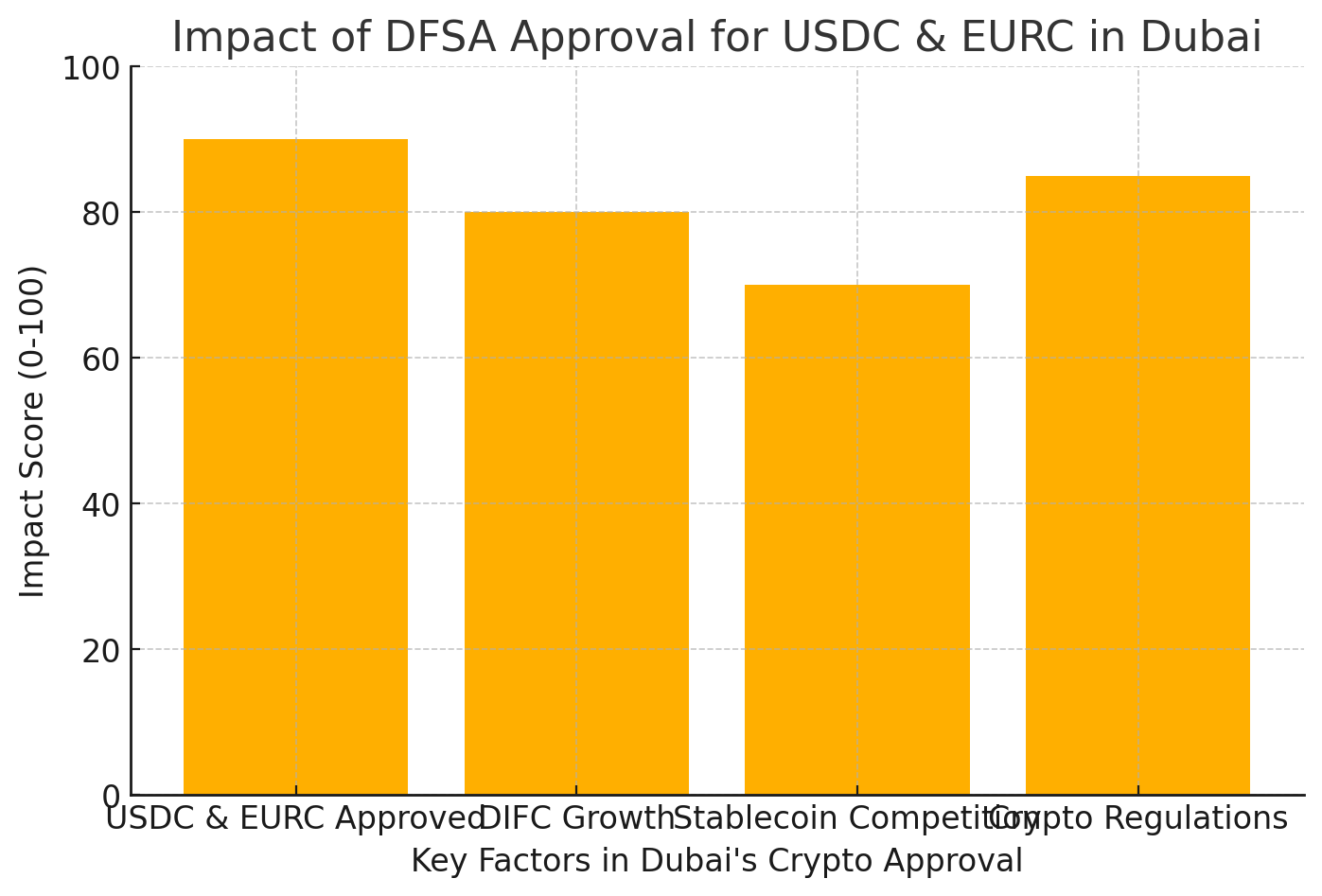

As per the news, Circle’s USD Coin (USDC) and Euro Coin (EURC) have been officially recognized by the Dubai Financial Services Authority (DFSA) as the first stablecoins approved under the Dubai International Financial Centre’s (DIFC) crypto token regime. This approval, announced on February 24, 2025, signifies a pivotal advancement in integrating digital currencies within Dubai’s financial ecosystem.

