The BNB ecosystem is racing back into the spotlight, with on-chain activity recently reaching its highest point in three months. Binance Smart Chain is experiencing increased growth in BNB transactions, with over 14 million daily transactions and a monthly active user base that exceeds 33 million. This recent increase in utility is more than just data; it might be the catalyst for the next leg of BNB’s price climb.

Analysts believe BNB is poised for a strong breakout as BNB transactions volumes rise and smart contract usage increases. Institutional activity, strategic accumulation, and technical momentum are combining to make a potent mix, placing BNB in a solid position to surge beyond $1,200.

Institutional Accumulation Backs the Bullish Thesis

While ordinary traders continue to monitor market sentiment, institutional investors are secretly stockpiling BNB in big amounts. Several financial groups have allegedly added BNB stakes worth $90 million to $200 million in recent weeks. A financial analyst said, “Institutions are preparing for a multi-quarter altcoin cycle, and BNB remains one of the few large caps with deep liquidity and strong fundamentals.”

Furthermore, recent technological advancements to the BNB Chain have attracted significant investment. The network is presently processing up to 5,000 BNB transactions per second and aims to reach 20,000 TPS in the next quarters. This scalability is critical for handling increased DeFi, GameFi, and NFT volume without sacrificing performance or cost.

The end outcome is increased investor confidence. “BNB’s tech stack has matured, what we’re seeing now is the beginning of a new utility-driven cycle,” explained one blockchain expert.

Price Predictions: Is $1,200 the Next Logical Step?

