While the crypto market remains volatile, Cardano (ADA) has been in the spotlight after notable price drops in March. However, a prominent crypto analyst sees this pullback not as a warning sign—but as a setup for an explosive rally. According to the analyst, ADA could deliver up to 10x returns by 2025, sparking renewed interest among investors.

But is this bullish prediction backed by real data? Let’s dive into the technical patterns, on-chain metrics, and investor behavior that may shape ADA’s future.

Technical Patterns Flash Bullish: Is History Repeating?

The analyst highlights a potential inverse head and shoulders formation emerging on ADA’s long-term charts. Historically, this technical structure has preceded major rallies in crypto markets. Using logarithmic trend analysis, the expert projects a potential 153% increase in ADA dominance—a metric that could translate into a surge in price.

If this scenario plays out, ADA could first climb to $2.90, with a long-term upside target of $7.10. That’s nearly a 10x increase from current levels, assuming market conditions align favorably.

Search Interest Slipping: A Red Flag or Quiet Before the Storm?

Despite the optimistic outlook, data from Google Trends reveals a mixed picture. Search volume for terms like “Cardano price prediction” spiked earlier this year, particularly during brief price recoveries in January and March. However, that interest has dropped sharply toward the end of March.

This decline in online attention could indicate waning retail investor enthusiasm—an important factor to watch, especially when social sentiment often drives crypto market momentum.

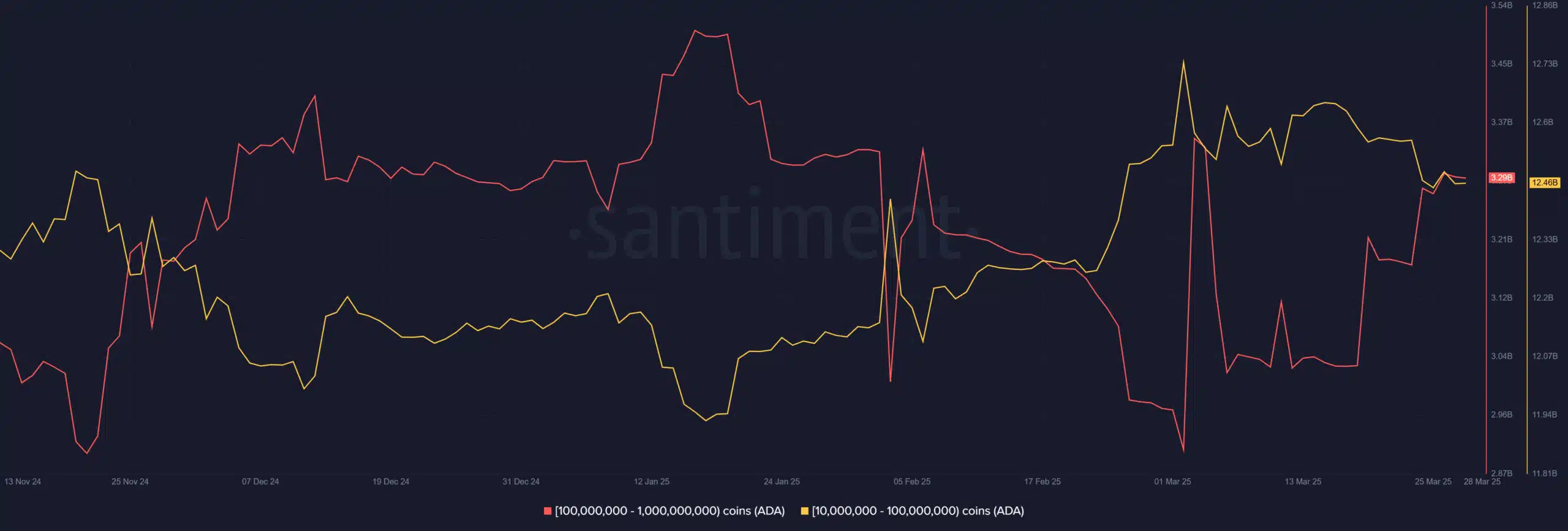

Whales Making Moves: Sell-Off Signals Caution

On-chain data suggests that major ADA holders—wallets containing between 10 million and 100 million ADA—have started reducing their positions. This group, which holds a combined 12.46 billion ADA, has trimmed down from 12.74 billion just weeks earlier.

This quiet sell-off by “whales” appears to correlate with the price dip observed in late March. Their behavior underscores how large wallet addresses can have a direct impact on price action, making whale tracking a critical tool for ADA investors.

ADA Range-Bound: Bitcoin’s Next Move Holds the Key

For now, ADA remains trapped in a tight range between $0.70 and $0.77, lacking clear direction. Analysts say ADA’s next big move will likely mirror Bitcoin’s trajectory. If BTC breaks upward, ADA could follow with a bullish breakout. But if Bitcoin falters, ADA might see further downside pressure.

Until then, ADA’s fate may rest in the hands of the broader market—and especially Bitcoin’s next breakout or breakdown.

Final Thoughts from The Bit Journal

While the 10x price target may sound ambitious, it isn’t entirely out of reach given crypto’s history of parabolic moves. That said, current market signals suggest caution. From whale movements to falling search interest, investors should weigh both technical signals and macro trends before jumping in. Stay tuned with The Bit Journal for more expert analysis and real-time crypto insights.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!