Paving the Way for Digital Finance in the DIFC

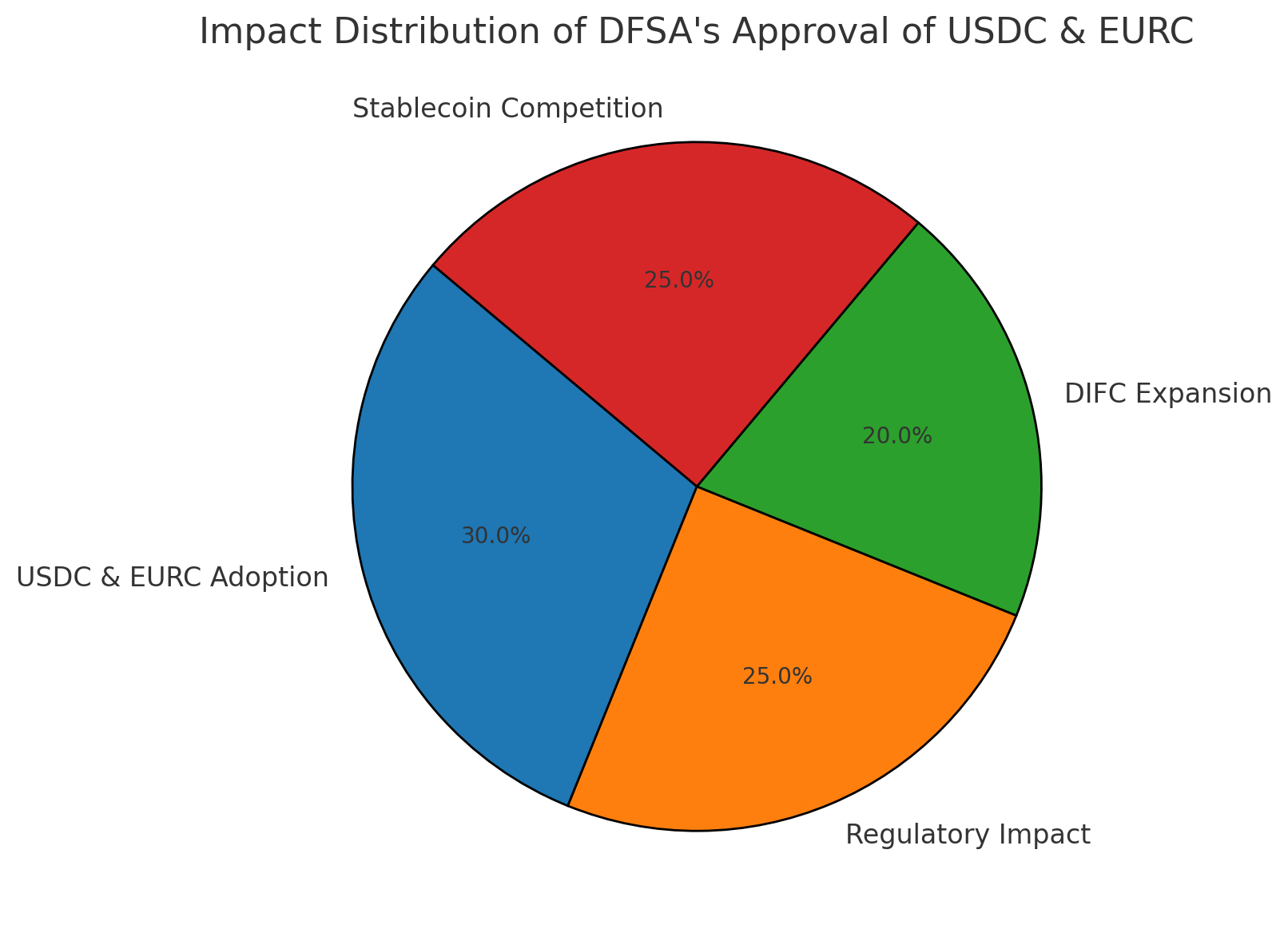

The DIFC, established in 2004, serves as a prominent financial hub connecting markets across the Middle East, Africa, and South Asia. With nearly 7,000 active companies, the center has been instrumental in fostering financial innovation. The DFSA’s recognition of USDC and EURC enables these entities to seamlessly incorporate these stablecoins into various financial operations, including payments, treasury management, and broader digital asset services. This move is poised to enhance transactional efficiency and promote the adoption of digital currencies within the region.

Dante Disparte, Circle’s Chief Strategy Officer and Head of Global Policy and Operations, emphasized the significance of this milestone:

“The DFSA’s approval of USDC and EURC as recognized crypto tokens within the DIFC is yet another validation of our constructive approach to regulatory and policy engagement.”

He further stated,

“As the first stablecoins to receive this designation, USDC and EURC continue to set the global standard for transparency, compliance, and utility.”

This approval aligns with Circle’s mission to make digital dollars and euros more accessible and interoperable for businesses and financial institutions worldwide.

