The New York County District Attorney’s office has brought charges against Michael Lauchlan for allegedly running a fraudulent crypto recovery scheme. This case, underscoring the vulnerabilities within the rapidly growing crypto sector, has attracted significant attention from both the media and the crypto community.

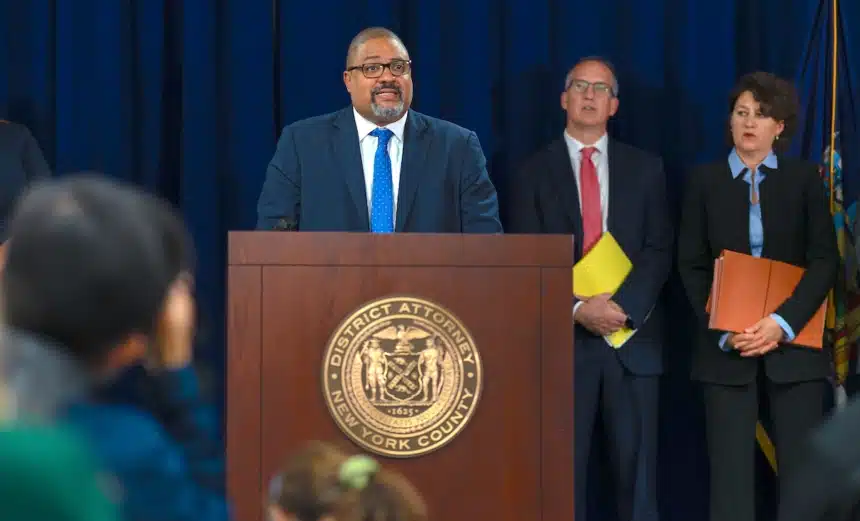

Manhattan District Attorney Alvin Bragg revealed the charges in an August 1 notice, stating that Lauchlan faces three counts of grand larceny and two counts of scheme to defraud due to the crypto recovery scheme. The charges stem from his alleged role in stealing from users of Coin Dispute Network, a platform purportedly designed to trace and recover lost crypto assets.

According to the DA, Coin Dispute Network was a “sham” that instead of providing the advertised recovery services, bilked customers out of fees and stole Ether (ETH) from at least three victims. The DA’s office reported that approximately $14,000 was seized from the operators of the fraudulent network.

Crypto Recovery Scheme: A Growing Concern in the Crypto World

The emergence of fraudulent crypto recovery scheme is not new, but the sophistication and audacity of operations like Coin Dispute Network are causing increased concern. The case against Lauchlan underscores the need for heightened vigilance and regulation in the industry.

“Cryptocurrency offers tremendous opportunities but also significant risks, particularly from bad actors who exploit the complexity and novelty of the technology to deceive investors,” said District Attorney Bragg. “This case should serve as a warning to those who seek to take advantage of the crypto community through fraudulent schemes.”

The Impact of Crypto Recovery Scheme on Victims

The alleged actions of Lauchlan and his associates have had a profound impact on the victims. One such victim, who preferred to remain anonymous, shared their experience: “I thought I had found a legitimate service that could help me recover my lost funds. Instead, I ended up losing even more money. It’s been a devastating experience.”

Experts in the crypto industry have long warned about the risks associated with unverified crypto recovery scheme services. “The decentralised nature of cryptocurrencies makes it extremely challenging to recover lost or stolen assets,” said Jane Doe, a cybersecurity analyst at a leading blockchain security firm. “Scammers prey on individuals’ desperation to reclaim their investments, offering false hope and, in many cases, further financial loss.”

Crypto Recovery Scheme: The Road to Recovery

While the DA’s office has taken significant steps by seizing funds and pressing charges, the path to recovery for the victims remains uncertain. Legal experts suggest that while some restitution may be possible through the seized funds, it is unlikely to cover the full extent of the losses incurred by all victims.

“In cases like these, asset recovery is complicated and often falls short of compensating all victims fully,” said John Smith, a legal expert in financial crimes. “However, the actions taken by the DA’s office are a crucial step in holding fraudsters accountable and deterring future scams.”

The case against Coin Dispute Network has reignited calls for stricter regulations in the cryptocurrency industry. Advocates argue that more robust oversight could prevent similar fraudulent schemes from taking root.

“Regulation is essential to protect investors and maintain the integrity of the market,” said Mary Johnson, a cryptocurrency regulation advocate. “Without it, we will continue to see bad actors exploit the system and harm individuals.”

The charges against Michael Lauchlan and the seizure of funds from Coin Dispute Network serve as a stark reminder of the risks inherent in the cryptocurrency market. As authorities work to bring justice to the victims, the crypto community must remain vigilant and push for greater regulatory safeguards.

For those navigating the complex world of crypto recovery investments, this case underscores the importance of conducting thorough due diligence and being wary of offers that seem too good to be true. The journey to a more secure and transparent crypto market continues, with each step forward marked by the lessons learned from cases like this. By shedding light on these fraudulent schemes, we can better protect investors and build a more secure future for cryptocurrency enthusiasts worldwide. Stay glued to The BIT Journal for minute-by-minute updates.