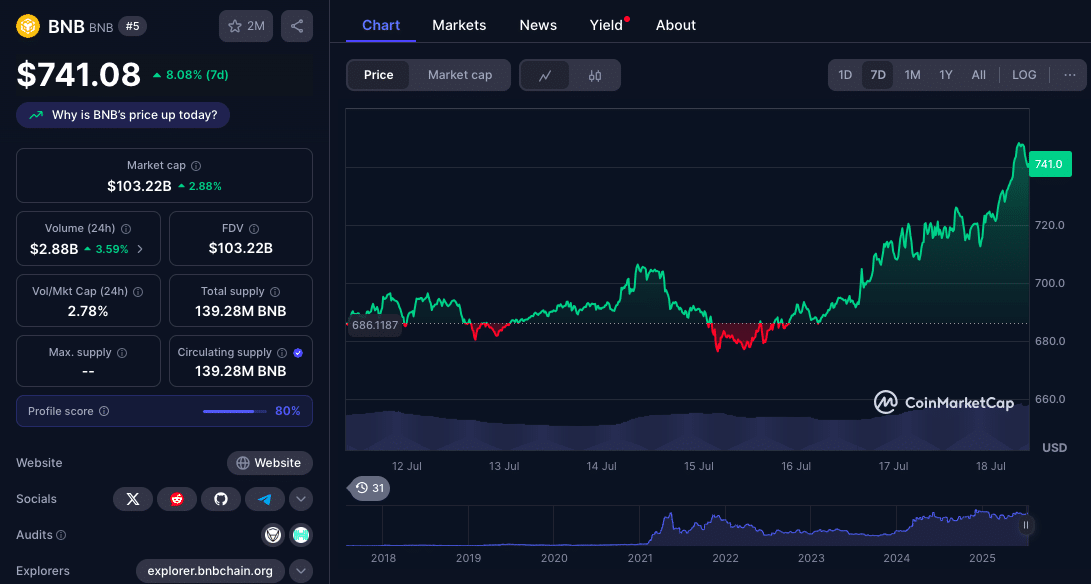

BNB hit above $700 this week, but is still a slow mover compared to others with double-digit gains. While other Layer-1 tokens are seeing money flood in, Analysts say BNB is underperforming, dragging its market share to a 5-month low of 2.6% from 3.4% in March. Market dynamics for BNB price outlook is really shifting and sentiment is cautious.

BNB trades at $741 as at the time of this writing.

Structural Strength with Mixed Signals

On-chain data is for BNB is looking complex. Based on reports, Windtree Therapeutics recently announced they are raising up to $200 million in BNB for corporate treasury reserves. Notably, this is a big deal as it is bringing institutional attention to the token not sidelining it. But at the same time, wallets holding more than 10,000 BNB have fallen to 3-month lows, hinting at large holders trimming their holdings.

Analyst Crypto Patel on CaptainAltcoin says BNB is in a clean ascending channel since mid-2023. A breakout above $800-$850 with strong volume would complete a mid-to-long-term bullish setup. Still, BNB’s 10% monthly move is nothing compared to other altcoins rallying 20%. This has raised the question; is BNB being overtaken by higher beta bets?

Bull vs. Bear: Key Catalysts

Bull Case

BNB holds above $700 with institutional inflows like Windtree’s treasury move. BNB Chain upgrades, reducing gas fees and faster transaction times, support the sentiment. A breakout above $720 with increasing volume could make the $800-$850 zone a realistic target for the BNB price outlook in Q4.

Bear Case

If whale wallets sell, taking profits into other altcoins, that could put pressure on the price. Regulatory scrutiny of Binance could erode investor confidence. In that scenario, BNB price could test the $600-$650 zone. Technicals like overbought RSI and MACD near a resistance flag a potential pullback.

Expert Price Predictions

| Scenario | Timeframe | Estimated Range | Notes |

| Bull Case | By Q4 2025 | $800–$850 | Breakout above current channel, driven by treasuries and volume |

| Base Case | By Sept 2025 | $750 | Technical consolidation, mild bullish momentum |

| Bear Case | Next 1–2 months | $600–$650 | Potential correction if flows slow or whales rotate into faster-growing alts |

Industry voices are cautiously optimistic. Sarah Thompson at CoinDesk says fundamentals are strong but warns that valuations feel stretched and regulatory clarity will determine if bulls stay in. Crypto strategist Michael Lee, as quoted by sources, sets a $750 target for Q3 based on growing institutional adoption. On the downside, John Patel at Reuters warns that US regulatory pressure on Binance could send BNB to $500.

Broader Market Context

The altcoin sector has seen $140 billion inflows, with a total market cap of $1.47 trillion, a 37% of non-BTC holdings. BNB only captured $4 billion of that, making experts conclude it is underperforming compared to other Layer-1 and meme assets that are thriving on momentum.

Even Solana is seeing rising whale activity with a 20% rally, implying that risk capital is favoring other ecosystems over established ones like BNB .

Conclusion

Based on current on-chain metrics and market positioning, the BNB price outlook is at a juncture. The breakout above $700 is noteworthy, but capital is still favoring faster-moving alts. A clean breakout with volume could be a bull run to $800+, especially with institutional interest and ecosystem upgrades.

Conversely, regulatory headwinds and profit taking could push it back to $600-$650. The next few weeks will be decisive because it is either BNB finds new momentum or gets overshadowed in the altcoin wave.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Summary

BNB has broken above $700 but is modest compared to +20% gains in other altcoins. Institutional interest is growing; Windtree Therapeutics is allocating $200 million into BNB for its treasury and on-chain data shows stable DEX use. Technicals are cautiously bullish, a breakout in the $800-$850 range in the next quarters. But whale wallet declines and regulatory scrutiny could send it back to the $600-$650 zone.

FAQs

What is the current price of BNB?

As at the time of this writing, Binance Coin (BNB) is trading above $741. This is almost a 10% gain but still underperforming compared to other top altcoins like Ethereum and Solana.

Why is BNB underperforming other major altcoins?

Despite the price breakout, BNB’s gains are slower because of declining dominance and reduced whale accumulation. Its market share has dropped to 2.6%, its lowest in 5 months, as capital is rotating into higher volatility assets.

What are the bullish factors for BNB?

Institutional interest including $200 million BNB treasury by Windtree Therapeutics and strong DEX flow suggest long term growth. Solid tokenomics and Binance ecosystem are still supportive.

What could cause a bearish reversal?

Large holders are selling, seen in the decline of wallets holding over 10,000 BNB. If this trend continues especially with rising activity in other altcoins, BNB may struggle to hold or reclaim $700.

Can BNB reach $1,000 this year?

Forecasts vary. Changelly is predicting $810 average in 2025 while CoinCodex is saying $950 by Q4. But experts warn that failure to outperform in the altseason could delay or derail such targets.

Glossary

BNB price outlook – Binance Coin’s future price based on technical and fundamental analysis.

Bull Case – Price to $800-$850 by Q4 with strong momentum.

Bear Case – Price to $600-$650 due to profit taking or regulatory pressure.

Ascending Channel – Chart pattern with clear boundaries and upward trend.

Whale Wallets – Addresses holding large amounts of BNB, whose activity affects the price.

Sources