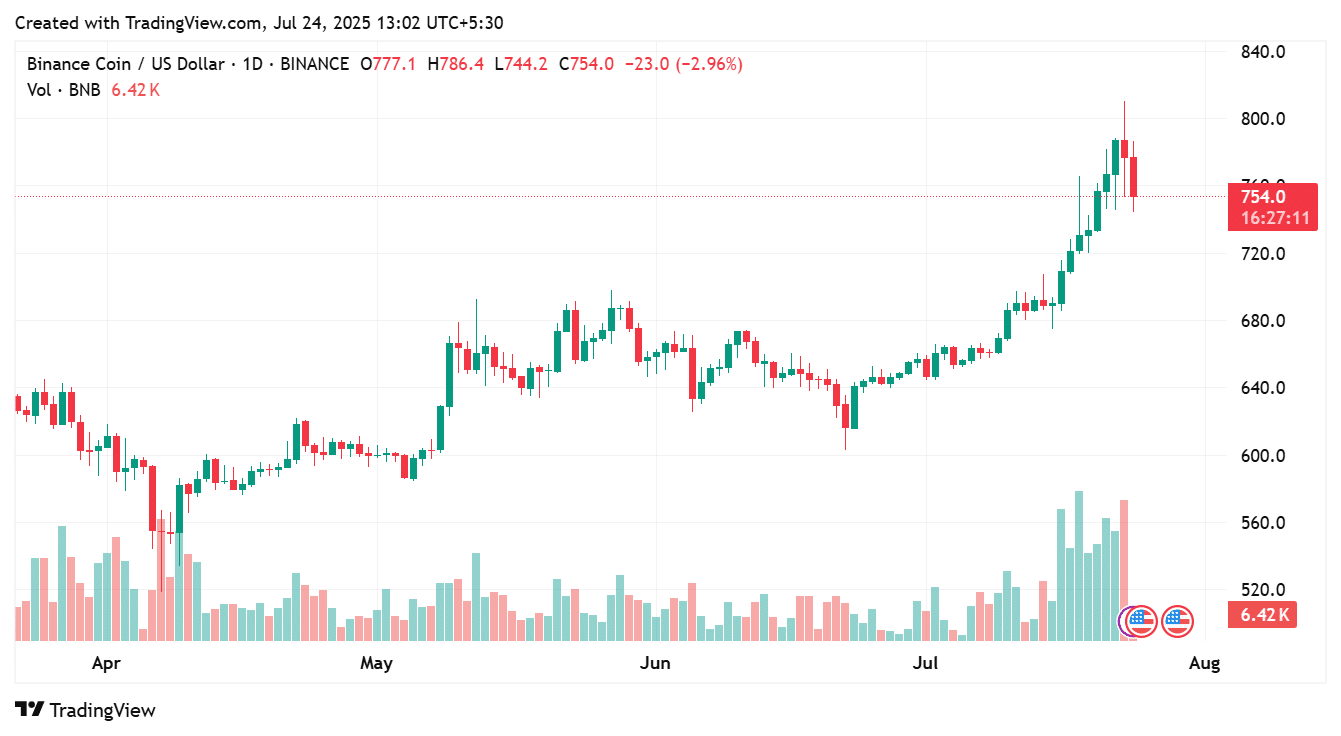

With technical signs aligning and utility measures improving, the BNB price forecast trend is optimistic. Analysts note that BNB just broke through major barrier around $800, aided by hefty BNB transactions fees and contract growth. If support remains at $768-$770, momentum might build to $900 in the following weeks.

The most bullish predictions call for a $1,000-$1,200 range by year-end, provided macroeconomic circumstances stay good. One well-known trader commented, “If BNB clears $815 with volume, it opens the door to $1,000 faster than most expect.”

