As per the source, Nasdaq has filed for approval from the U.S. Securities and Exchange Commission (SEC) to introduce an exchange-traded fund (ETF) that offers investors exposure to a diversified basket of digital assets. This initiative aims to provide a regulated avenue for both retail and institutional investors to engage with multiple cryptocurrencies through a single investment vehicle.

The Nasdaq Crypto Index (NCI): A Benchmark for Digital Assets

To support this ETF, Nasdaq has co-developed the Nasdaq Crypto Index (NCI) in partnership with Hashdex, a prominent global crypto-focused asset manager. The NCI is designed to reflect the performance of a broad spectrum of the cryptocurrency market, ensuring that only assets meeting stringent liquidity, market capitalization, and custody standards are included. As of February 20, 2025, the NCI’s composition includes:

- Bitcoin (BTC): 74.71%

- Ethereum (ETH): 11.73%

- Ripple (XRP): 6.59%

- Solana (SOL): 4.24%

- Cardano (ADA): 1.37%

- Litecoin (LTC): 0.48%

- Chainlink (LINK): 0.45%

- Avalanche (AVAX): 0.25%

- Uniswap (UNI): 0.19%

This diversified approach aims to mitigate the volatility associated with individual cryptocurrencies by providing balanced exposure across multiple digital assets.