Strengthening Dubai’s Position as a Crypto-Friendly Jurisdiction

Dubai’s strategic approach to cryptocurrency regulation has been pivotal in attracting global fintech companies. The DFSA’s comprehensive framework for crypto tokens ensures that only recognized tokens are permitted for use and promotion within the DIFC, providing legal certainty and fostering a secure environment for digital asset operations. This regulatory clarity bolsters investor confidence and positions Dubai as a forward-thinking jurisdiction in the global crypto landscape.

The UAE’s commitment to embracing digital finance is further exemplified by the Central Bank of the UAE’s (CBUAE) proactive measures. On October 14, 2024, the CBUAE granted in-principle approval for the AED Stablecoin, the first fully regulated dirham-pegged stablecoin under the country’s Payment Token Service Regulation framework. This initiative aims to integrate digital currencies within the UAE’s broader digital economy strategy, enhancing the nation’s financial infrastructure.

Global Implications and Competitive Dynamics

Circle’s achievement in Dubai complements its regulatory successes in other regions. The company has distinguished itself as the first major global stablecoin issuer to comply with the European Union’s Markets in Crypto-Assets (MiCA) regulations and Canada’s new listing rules. These accomplishments underscore Circle’s dedication to adhering to stringent regulatory standards, thereby fostering trust and facilitating the global adoption of its stablecoins.

The approval of USDC and EURC in Dubai also intensifies the competitive landscape among stablecoin issuers. Tether, for instance, has been expanding its footprint in the region, announcing plans in August 2024 to introduce a dirham-pegged stablecoin in collaboration with local entities. Paolo Ardoino, Tether’s CEO, highlighted the strategic importance of this move:

“The main purpose is actually creating an optionality towards the U.S. dollar.” He added, “We see a lot of interest in holding AED outside of the UAE.”

This competitive dynamic reflects the UAE’s burgeoning role as a nexus for digital asset innovation, offering a conducive environment for both established and emerging players in the cryptocurrency sector.

Conclusion

The DFSA’s recognition of USDC and EURC as the first approved stablecoins within the DIFC marks a significant milestone in Dubai’s journey toward becoming a global leader in digital finance. This development not only enhances the utility of digital currencies in the region but also sets a precedent for other jurisdictions aiming to integrate cryptocurrencies into their financial systems. As Dubai continues to implement progressive regulations and foster innovation, it is well-positioned to shape the future trajectory of the global digital economy.

Stay tuned to The BIT Journal and watch Crypto’s updates.

FAQs

1. What does Dubai’s approval of USDC and EURC mean for crypto adoption?

Dubai’s approval of USDC and EURC under the DFSA’s crypto token regime allows these stablecoins to be legally used within the Dubai International Financial Centre (DIFC). This move enhances regulatory clarity and encourages broader adoption of digital currencies in the region.

2. Why is Circle’s USDC and EURC recognition in Dubai significant?

This marks the first time Dubai’s financial regulators have legally recognized stablecoins, reinforcing the UAE’s position as a crypto-friendly jurisdiction and boosting confidence in regulated digital assets.

3. How does this approval impact businesses and financial institutions?

Businesses operating in the DIFC can now integrate USDC and EURC for transactions, payments, and treasury management, facilitating smoother cross-border settlements and digital finance services.

4. How does Dubai’s crypto regulatory framework compare to other regions?

Dubai’s DFSA framework is among the most structured and progressive, offering clear regulations for crypto assets. It aligns with global standards, similar to Europe’s MiCA regulations and Canada’s crypto asset rules.

5. What does this mean for competitors like Tether (USDT)?

Tether is also expanding its presence in the UAE, recently announcing plans for a dirham-pegged stablecoin. The competition between stablecoin issuers is expected to intensify as Dubai solidifies its role as a global crypto hub.

Glossary of Key Terms

Stablecoin – A type of cryptocurrency that is pegged to a stable asset, like the US dollar or the euro, to minimize price volatility.

USDC (USD Coin) – A regulated stablecoin issued by Circle, pegged 1:1 to the US dollar.

EURC (Euro Coin) – A stablecoin issued by Circle, pegged 1:1 to the euro.

DFSA (Dubai Financial Services Authority) – The regulatory body overseeing financial activities within the DIFC.

DIFC (Dubai International Financial Centre) – A major financial hub in Dubai that connects markets across the Middle East, Africa, and South Asia.

MiCA (Markets in Crypto-Assets Regulation) – The European Union’s regulatory framework for crypto assets, ensuring compliance and consumer protection.

CBDC (Central Bank Digital Currency) – A digital version of a country’s fiat currency issued and regulated by its central bank.

Tether (USDT) – A leading stablecoin pegged to the US dollar, issued by Tether Limited.

Regulatory Approval – The official authorization given by financial authorities for the legal use of an asset or service within a specific jurisdiction.