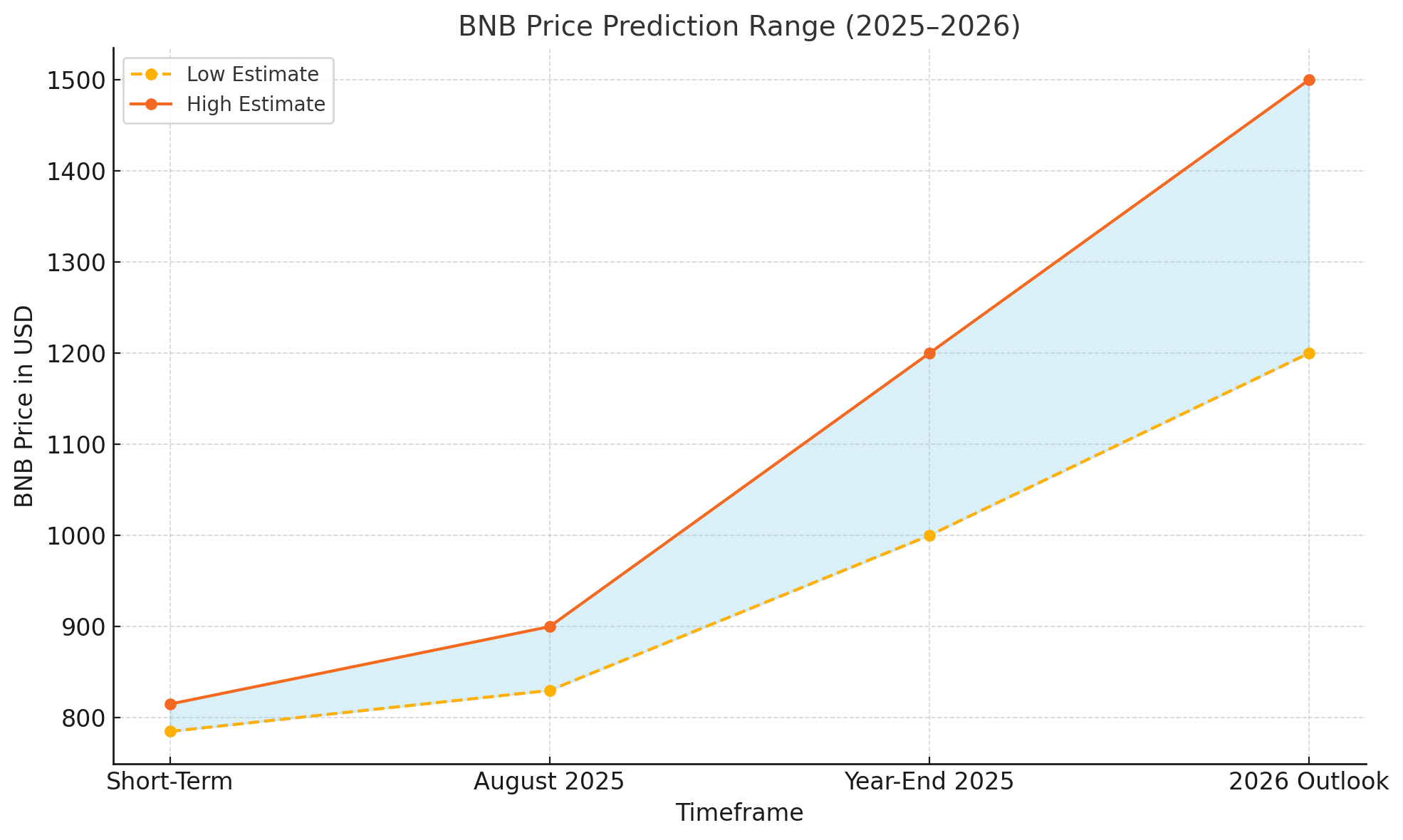

BNB Price Prediction Table

| Timeframe | Predicted Range |

|---|---|

| Short-Term (1–2 weeks) | $785 – $815 |

| August 2025 | $830 – $900 |

| Year-End 2025 | $1,000 – $1,200 |

| 2026 Outlook | $1,200 – $1,500+ |

Technicals and Market Context

According to technical indicators, BNB continues to trade above its 50-day and 100-day moving averages, signaling further bullish pressure. The daily RSI remains modest, allowing bulls additional room to surge.

At the macro level, investor interest in alternative assets is returning, particularly since US inflation forecasts are receding. This risk-on mood has spread to crypto, raising large-cap altcoins such as BNB while increasing ETF and DeFi interest.

In addition, there is a rising narrative that BNB is undervalued in terms of BNB transactions throughput and ecosystem adoption. With over $8.5 billion in Total Value Locked and more than 49% increase in verified smart contracts, the platform is displaying real-world activity to back up its claims.

What This Means for Investors and Traders

For long-term investors, the increase in BNB utility and institutional accumulation provides solid indication of future potential. Short-term traders should consider the present consolidation range of $768 to $815 as a significant decision zone. A breach above $815 on solid volume might spark a quick rise above $900.

At the same time, the growing Altcoin Season Index and good trading circumstances suggest BNB may profit from more sector rotation. “The next altcoin wave could be led by infrastructure coins like BNB,” one market watcher speculated.

Conclusion: The Utility Rally Has Just Begun

The recent jump in BNB transactions activity is more than a one-time blip; it represents a larger story of increasing acceptance, strategic backing, and optimistic pricing momentum. With utilities at its highest in months and institutions discreetly accumulating positions, the route to $1,000-$1,200 becomes more likely. For those paying careful attention, BNB might be spearheading the next wave of crypto industry development.

Also visit BNB to new ATH.

FAQs

Q1. Can BNB reach $1,200 by the end of 2025?

Yes, if current utility trends and institutional inflows continue, BNB could realistically hit $1,200 or more.

Q2. What is driving BNB’s growth right now?

Key drivers include increased on-chain activity, institutional accumulation, and tech upgrades on BNB Chain.

Q3. What’s the next price level to watch for BNB?

$815 is the critical resistance. A break above that could signal a rally toward $900.

Glossary

TPS: Transactions Per Second, measures blockchain speed.

TVL: Total Value Locked, gauges DeFi activity on a blockchain.

Resistance Level: A price point where selling typically increases.

Altcoin Season Index: Metric indicating capital flow into altcoins vs Bitcoin.