The cryptocurrency market is on edge today as $3.42 billion worth of Bitcoin and Ethereum options contracts are set to expire. With Bitcoin nearing its highly anticipated $100,000 milestone, this options expiry could drive significant short-term price movements. Both traders and investors are bracing for potential market turbulence.

Bitcoin and Ethereum Options Expiry: What to Expect

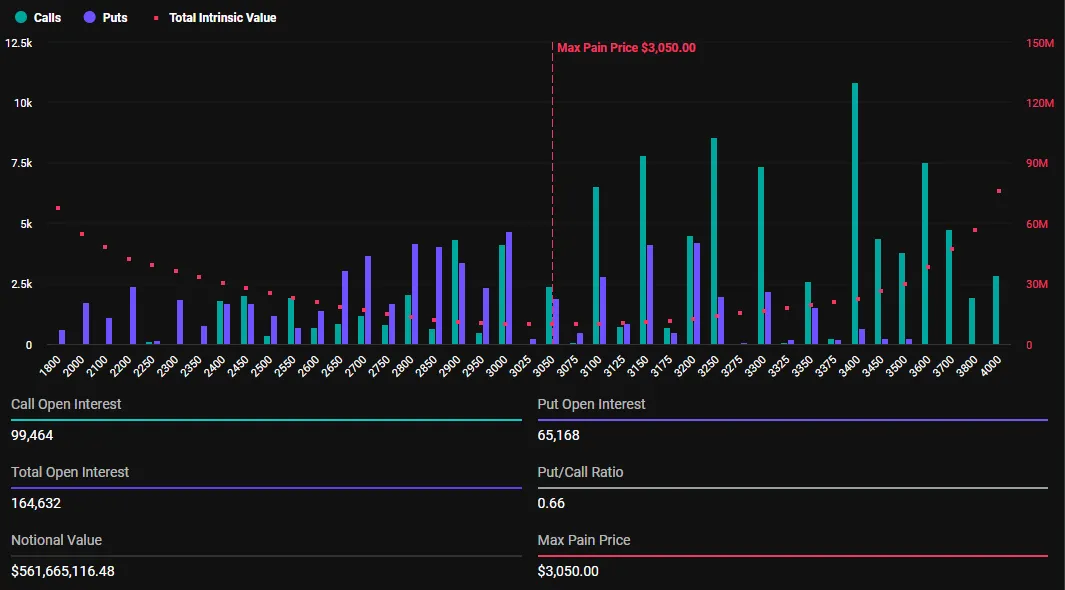

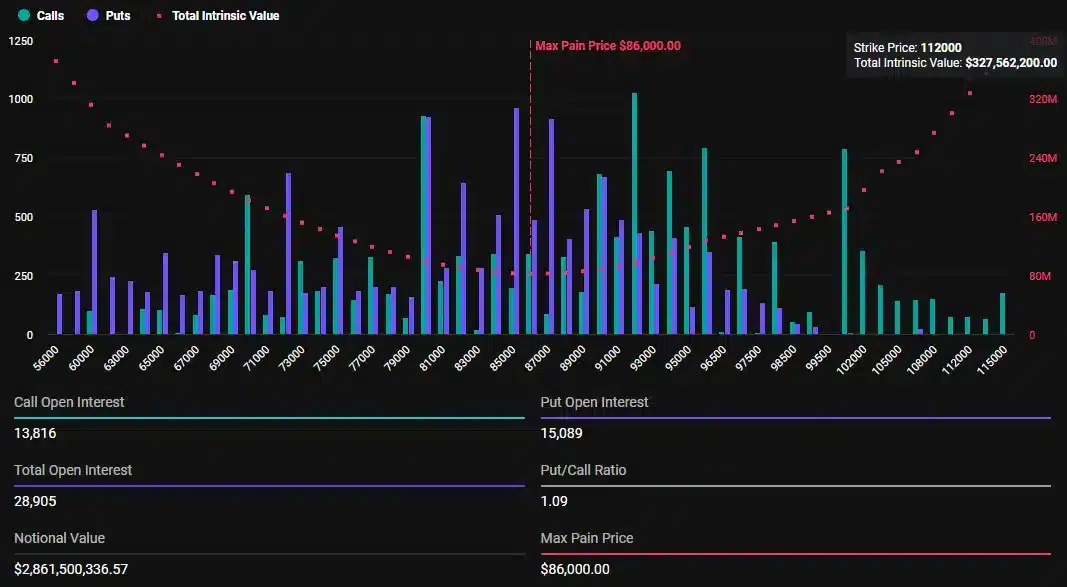

The crypto market is closely monitoring this critical options expiry. According to Deribit, 28,905 Bitcoin options contracts are set to expire, with a put/call ratio of 1.09 and a max pain point at $86,000. Similarly, 164,687 Ethereum contracts will also expire today, featuring a lower put/call ratio of 0.66 and a max pain level at $3,050.

The put/call ratio serves as a key indicator of market sentiment. Ratios above 1 suggest bearish sentiment, while values below 1 reflect bullish optimism. For Bitcoin, the higher put/call ratio implies a more pessimistic outlook, whereas Ethereum’s lower ratio signals growing confidence in its price potential.

Diverging Paths for Bitcoin and Ethereum

Traders seem to be betting against Bitcoin while remaining bullish on Ethereum. This sentiment aligns with market dynamics, where Bitcoin is showing signs of price correction, while Ethereum continues to gain momentum. Analysts suggest that Bitcoin’s price could be pressured towards its max pain level, while Ethereum’s bullish sentiment might push its price higher.

According to the Max Pain Theory, asset prices tend to gravitate toward the level where the highest number of options contracts expire worthless. This theory implies short-term price pressures for both Bitcoin and Ethereum, though these effects may dissipate after today’s expiry.

Market Sentiment and Volatility Trends

Analysts at Greeks.live note an increase in Ethereum’s implied volatility (IV), driven by the recent rally, while Bitcoin’s IV remains stable. This divergence highlights Ethereum’s growing appeal as a speculative asset compared to Bitcoin’s relatively stagnant market dynamics.

The positive sentiment surrounding Ethereum is further supported by strong institutional demand, as seen in the inflow of capital into ETF-related investments and robust spot market activity. Meanwhile, Bitcoin faces headwinds from potential corrections, though the broader crypto rally and institutional support, such as BlackRock’s IBIT options, provide some stability.

The Road Ahead for Investors

While Bitcoin may face near-term volatility, its long-term prospects remain tied to institutional adoption and macroeconomic factors. On the other hand, Ethereum appears well-positioned for continued growth, thanks to its strong market sentiment and lower put/call ratio. Investors in both cryptocurrencies should stay vigilant, as today’s expiry could bring unexpected opportunities and risks.

Stay tuned to The Bit Journal for the latest updates and insights into the cryptocurrency market.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!