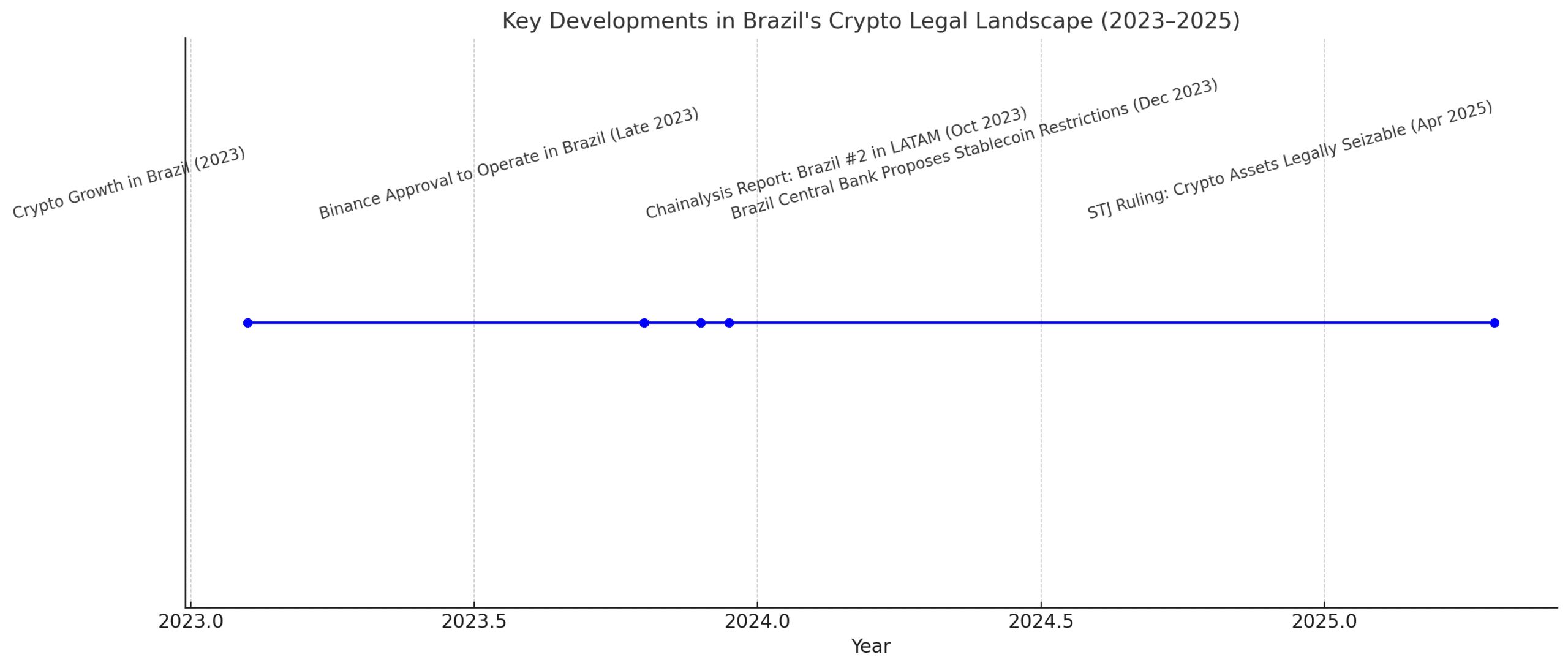

Brazil’s Superior Court of Justice (STJ) has authorized judges to seize cryptocurrency assets from debtors to settle outstanding obligations. This unanimous ruling by the STJ’s Third Panel marks a significant shift in the legal treatment of digital currencies within Brazil’s financial and judicial systems.

Cryptocurrencies Recognized as Seizable Assets

Traditionally, Brazilian courts had the authority to freeze and confiscate funds from traditional bank accounts to satisfy creditors. This new ruling extends that authority to include cryptocurrencies, allowing judges to directly notify cryptocurrency exchanges to seize a debtor’s digital assets without prior notice. The court emphasized that while cryptocurrencies are not recognized as legal tender, they function effectively as means of payment and stores of value.

Implications for Debtors and Creditors

For creditors, this development provides a robust mechanism to recover debts from individuals who hold assets in digital currencies. Debtors must now be aware that their cryptocurrency holdings are no longer beyond the reach of legal enforcement. This ruling underscores the necessity for debtors to manage their digital assets with the same diligence as traditional assets, given their newfound susceptibility to legal claims.

Brazil’s Transforming Cryptocurrency Landscape

Despite the absence of comprehensive regulations governing cryptocurrencies, Brazil has emerged as a significant player in the digital asset arena. An October report by Chainalysis highlighted Brazil as ranking second in Latin America for total crypto value received, indicating substantial adoption and utilization. Furthermore, major cryptocurrency exchanges, such as Binance, have secured approval to operate within the country, reflecting growing institutional interest.

However, regulatory developments have been mixed. In December, Brazil’s central bank proposed restrictions on stablecoin transactions via self-custodial wallets, raising concerns among users who rely on these assets to hedge against currency devaluation. Industry experts have pointed out the challenges in enforcing such bans, especially given the decentralized nature of many cryptocurrency platforms.

Summing Up

The STJ’s decision marks a significant step toward integrating digital assets into the Brazilian legal framework. As the country continues to grapple with the complexities of cryptocurrency regulation, this ruling may serve as a precedent for future legislative and judicial actions. Stakeholders, including financial analysts, blockchain developers, and crypto enthusiasts, should closely monitor these developments, as they will undoubtedly shape the trajectory of digital asset utilization and regulation in Brazil.

Frequently Asked Questions

1. Can Brazilian courts now seize cryptocurrency assets to settle debts?

Yes, following a recent ruling by Brazil’s Superior Court of Justice, judges are authorized to seize cryptocurrency assets from debtors to satisfy outstanding obligations.

2. Are cryptocurrencies considered legal tender in Brazil?

No, cryptocurrencies are not recognized as legal tender in Brazil. However, they are acknowledged as valid means of payment and stores of value.

3. How does this ruling affect creditors and debtors?

Creditors now have a legal avenue to claim cryptocurrency assets from debtors, while debtors must be aware that their digital assets can be legally seized to settle debts.

4. What is the current state of cryptocurrency regulation in Brazil?

Brazil lacks comprehensive cryptocurrency regulations, but the recent court ruling and increasing adoption indicate a move toward integrating digital assets into the legal and financial systems.

Glossary of Terms

Cryptocurrency: A digital or virtual currency that uses cryptography for security and operates independently of a central authority.

Legal Tender: Official money that must be accepted if offered in payment of a debt.

Stablecoin: A type of cryptocurrency that is pegged to a stable asset, such as a fiat currency, to minimize price volatility.

Self-Custodial Wallet: A digital wallet that allows users to retain control of their private keys and, consequently, their cryptocurrency assets.

Decentralized Platform: A system that operates on a distributed network, removing the need for a central authority or intermediary.