After weeks of consolidation, the Bitcoin price appears poised for a major breakout, with leading analysts pointing toward a potential surge to $120,000 in the coming months. Four key catalysts are converging to strengthen the bull case: a dovish Federal Reserve outlook, dropping oil prices, robust technical indicators, and renewed institutional demand.

The latest report from CoinDesk outlines these bullish dynamics in detail, with market strategists and traders highlighting how macroeconomic relief and technical setups are lining up for what could be the Bitcoin price’s next explosive phase.

Bitcoin Price Holds Strong Amid Geopolitical Tensions

The Bitcoin price has maintained a solid base above $100,000, even in the face of rising geopolitical tensions and inflation concerns. As noted by Barron’s, Bitcoin continues to defy short-term volatility pressures and remains a favorite among investors seeking long-term upside.

Trump’s recent ceasefire announcement between Israel and Iran has fueled market-wide optimism. Risk-on assets, including Bitcoin, rebounded as the dollar weakened and oil prices dipped. This sudden macro relief injected confidence into crypto markets, reviving discussions around Bitcoin’s status as a long-term hedge.

Four Catalysts Behind the $120K Bitcoin Price Prediction

1. Technical Alignment: Bullish Moving Averages

Bitcoin has triggered a golden crossover on both the 50-day and 200-day moving averages, an indicator historically associated with extended bull runs. The Bitcoin price bouncing off support zones and breaching key resistance levels points to growing momentum.

2. Federal Reserve Pivot

With inflation cooling and job data softening, the Fed is widely expected to begin rate cuts by Q3 2025. Looser monetary policy tends to boost risk assets. As highlighted by Yahoo Finance, this could spark significant capital inflows into Bitcoin and other top cryptocurrencies.

3. Cooling Oil Prices = Inflation Eases

A major factor behind the Fed’s dovish tilt is falling oil prices. Lower energy costs directly reduce inflation pressure, giving policymakers more room to ease. Historically, easing inflation combined with an accommodative policy has driven rallies in the Bitcoin price.

4. Whale and Institutional Accumulation

On-chain metrics reveal increasing accumulation by large wallets. According to CoinDCX, institutional investors have been quietly stacking Bitcoin in anticipation of a Q3 breakout. This accumulation, combined with exchange outflows, hints at long-term confidence.

Bitcoin Price Prediction: Can BTC Really Hit $120K?

While predictions vary, a consensus is forming around $120,000 as a likely target for the Bitcoin price in late 2025. Standard Chartered reiterated its projection of $100K–$120K in their revised outlook, citing macro tailwinds and diminishing sell-side pressure. CoinDesk analysts suggest early Q4 could hit $114K if current conditions persist.

More aggressive forecasts by firms like CoinDCX go further, anticipating a move to $130K–$150K if spot ETFs see renewed inflows and regulatory clarity improves across the U.S. and Europe.