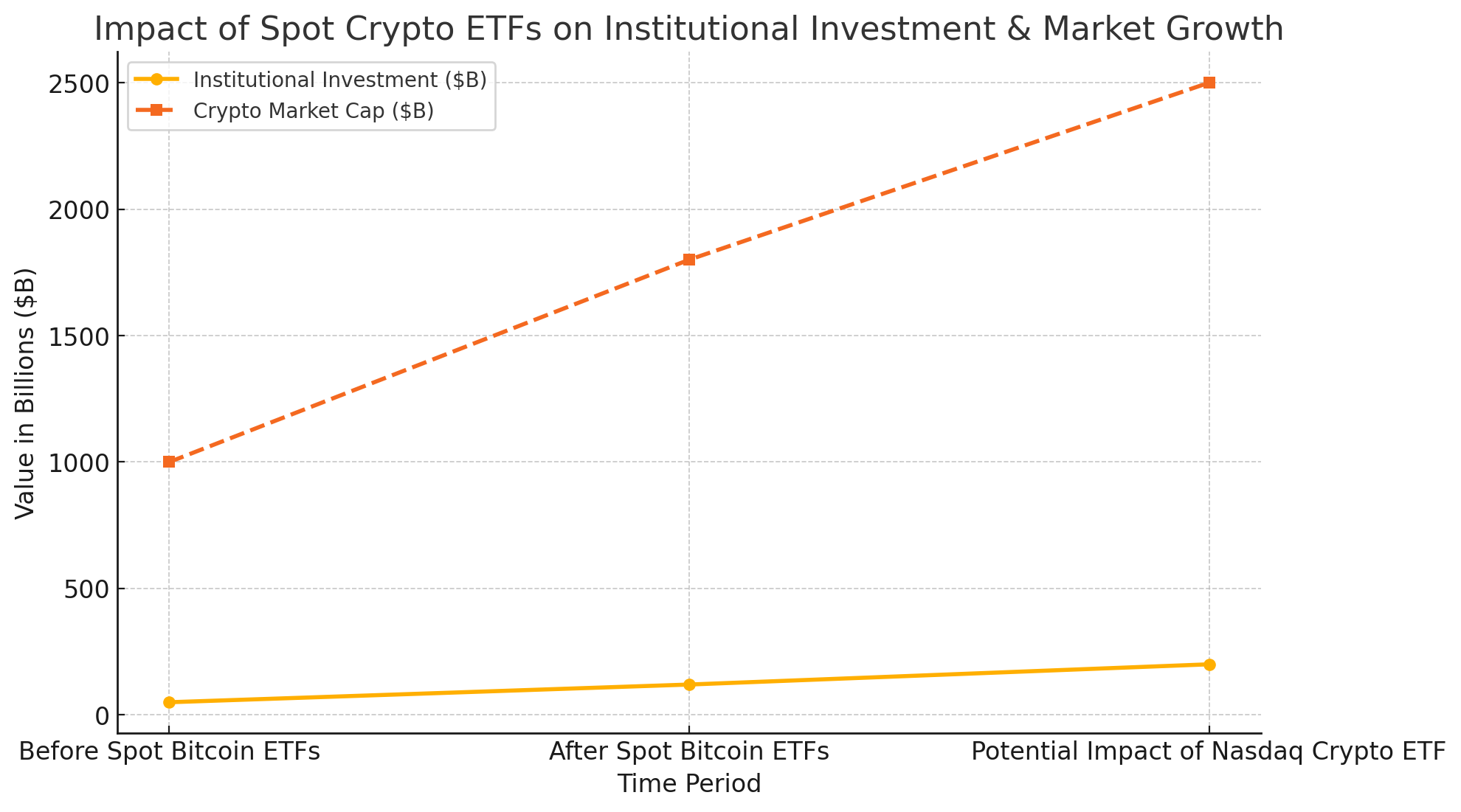

Growing Institutional Interest and Market Impact

The cryptocurrency sector has witnessed a surge in institutional adoption, especially following the SEC’s approval of spot Bitcoin ETFs in early 2024. These ETFs have collectively amassed over $120 billion in assets under management within a year, signaling robust demand from institutional investors. The introduction of a diversified crypto ETF by Nasdaq is poised to further accelerate this trend, offering a more comprehensive investment option that appeals to a broader audience.

Industry experts anticipate that such innovations will “turbo-charge the crypto ETF industry,” leading to increased liquidity and potentially more stable pricing in the cryptocurrency markets. However, regulatory challenges persist, particularly concerning the classification of various digital assets as commodities or securities, which could impact the ETF’s composition and approval process.

Conclusion

Nasdaq’s proactive approach in developing a diversified crypto ETF underscores the evolving landscape of digital asset investments. By collaborating with Hashdex to create the Nasdaq Crypto Index, Nasdaq aims to provide investors with a regulated and efficient means to gain exposure to the burgeoning cryptocurrency market. As the SEC reviews this proposal, the financial community eagerly awaits a decision that could further legitimize and expand access to digital assets.

FAQs

What is the Nasdaq Crypto Index (NCI)?

The NCI is a benchmark index co-developed by Nasdaq and Hashdex to track the performance of a diversified basket of cryptocurrencies. It ensures inclusion based on strict liquidity, market capitalization, and custody standards.

Which cryptocurrencies are included in the NCI?

As of February 20, 2025, the NCI includes Bitcoin, Ethereum, Ripple (XRP), Solana, Cardano, Litecoin, Chainlink, Avalanche, and Uniswap.

How does a diversified crypto ETF benefit investors?

A diversified crypto ETF offers exposure to multiple cryptocurrencies within a single investment, potentially reducing the risk associated with investing in a single digital asset.

What regulatory challenges could affect the approval of Nasdaq’s crypto ETF?

The SEC’s classification of digital assets as either commodities or securities plays a crucial role in the approval process, as it determines the regulatory framework applicable to the ETF.

When is the expected decision from the SEC regarding Nasdaq’s crypto ETF proposal?

While the exact timeline is uncertain, the SEC typically reviews ETF proposals within a few months. The financial community is closely monitoring for updates.

Glossary of Key Terms

Exchange-Traded Fund (ETF): An investment fund that trades on stock exchanges, holding assets such as stocks, commodities, or bonds, and offers investors a proportionate share in the fund’s assets.

Nasdaq Crypto Index (NCI): A benchmark index developed by Nasdaq and Hashdex to measure the performance of a diversified basket of cryptocurrencies.

Securities and Exchange Commission (SEC): The U.S. federal agency responsible for enforcing federal securities laws and regulating the securities industry.

Spot Bitcoin ETF: An ETF that provides direct exposure to Bitcoin by holding the actual cryptocurrency, as opposed to futures-based ETFs that hold derivative contracts.

Institutional Investors: Organizations that invest large sums of money into securities, real estate, and other investment assets; examples include banks, insurance companies, pensions, and hedge funds.

Liquidity: The ease with which an asset can be bought or sold in the market without affecting its price.

Market Capitalization: The total market value of a cryptocurrency, calculated by multiplying its current price by its total supply.

Custody Standards: Regulations and practices ensuring that digital assets are securely stored and managed on behalf of investors.

Commodity vs. Security: A commodity is a basic good used in commerce that is interchangeable with other goods of the same type, while a security represents an ownership position in a corporation (stock), a creditor relationship with a governmental body or corporation (bond), or rights to ownership as represented by an option.