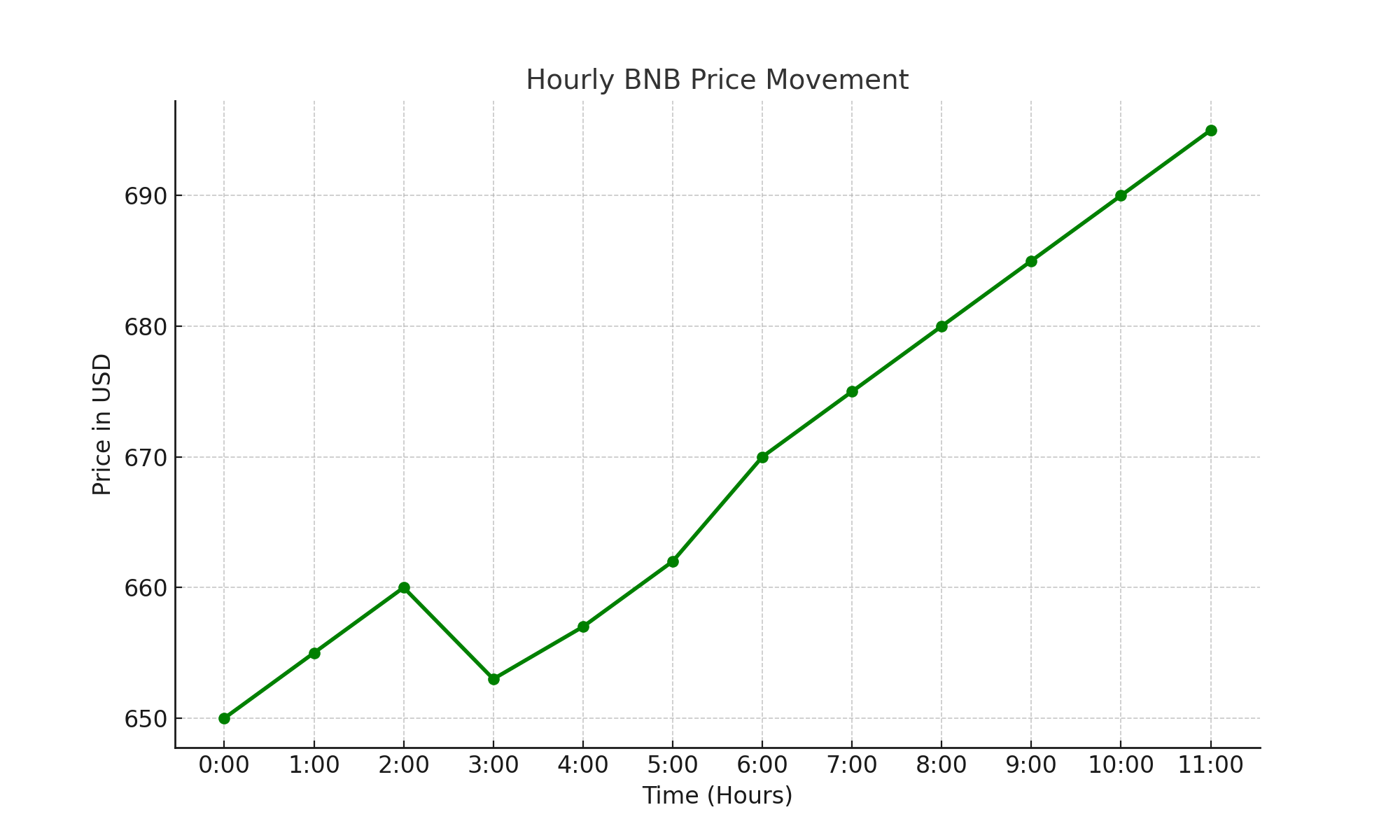

BNB price currently recovers from its $630 support area while displaying indication toward additional price gains. Traders wait expectantly as BNB gets near the resistance zones $655 and $660 with the goal of challenging the $680 resistance barrier before a possible price advance towards $700. BNB price development for the future will depend on its ability to sustain its current elevated position above $650 and prosper at that level.

Market participants monitor essential technical metrics along with price resistance levels to determine whether BNB will keep advancing or if it is set to reverse. The path of BNB price to a significant level remains the primary focus for market observers who require knowledge about forthcoming price changes.

BNB Price on the Rise: Eyes on the $655 Resistance

BNB price established a stable position above the $630 support zone and then surpassed both $635 and $640 resistance marks in its upward recovery. Bitcoin Binance Coin surpassed both Bitcoin and Ethereum in price elevation as it broke through the essential $650 mark.

Markets are watching the BNB price closely now that it reaches a crucial moment near the $655 resistance threshold. A major bearish trend line has developed, providing resistance at the $655 level within the BNB/USD hourly chart. Based on its performance against the $655 resistance level, the market will establish its next substantial directional shift.

