President Donald Trump is set to sign an executive order easing restrictions on banks engaging with cryptocurrencies in a major policy shift that could redefine the relationship between traditional finance and digital assets. This move is expected to provide U.S. financial institutions with clearer regulatory pathways for offering crypto-related services, a significant shift from previous federal policies that largely kept the industry at arm’s length.

What Trump’s Executive Order Means for Crypto Banking

For years, the regulatory uncertainty surrounding cryptocurrencies has led many banks to avoid dealing with digital assets altogether. Under prior regulations, financial institutions faced strict limitations on offering services like crypto custody, stablecoin settlements, and blockchain-based transactions.

However, the new executive order aims to change that by:

- Allowing Banks to Directly Engage in Crypto Services: Financial institutions will no longer need prior regulatory approval to offer crypto custody, process transactions, or deal in stablecoins.

- Establishing a Strategic Bitcoin Reserve: The federal government will stockpile digital assets, including Bitcoin, as part of a broader financial strategy.

- Creating a Crypto Regulatory Task Force: A new federal body will develop a unified national framework for crypto oversight, ensuring consistency across banking and financial regulations.

Why the Shift?

The administration decides as the crypto market matures and institutional adoption accelerates. While early concerns revolved around security risks and financial instability, recent advancements in blockchain security and compliance solutions have mitigated some of these worries.

Additionally, Trump’s move appears to be a direct response to increasing pressure from the financial sector. Many U.S. banks have expressed interest in offering crypto-related services but were deterred by unclear regulations and the risk of sudden policy reversals.

