The Injective Blockchain has made waves by unveiling a new tokenized index for BlackRock’s USD Institutional Digital Liquidity (BUIDL) Fund. This new index enables investors to access the fund through on-chain financial tools, marking a significant leap forward in the tokenization of assets. Rather than focusing on the fund’s price, the index tracks the supply, providing a continuous and transparent market. This move responds to the increasing demand for transparency in fund flows and offers valuable insights into institutional participation in crypto. Following this announcement, the altcoin’s price made a sharp upward move.

Altcoin Price Jumps After BlackRock BUIDL Fund Announcement

Eric Chen, co-founder and CEO of Injective Labs, highlighted the importance of this new index. He stated, “For the first time, institutions and retail users have direct access to a real-world asset (RWA) offering, directly tracking a fund led by BlackRock.” The introduction of the BUIDL index has had an immediate positive effect on the native token, INJ, which saw a 14% price surge. As of the latest update, INJ was trading at $17.18, reflecting a 10.80% increase.

The BUIDL index operates through decentralized exchanges like Helix, part of the Injective ecosystem, where investors can use leverage to take long or short positions on the index. The price is adjusted using a 1-hour time-weighted average price (TWAP) to reduce volatility caused by significant token movements, aligning the price with changes in the BUIDL token supply.

Expanding Access to the BUIDL Fund

Injective’s latest move significantly expands access to the BUIDL fund, previously only available to institutional investors with a minimum investment of $5 million. As a result, only 18 holders possessed BUIDL tokens, with the most prominent investor controlling more than 33% of the fund, valued at approximately $178 million. With this new development, a much broader audience can now access the BUIDL index for as little as $1. This democratization of tokenized assets may reshape retail investor participation in high-end investment products.

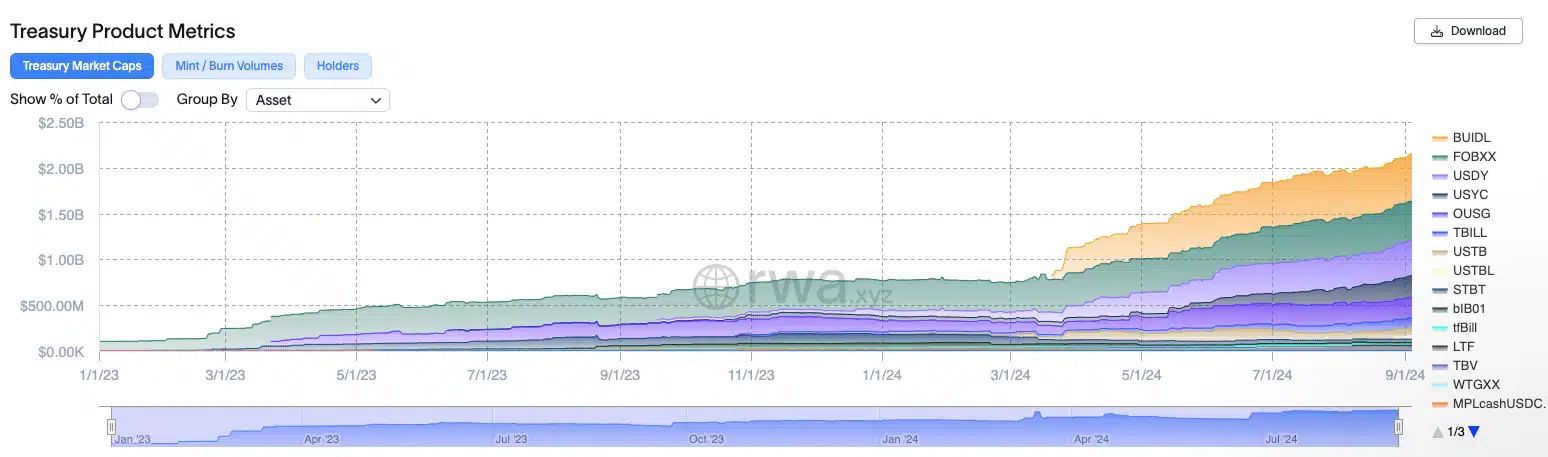

As of September, the BUIDL fund boasts a market cap exceeding $517 million. Additionally, the fund recently made a record-breaking $2.1 million dividend payout in July. Platforms like BlackRock’s BUIDL and Franklin Templeton’s FOBXX, which tokenizes U.S. Treasury bonds, have played a vital role in the growth of the tokenized assets market, valued at over $2.15 billion.

The increasing interest in real-world asset (RWA) markets signals a trend towards broader institutional and retail involvement, with the BUIDL fund becoming a critical indicator of sentiment in the altcoin sector.