“The BNB token trades at $660 or lower at this moment but faces resistance at $655. Price movement upward might extend to $680 after it surpasses $655 resistance”

Success in reclaiming prices above $650 level represents a key factor to sustain present market growth. A failure to surpass both $655 and $660 resistance levels would result in a price reversal that could drive BNB downward toward alternative support regions.

Potential Bullish Move: Testing the $680 Resistance

BNB has the opportunity to push beyond the $662 resistance point because this level corresponds to the 61.8% Fibonacci retracement of its downward action from $682 to $630. Price movement for BNB could try to examine the $680 resistance for determining the fate of continued upward expansion beyond current levels.

The BNB price will experience a significant upward move after breaking above $680 while $700 establishes itself as the subsequent important resistance threshold. Market observers are carefully analyzing the $662 price point to determine if it will activate new upward market progress. The BNB price could aim for $700 or more if the vital market control point at this level gets cleared successfully.

The Price Continues Declining If It Drops Below $650

There remains a risk that BNB will not succeed in surpassing the $662 milestone as the market shows rising prices. The market potentially returns to decline after a downward move, but its first support point lies at $650. The prospect of price stability depends on not falling beneath $650 because such a move would potentially trigger additional downward pressure.

The primary support rests at $642 beneath $650 while an additional support exists at $630. The price support areas at these levels serve as crucial barriers to sustain BNB’s positive market direction. A breakdown below $630 in BNB price could trigger a more extensive price drop whose lowest possible levels extend to $612 then $600.

“BNB must maintain its position above $650 support because this figure determines the continuation of its upward movement. The price is likely to suffer major declines if the level of $630 gets breached”

The current price rally will receive close monitoring from traders who watch both hourly MACD and Relative Strength Index (RSI) indicators to determine if an upward momentum persists or downward pressure sets in.

What to Expect: The Key Levels to Watch

The upcoming price levels serve as markets watch for BNB where participants use multiple technical indicators to validate future direction.

| Level | Description |

| $655 Resistance | First important resistance level stands as a crucial test point for upward movement assessment. |

| $662 Resistance | GBN trading above this threshold may push the BNB price to reach $680. |

| $680 Resistance | The price might rise toward $700 if traders successfully break through this essential resistance level. |

| $650 Support | The main level of support exists to preserve upward market tendencies. |

| $642 Support | The price would show additional decreases if the secondary support level gets crossed. |

| $630 Support | The current support holds significant value but a breach could trigger risk to fall between $612 and $600. |

The current market consolidation demands BNB to break through these key levels to establish its next direction as either sustained upward momentum or downward correction.

Conclusion

The value of BNB will define upcoming movement by testing the keys at $655 and $662. After breaking past $662, BNB may successfully challenge the $680 barrier on its way towards achieving $700. A pullback may occur for BNB if the price fails to surpass these essential levels, while support will exist at designated areas, including $650, $642, and $630.

Future price movements of BNB need close monitoring because these identified levels will determine if BNB’s price will continue upward or reverse direction. The forthcoming days will spell out what direction BNB will take for its next substantial price change. Keep following The Bit Journal and keep an eye on BNB price

FAQs

The upcoming major resistance area for BNB can be identified at which value?

BNB requires two important levels of resistance at $662 before reaching $680.

would the situation become negative if BNB price dips below the $630 support level?

A drop below $630 in BNB price would create potential for more decreases toward $612 until a potential stop at $600.

What technical indicators should I monitor for BNB?

Somber indicators present two key components to understand how prices behave and direction of trends which include the hourly MACD alongside RSI and Fibonacci retracement levels.

Can BNB break above $680?

BNB’s potential for reaching $680 requires it to rise above $662 first and successfully surpass that point could push the price to $700.

The essential support mark that BNB needs to maintain its value is at which level?

BNB has two principal support zones at $650 and $630.

Glossary of Key Terms

Support: A price support represents the lowest point where asset buyers step in and establish purchase interest to stop market deterioration.

Resistance: This market stage represents a strong area of selling pressure which hinders any further uptrend in prices.

The technical indicator MACD: evaluates patterns between converging and diverging moving average data for revealing trend shifts regarding their strength direction momentum and length.

The RSI (Relative Strength Index): functions as a momentum oscillator which evaluates the pace along with the modifications of price fluctuations.

References

- Aayush Jindal. (2025, February 10). BNB Price Approaches a Key Level—Can It Clear the Hurdle?

- CoinDesk. (2025, February 10). Crypto Technical Analysis of BNB Price Movement.

- Binance Research. (2025). Market Trends and Analysis for BNB/USD Pair.

- IntoTheBlock. (2025). BNB Price Movements and Technical Indicators Analysis.

- Bitcoin Magazine. (2025). Margin Calls and Market Reactions.

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!