Global investment firm VanEck has taken a major step toward expanding its cryptocurrency offerings by registering an Avalanche exchange-traded fund (ETF) in the United States. The filing, which was recorded on March 10, 2025, in Delaware, suggests that VanEck may be planning to launch a spot AVAX ETF in the near future. This move marks another milestone in the increasing adoption of crypto-based financial products, despite ongoing regulatory uncertainties.

Key Developments

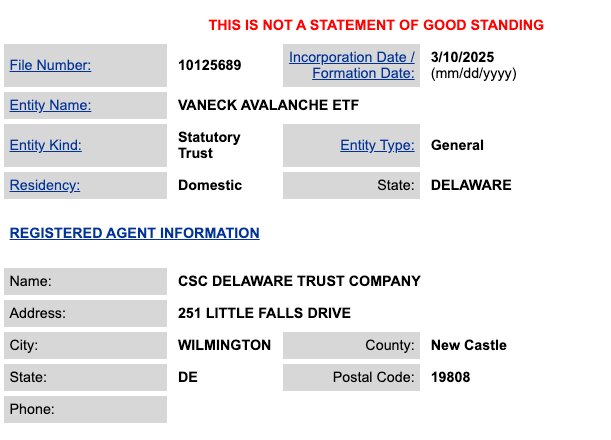

VanEck registered the “VanEck Avalanche ETF” under filing number 10125689, classifying it as a trust corporate service company in Delaware. This registration follows VanEck’s past filings for ETFs based on Bitcoin (BTC), Ether (ETH), and Solana (SOL). By adding Avalanche to its ETF lineup, VanEck is broadening its scope of crypto investment options available to institutional investors.

The filing comes at a time of heightened volatility in the cryptocurrency market. Avalanche’s native token, AVAX, has experienced a 55% decline in value year-to-date, reflecting broader market trends. Bitcoin (BTC) has also dropped approximately 17% during the same period. This downward trend has raised concerns among investors, but some believe that an ETF could help stabilize AVAX by increasing institutional interest.

Overview of Avalanche

Avalanche was launched in 2020 by Ava Labs and is designed to serve as a high-speed, scalable alternative to Ethereum. It enables developers to build decentralized applications (dApps) while offering lower fees and faster transaction speeds. The network operates on a unique three-chain architecture that improves efficiency and reduces congestion.

Despite the recent downturn, Avalanche remains a significant player in the crypto ecosystem. It reached the top 10 cryptocurrencies by market capitalization in 2021, demonstrating its potential to compete with leading blockchain networks. As of early 2025, AVAX ranks 20th in market capitalization, valued at approximately $7 billion.

VanEck’s Growing Influence in Crypto ETFs

VanEck has been a key player in the cryptocurrency ETF market for years. It was among the first firms to apply for a Bitcoin futures ETF in 2017 and later launched a spot Bitcoin ETF in 2024. The company has also been a leader in developing other digital asset investment products, including a spot Solana ETF filed with the U.S. Securities and Exchange Commission (SEC) in June 2024.

By filing for an Avalanche ETF, VanEck is positioning itself at the forefront of crypto asset management. The move also highlights the growing demand for regulated crypto investment vehicles, which offer investors exposure to digital assets without the complexities of directly buying and storing cryptocurrencies.

Impact on Institutional Investors

A spot Avalanche ETF would allow institutional investors to gain exposure to AVAX through a regulated financial product. This could attract new capital into the Avalanche ecosystem, improving liquidity and reducing volatility in the long term. Investors who have been hesitant to enter the crypto market due to concerns about security and regulation may find an ETF to be a safer alternative.

With regulatory scrutiny intensifying, the approval process for a spot Avalanche ETF could be complex. The SEC has historically been cautious about approving crypto ETFs, citing concerns over market manipulation and investor protection. However, the approval of spot Bitcoin ETFs in early 2024 has set a precedent, raising hopes that similar products for other cryptocurrencies may soon be greenlit.

Market Reaction and Future Prospects

News of the Avalanche ETF registration has sparked increased activity on the Avalanche network. In the first quarter of 2025, new user participation surged by 120%, reaching 45,000 in March alone. This growth reflects renewed optimism among traders and investors who view an ETF as a potential catalyst for AVAX’s recovery.

Despite the positive sentiment, challenges remain. The crypto ETF market is still in its early stages, and regulatory hurdles could delay the launch of an Avalanche ETF. Additionally, the broader market downturn poses risks to investor confidence. If AVAX continues to experience sharp price declines, institutional interest in the ETF could be dampened.

VanEck’s move also raises questions about the future of other cryptocurrency ETFs. Some industry observers expected an XRP ETF to be filed before an AVAX ETF, highlighting the unpredictability of institutional strategies in the crypto space. VanEck’s decision to prioritize Avalanche suggests confidence in the network’s long-term potential.

Conclusion

VanEck’s registration of an Avalanche ETF represents a significant step in the mainstream adoption of crypto-based financial products. While regulatory challenges remain, the move underscores the growing demand for diversified crypto investment options. If approved, the ETF could bring new institutional capital into the Avalanche ecosystem, enhancing liquidity and reducing volatility.

The success of an Avalanche ETF will depend on multiple factors, including regulatory approval, market conditions, and investor interest. If the SEC approves the fund, it could pave the way for additional crypto ETFs in the future. As the digital asset industry continues to evolve, institutional investors will likely play an increasingly important role in shaping the market.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQs)

1- What is the significance of VanEck’s Avalanche ETF registration?

VanEck’s registration of an Avalanche ETF signals growing institutional interest in AVAX and could pave the way for a regulated investment product in the U.S.

2- How could an Avalanche ETF impact AVAX’s price and market stability?

A spot Avalanche ETF could bring increased liquidity, reduce volatility, and attract more institutional investors to the AVAX ecosystem.

3- What regulatory challenges could delay the approval of the Avalanche ETF?

The SEC’s cautious stance on crypto ETFs, concerns over market manipulation, and investor protection measures could slow down the approval process.

4- Why VanEck prioritizes an Avalanche ETF over other cryptocurrencies like XRP?

VanEck’s decision to file for an AVAX ETF before an XRP ETF suggests confidence in Avalanche’s long-term potential and growing adoption in decentralized applications.

Appendix: Glossary of Key Terms

Exchange-Traded Fund (ETF): An investment fund traded on stock exchanges, holding assets like stocks, commodities, or bonds.

Avalanche (AVAX): A decentralized platform for launching dApps and enterprise blockchain deployments; AVAX is its native token.

Securities and Exchange Commission (SEC): A U.S. federal agency responsible for enforcing federal securities laws and regulating the securities industry.

Staking: The process of participating in transaction validation on a proof-of-stake (PoS) blockchain by holding and locking up a certain amount of cryptocurrency.

Decentralized Application (dApp): An application that runs on a decentralized network, utilizing blockchain technology to operate without a central authority

Referneces

Cointelegraph – cointelegraph.com

AInvest – ainvest.com

CryptoRank – cryptorank.io

PANews – panews.com