Bitcoin’s rally hit a rough patch this weekend as geopolitics collided with a fragile market. The flagship cryptocurrency dipped below $100,00 during the weekend and over $127.3 million in longs got liquidated in just 24 hours. Now, analysts and on-chain data say this could be more than just a blip; and could be the start of a deeper correction that takes prices to the $82K Bitcoin price range.

This Bitcoin pullback isn’t just based on price action. Several key indicators are flashing red, warning of growing downside risks as markets digest the latest macro shocks.

Geopolitics Hit BTC Harder Than You Think

The drop followed confirmed US airstrikes on Iranian nuclear infrastructure, which triggered panic selling across assets. As Bitcoin fell below $100,000, cascading liquidations added to the pressure. These forced liquidations, which mainly hit leveraged longs, showed a market that can’t absorb sudden shocks.

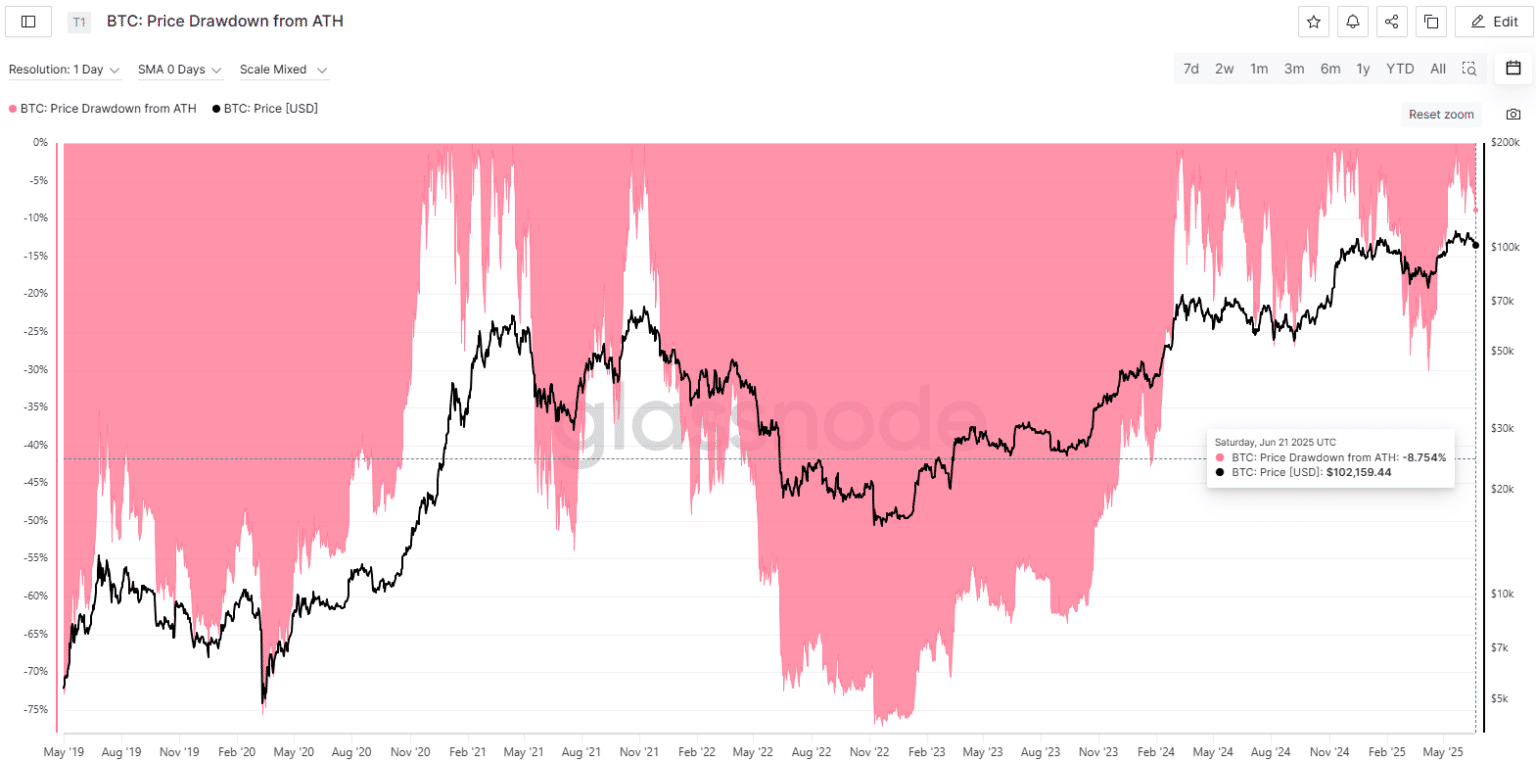

While the retracement, about 9% from the all-time high may seem mild compared to previous corrections, analysts say this could be the start of a longer reversion cycle.

Glassnode’s MVRV Extreme Deviation Pricing Bands are one of the strongest technical arguments for caution. As of June 21, Bitcoin’s price fell below the +0.5σ deviation band, which is around $102,770. In previous cycles, a break below this level has led to deeper downturns. One recent example was in February when BTC went down for six weeks and bottomed at $83,000.

This same $82K Bitcoin price level is now the next mean reversion target. If momentum doesn’t reverse quickly, the market may be setting up for a retracement that aligns with previous drawdowns rather than short-term panic.

SSR Is Mixed Despite Fresh Buying Power

Traders are also watching the Stablecoin Supply Ratio (SSR). This metric compares stablecoin reserves to Bitcoin’s market cap and shows sidelined liquidity. SSR dropped as Bitcoin’s price fell, indicating that stablecoin buying power is growing.

However, SSR hasn’t dropped as much as it did in March and April. In other words, analysts are saying there is accumulation but it’s not yet translating into buying. As a result, this is making bulls question if Bitcoin market will be able to hold $100K.

Long-Term Context: Past Drawdowns Mean More Room to Fall

At 9% off the peak, this is a shallow drawdown compared to previous bull market corrections which are 20-50% deep. April’s 24% drop showed that big pullbacks can happen even in strong macro trends.

