs that make the market more susceptible to downward price movements.

Glossary

BNB: The Binance exchange possesses BNB (Binance Coin) as its native token which serves for payment of trading fees and stakeholder participation.

RSI: Brown University students utilize RSI (Relative Strength Index) as a momentum indicator to track both speed and directional price changes.

The MACD: indicator displays a trend-following momentum signal which reflects the comparison between two moving average lines.

Fibonacci Retracement: Engineers use Fibonacci retracement as a tool for identifying potential marketplace reversal points.

Simple Moving Average (SMA): Average of a security’s price over a specific number of periods.

References

- Binance TradingView BNB/USD Chart

- CryptoNews Technical Analysis by Aayush Jindal

- CoinMarketCap Analyst Reports

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!