Bitcoin held firm near $108,700 even as global markets showed signs of renewed volatility due to trade tensions. Traditional equities slipped after U.S. President Donald Trump announced potential tariff hikes on European goods. Despite this, digital asset funds continued to attract inflows, pushing Bitcoin ETF assets under management (AUM) to record highs.

Bitcoin Holds Firm Despite Market Selloff

Bitcoin was trading above the 108.000 level through selloffs in Asian and U.S. market after Trump posted tariff threats. Even with copper and equity futures dropping, there were minimal responses to Bitcoin, making it appear more resistant to macroeconomic shocks. When the asset pared back slightly to new highs of around the 110000 mark, analysts observed that it had retained strength.

Though risk assets broadly declined, Bitcoin did not follow suit, suggesting investors remained committed to the long-term view. According to Han Xu, the director at HashKey Capital, the digital asset’s resilience shows increasing investor confidence. Nevertheless, the pace at which BTC was advancing was set to fall as buyers were taking a breather at major resistance points.

BTC buyers are being wary at the 110K mark, and yet a bidding is still being experienced due to the overwhelming technical support, said FxPro analyst Alex Kuptsikevich. Recent price action was supported by the 50-day moving average, which was not able to support potential buyers, though. As a result, bitcoin’s near-term trend stayed neutral despite positive inflow data.

Bitcoin ETFs See Twelve Weeks of Inflows

CoinShares reported that crypto investment products registered their 12th consecutive week of inflows. Nearly $1 billion entered digital asset funds last week, with bitcoin accounting for over $790 million. This brought the ETF AUM to an all-time high of 188 billion.

Money raised through Ether-traceable products reached 226 million dollars, whereas Solana and XRP received 22 million and 11 million dollars, respectively. These inflows reinforced the signs of persisting institutional interest, but the price action was lackadaisical. The statistics indicate much-needed growth in the long term as opposed to short-term moves.

The report indicated strong demand for diversified crypto exposure through regulated ETFs. Trading volumes in these products also stayed steady, indicating healthy market participation. Despite lower on-chain activity, the Bitcoin ETF sector showed resilience as a preferred vehicle for crypto investment.

On Chain Metrics Signal Investor Fatigue

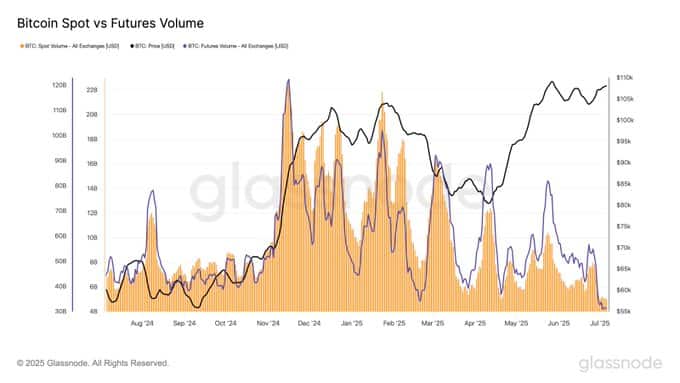

While price levels remained high, several indicators pointed to a weakening of activity under the surface. According to The Block, on-chain data and implied volatility reached their lowest points in nearly two years. This trend suggests reduced market participation and slower capital rotation.

Glassnode described the current state as a “summer lull,” driven by declining volumes and concentration of unrealized gains among long-term holders. Such conditions could lead to sharp corrections if sentiment shifts suddenly. Market watchers warned that complacency may lead to instability should external factors worsen.

However, Kuptsikevich pointed out that the market is optimistic and cautious. He said, “The capital is moving past the 200-day average, indicating a bullish situation.” He warned, however, that such abrupt changes in tone could cause rapid profit-taking and an increase in volatility.

Summary

Bitcoin held near $108,700 as trade tensions impacted global markets, yet Bitcoin ETF inflows pushed crypto assets under management to a record $188 billion. In spite of this power, on-chain statistics and volatility indicators have indicated low activity, which made traders suspect a summer lump. Though institutional demand is quite strong, analysts warned that in case of a sudden move to a downbeat attitude in the market, the profit-taking may be fast.

FAQs

Why is Bitcoin staying stable despite traditional market declines?

Bitcoin appears insulated from macroeconomic events, and investors remain focused on its long-term potential, not short-term noise.

What is driving the increase in Bitcoin ETF AUM?

Consistent weekly inflows, especially into bitcoin and ether products, are fueling record-breaking ETF assets under management.

Are other cryptocurrencies seeing similar ETF demand?

Yes, ether, solana, and XRP all received positive inflows, reflecting broader institutional interest across multiple digital assets.

What does “summer lull” mean in the crypto context?

It refers to a period of reduced trading volume, low volatility, and inactivity, often linked to seasonal slowdowns.

Should traders be concerned about the lull?

While not immediately alarming, it could signal vulnerability to sharp moves if sentiment or macro conditions shift quickly.

Glossary of Key Terms

AUM (Assets Under Management): The total market value of assets a fund or investment product controls.

ETF (Exchange-Traded Fund): A type of investment fund traded on stock exchanges, offering exposure to various assets, including cryptocurrencies.

Implied Volatility: A metric used to forecast future price volatility based on options market prices.

On-Chain Data: Data that comes directly from the blockchain, reflecting user activity and network performance.

50-Day Moving Average: A technical analysis indicator showing the average closing price over the past 50 days.