If BTC breaks below $100K and bearish momentum picks up, a drop to $82K Bitcoin price wouldn’t be unprecedented nor out of character for a still volatile asset adjusting to institutional influence.

Despite the bearish tone, whales aren’t entirely out. Glassnode data shows large holders haven’t dumped en masse and overall exchange outflows are stable. However, derivatives activity and open interest are rising and this might just amplify short term swings, not stabilize them.

Currently, retail traders are cautious. Social chatter and exchange inflows are showing hesitation and smaller traders are reducing exposure.

Conclusion

Tensions are high and liquidation pressure is fresh. Bitcoin is at a crossroads. This Bitcoin pullback forecast doesn’t mean it will go to $82K Bitcoin price, but historical patterns, technicals and cautious investor behavior says it could be possible. Whether bulls can hold the $100K line in the next few days will define the rest of the summer.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQ

Why is $82K Bitcoin price being flagged as a support?

Previous corrections in similar setups especially after breaking below the +0.5σ MVRV band tend to revert to long term average support bands, now sitting at $82K.

What caused the recent Bitcoin price drop?

The sell off was triggered by geopolitical unrest after US military action against Iran which caused market wide fear and liquidation cascades.

What’s the significance of SSR?

Lower SSR means more stablecoin capital relative to Bitcoin’s market cap which can be deployed to buy BTC. But current levels are not as strong as during past recoveries.

Has Bitcoin faced similar corrections before?

Yes. BTC has had 20-50% corrections even during strong bull runs. This dip is 9% and could go deeper.

How are institutions reacting?

No panic selling from institutions. Exchange outflows are steady, but leveraged positions and speculative trades are adding volatility.

Glossary

MVRV (Market Value to Realized Value): A ratio to measure when Bitcoin is over or undervalued by comparing market value to the value at which coins last moved.

+0.5σ Band: A statistical deviation level above the MVRV mean. Breaking below this level often means correction.

SSR: Buying power indicator based on stablecoin to Bitcoin’s market cap.

Liquidation cascade: Forced position closures that amplify a move and often cause market to overshoot.

Drawdown: Percentage drop from recent high.