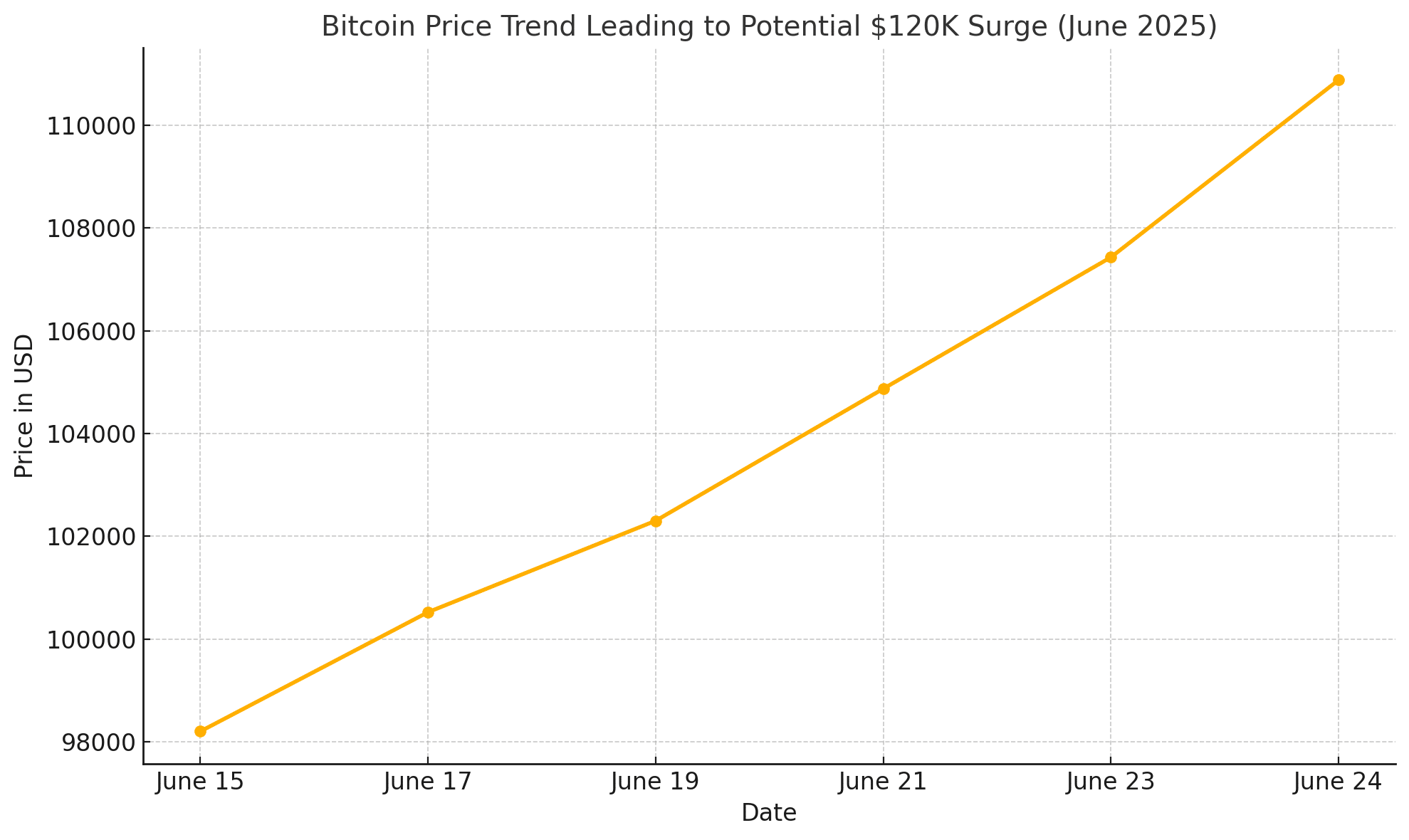

Bitcoin Price Table

| Date | Opening Price | Closing Price | 24h Change | 24h Volume |

|---|---|---|---|---|

| June 20 | $101,230 | $102,100 | +0.86% | $34.5B |

| June 21 | $102,100 | $100,520 | -1.55% | $32.9B |

| June 22 | $100,520 | $104,870 | +4.32% | $38.2B |

| June 23 | $104,870 | $107,430 | +2.44% | $41.7B |

| June 24 | $107,430 | $110,880 | +3.21% | $45.3B |

This five-day trend highlights the steady upward trajectory in the Bitcoin price, supported by increasing volume, a signal of strong buying interest.

What Could Derail the Rally?

Despite the bullish backdrop, there are risks. Continued regulatory uncertainty, delayed ETF approvals, or an unexpected Fed hawkish turn could dampen momentum. Additionally, a strong bounce in oil or inflation prints may reset interest rate expectations, pressuring the Bitcoin price in the short term.

For the Investors

For long-term crypto investors, this is a pivotal moment. The Bitcoin price is not only holding firm above $100K but is also gaining traction with the support of macroeconomic relief and technical confirmation. Analysts believe that if momentum continues, $120K could become a self-fulfilling target.

With institutional whales quietly accumulating and interest rate cuts looming, investors who stayed patient through the downturn may soon be rewarded. Strategic positioning now could offer significant upside in Q3 and beyond.

Final Thoughts

The stars are aligning for a major breakout in the Bitcoin price. With favorable macroeconomic signals, solid technicals, and rising institutional involvement, Bitcoin could very well reach or surpass $120K before year-end. Investors and analysts alike are now watching July and August closely for confirmation of the next bull phase.

For those waiting on the sidelines, now may be the moment to re-enter the conversation.

Summary

The Bitcoin price is gaining bullish momentum, driven by macro relief, technical breakouts, and whale accumulation. Analysts now point to $120,000 as a realistic target for late 2025. Recent factors, including Fed rate cut expectations, falling oil prices, and strong support above $100K, are aligning to support this next leg upward. As institutional investors re-enter the market, Bitcoin appears poised for a potential rally that could reshape sentiment and spark renewed enthusiasm across the crypto landscape.

FAQs

What is fueling the recent Bitcoin price rally?

Key drivers include falling inflation, Fed rate cut expectations, technical breakouts, and institutional buying.

Is $120K a realistic Bitcoin price target in 2025?

Yes. Analysts from CoinDesk and Standard Chartered see $120K as reachable by Q4 if current momentum holds.

What are the risks to this prediction?

A resurgence in inflation, Fed policy shifts, or regulatory setbacks could delay or weaken the move to $120K.

Glossary of Key Terms

Bitcoin Price: The current market value of one Bitcoin, typically expressed in U.S. dollars and influenced by supply, demand, and market sentiment.

Bull Run: A prolonged period of rising asset prices, driven by investor optimism, strong fundamentals, or macroeconomic factors.

Moving Averages: Technical indicators that smooth out price data over time. Common types include 50-day and 200-day moving averages, which help identify trends.

Federal Reserve (Fed): The central banking system of the United States. Its decisions on interest rates and monetary policy greatly impact financial markets.

Rate Cuts: A monetary policy tool where the Fed lowers interest rates to stimulate the economy. Often bullish for risk assets like Bitcoin.

Whale Accumulation: Large investors or institutions buying significant amounts of cryptocurrency, often seen as a signal of long-term confidence.

Inflation: The rate at which the general level of prices for goods and services rises. High inflation can weaken fiat currencies and boost crypto.

Golden Cross: A bullish technical signal that occurs when a short-term moving average crosses above a long-term one, such as the 50-day crossing the 200-day.