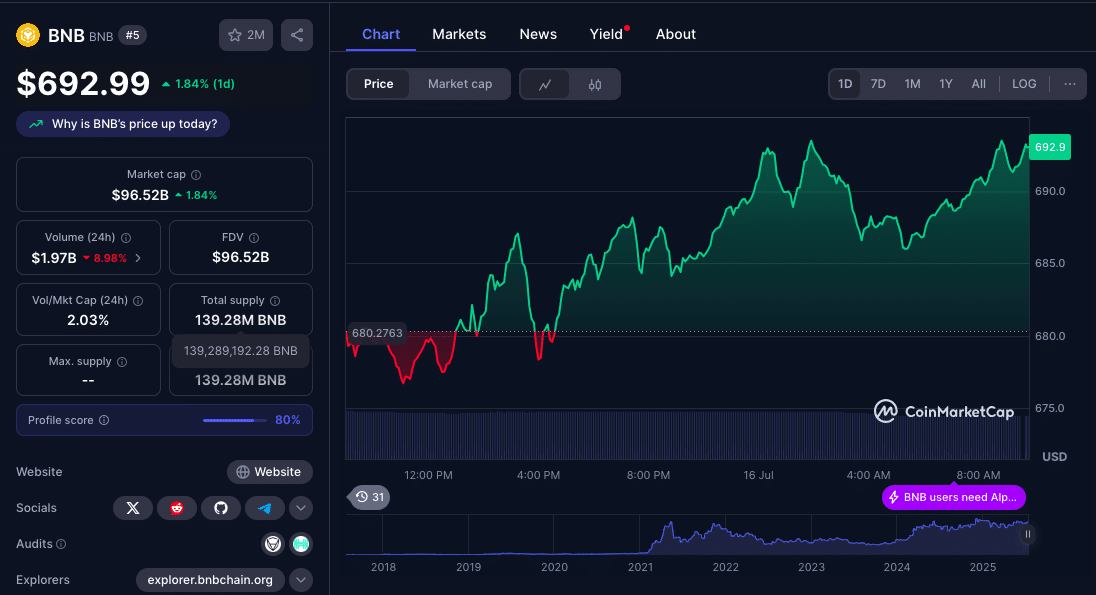

BNB price is trying to recover after being rejected at $708. It held $674 but is now facing pressure at $692 zone. As other altcoins like Solana and Avalanche are rising, BNB’s price action seems to be lagging behind in the bullish momentum.

At the time of writing, BNB is trading at $692.99 and 100-hour SMA, with a bearish trend line forming at $692 on the hourly chart, based on market data. Analysts say without a strong move above $695, BNB could enter another correction phase.

Technical Indicators Show Short-Term Neutral to Bearish

After failing to break $710, BNB started to correct and went below $680 before retracing. The bounce lifted the coin above 50% Fibonacci retracement from $707 high to $674 low but the price is now attempting to recover.

Hourly RSI is below 50 and MACD is decreasing. A key resistance is at $692 and further resistance is at $695 which is also 61.8% Fib retracement. If BNB can break these zones, a retest of $708 is likely and then $720 and $732.

But if BNB fails to reclaim $693, the price could go back to $680 or $674. A break below that will accelerate the decline to $665 and possibly $650, invalidating the short-term bullish thesis.

Forecast Table: Bullish and Bearish Price Paths

| Scenario | Target Price | Probability | Trigger Conditions |

| Bullish Continuation | $708 – $720 | Moderate | Breakout above $695 with volume |

| Sideways Range | $674–$692 | High | Stagnant momentum, low volatility |

| Bearish Breakdown | $665 → $650 | Moderate | Drop below $674, weak buyer interest |

Expert Forecasts: Mixed Signals for BNB Price Action

According to CoinCodex experts, it is predicted that the BNB price will reach $735 in 30 days if it breaks above $695 and sustains. But WalletInvestor is more conservative and has BNB price at $710 by mid-August.

Changelly analysts say BNB price can go up to $780 by year-end if Binance resolves regulatory issues and Layer-2 integrations gain wider adoption. But if BNB Chain’s TVL continues to decline, bearish sentiment will dominate.

Binance Ecosystem Fundamentals Weigh on Price

Reports have divulged that one of the reasons BNB price analysis is cautious is Binance’s ongoing regulatory issues in Europe and North America. This has led investors to reduce their exposure, and the derivatives market confirms that.

Data from CoinGlass shows BNB open interest on Binance futures down 2.68% in the last 24 hours. Funding rates are neutral, meaning both bulls and bears are not convinced.

Network activity is also declining. According to DeFiLlama, TVL on BNB Chain is down 6% in the last 2 weeks despite the overall market is bullish.

Altcoins Rally as BNB Stalls

While BNB consolidates, altcoins like Solana and Avalanche are rallying, benefiting from institutional attention and retail interest. Some investors take it as BNB is underperforming, especially in DeFi and NFT flows.

Experts have aired that BNB is underperforming other L1s due to macro uncertainty around its parent exchange and a dip in developer activity. But this could reverse if sentiment improves and volume returns to BNB-backed protocols.

Conclusion

Based on the latest research BNB price analysis shows a standoff between bulls and bears. The $692–$695 resistance zone is the key to any meaningful recovery. If bulls can clear that, $708 to $720 is possible. But if rejected, the price could go back to $665 or lower.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform, which provides you with updated information about the state of the crypto world.

Summary

BNB price analysis shows it struggling to regain bullish momentum at $692. Indicators like RSI and MACD are weak. Technicals point to $708 or $650. Experts are divided, with targets from $710 to $735. Binance regulatory issues and BNB Chain TVL decline weigh on sentiment. Altcoins are outperforming, BNB needs a fundamental catalyst to regain strength. Experts should watch $692–$695 for near-term direction.

FAQs

What is the resistance for BNB?

$692 and $695. Breakout could be $708 or higher.

Where is the support for BNB?

$680 and $674. Below $674 could be $665 and $650.

What do experts say about BNB?

Analysts expect a short-term up to $735 if momentum improves. Others warn of a downside if Binance issues persist.

Is BNB underperforming other altcoins?

Experts think so, Solana and Avalanche have outperformed BNB recently.

What’s holding BNB back?

Regulatory issues, lower open interest and declining activity

Glossary

BNB (Binance Coin): native token of the Binance ecosystem.

Fibonacci Retracement: technical analysis tool for identifying potential support/resistance levels.

RSI (Relative Strength Index): measures the speed and change of price movements.

TVL (Total Value Locked): total amount of assets locked in a DeFi protocol or ecosystem.

Open Interest: The total number of open derivatives contracts in a market.