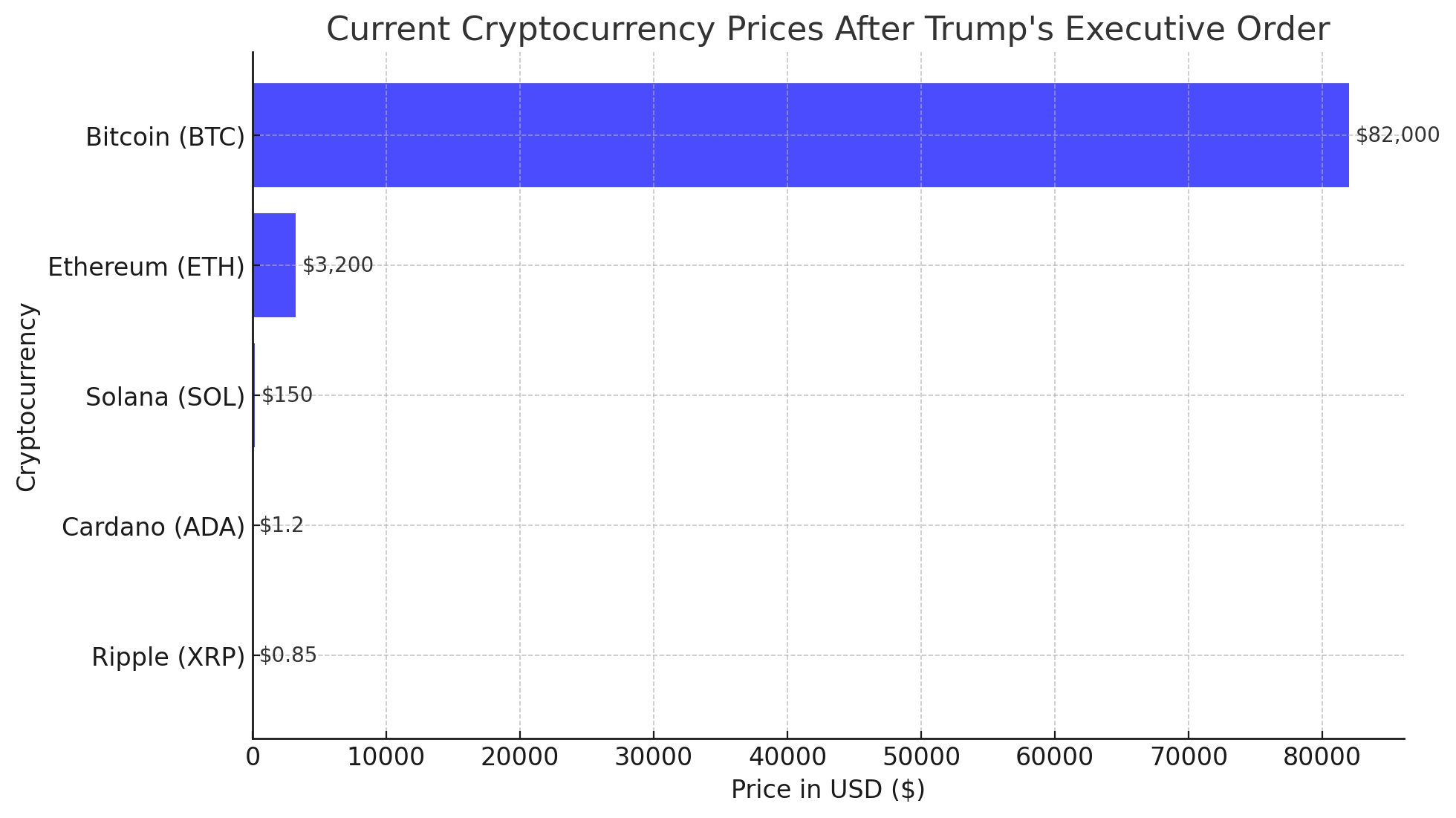

Market Reaction: Bitcoin Surges on News

Following reports of the pending executive order, Bitcoin and other major cryptocurrencies saw an immediate price jump. At the time of writing, Bitcoin is trading at $80,333, marking an almost 5% increase over the past 24 hours. Other major cryptos, including Ethereum and Solana, have also posted gains amid renewed investor optimism.

| Cryptocurrency | Current Price (USD) | 24H Change |

|---|---|---|

| Bitcoin (BTC) | $80,333.00 | +5% |

| Ethereum (ETH) | $3,200 | +4.5% |

| Solana (SOL) | $150 | +7% |

| Cardano (ADA) | $1.20 | +5% |

| Ripple (XRP) | $0.85 | +3.8% |

Market analysts believe this rally reflects growing institutional confidence in digital assets.

“This executive order is a game-changer for crypto adoption,” said one industry expert. “Banks have been waiting for a clear signal from regulators, and this could be it.”

Implications for Banks and FinTech Firms

For the banking sector, this policy shift presents new opportunities:

- Expanded Service Offerings: Traditional financial institutions can now integrate cryptocurrency solutions into their portfolios, potentially driving higher customer engagement.

- Increased Competition with Crypto-Native Companies: Banks can now compete with major crypto exchanges like Coinbase and Binance, offering regulated alternatives to retail and institutional investors.

- Regulatory Uncertainty Reduced: With clearer federal guidelines, banks can develop long-term crypto strategies without fearing sudden regulatory crackdowns.

However, challenges remain. While the executive order provides a green light for banks, institutions will still need to implement robust compliance frameworks to prevent fraud, money laundering, and cybersecurity risks.

Challenges and Considerations Moving Forward

Despite the enthusiasm surrounding the order, some experts caution that implementation will take time. Regulators will need to ensure that the policy change does not create loopholes for illicit financial activities. Additionally, banks may need to build or partner with blockchain infrastructure providers to offer seamless crypto services.

The newly formed Crypto Regulatory Task Force will play a critical role in addressing these challenges, with an initial 180-day period to develop comprehensive industry guidelines.

Final Thoughts on Crypto Banking

President Trump’s decision to lift crypto banking restrictions on cryptocurrencies marks a pivotal moment for digital finance in the U.S. By opening the door for banks to engage with crypto, this move has the potential to accelerate mainstream adoption, increase market stability, and position the U.S. as a leader in the global digital asset space.

However, as with any regulatory shift, the success of this initiative will depend on its implementation. The coming months will be crucial in determining how financial institutions, regulators, and market participants adapt to this new era of crypto-friendly banking.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

How will this executive order affect individual investors?

Individual investors may benefit from greater accessibility to crypto services through their banks. This could lead to more secure and regulated options for buying, holding, and trading digital assets.

What is the Strategic Bitcoin Reserve?

The U.S. government plans to hold Bitcoin and other cryptocurrencies as part of a broader financial strategy, signaling institutional confidence in digital assets.

When will banks start offering crypto services?

While the order allows immediate participation, banks will likely take several months to establish necessary compliance measures and technology infrastructure.

Glossary of Key Terms

- Crypto Custody: The act of holding and securing digital assets on behalf of clients.

- Stablecoin: A cryptocurrency designed to maintain a stable value by being pegged to a fiat currency or asset.

- Blockchain Infrastructure: The underlying technology that supports digital asset transactions.

- Strategic Bitcoin Reserve: A government-held stockpile of Bitcoin aimed at stabilizing national financial interests.